Timeline final update: March 22, 2022

Starting in late 2017, one international issue spent several years at the forefront of North American recycling conversations: China’s ban on the import of certain recovered materials, including a range of plastic types.

Chinese leaders formally announced their import intentions in a notice to the World Trade Organization in July of 2017, and the ban went into force at the start of 2018. But events going all the way back to the start of the country’s Green Fence customs crackdown in 2013 in many ways foreshadowed more recent moves.

To help stakeholders get a firm grasp on the Chinese import policies, we created a timeline of events related to the market phenomenon, regularly updating it through 2021.

If you’re having trouble viewing the timeline below, please refresh your browser.

February 2013: Green Fence goes up

China launches intensive inspections of incoming loads of scrap material, a policy that is in fact an effort to enforce import regulations passed in 2006 and 2010. Though it is officially slated to end in November 2013, insiders note it could be restarted at any time.

November 2015: Another two-month customs crackdown

Chinese authorities frame this effort as one looking to ensure Chinese scrap processors are handling material according to the procedures laid out in their individual licenses. This initiative is seen as different from Green Fence because it inspects importer practices and not loads on the dock.

February 2017: National Sword announced

This Chinese action has a specific focus on halting smuggling operations, meaning those groups using illegal permits to import materials. Inspection scrutiny is directed toward bales of low grade plastics as well as paper with high moisture content.

February - March 2017: Tightening the screws

Enforcement action is heightened on criminal activity, particularly permit fraud inside China. Authorities arrest 90 suspects and confiscate 22,100 metric tons of foreign scrap material in the first weeks of National Sword enforcement.

Early-April 2017: Pivot back toward quality

Reports out of China indicate National Sword is also being used to assess overall material quality, not just the legality of permits used to import loads. Customs officials are believed to be checking every container entering the country at certain ports, which causes delays for material shippers.

Mid-April 2017: A ban on the way?

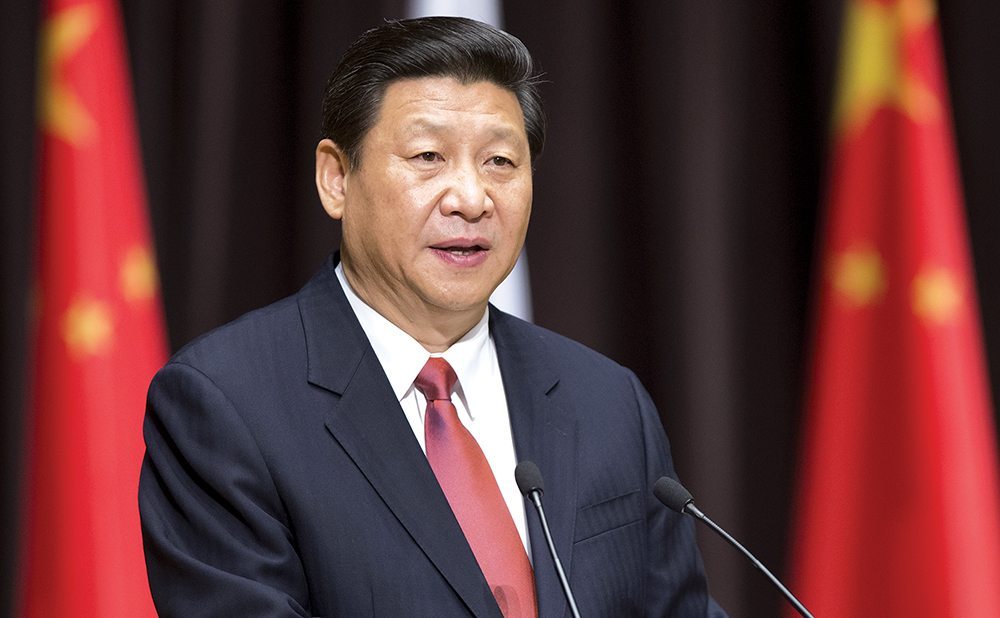

A meeting of top Chinese leaders, including President Xi Jinping (below), covers environmental reform possibilities. Delegates recommend “regulations should be enhanced to ‘significantly’ reduce the categories and volume of waste imports,” according to a state media report. The China Scrap Plastic Association’s Steve Wong, who was in attendance, says government officials suggested “a ban on solid waste imports by category.”

Late-April and Early-May 2017: Export unrest

Exporters describe import fees doubling over the course of a few weeks and extreme challenges in trying to move materials into China.

Late-May and Early-June 2017: Searching for answers

Officials from U.S. trade group the Institute of Scrap Recycling Industries (ISRI) travel to China and confirm that the National Sword effort and the possible materials ban seem to be separate policies, even though they are becoming increasingly intertwined. ISRI also reports Chinese authorities are looking at the materials ban as a way to increase China’s domestic recovery industry.

Mid-June 2017: ‘Sword’ enforcement continues

Another large raid by Chinese authorities leads to 85,000 metric tons of material seized and members of smuggling groups arrested.

Mid-July 2017: Pointing out polluters

Yet another round of import enforcement begins in China, this time focused specifically on facilities without proper pollution control measures in place, according to reports out of China.

July 18, 2017: FYI at WTO

China confirms its intent to ban certain recyclables from import by filing a notice with the World Trade Organization. The announcement indicates the country will ban imports of recovered mixed paper; recycled PET, PE, PVC and PS; textiles; and vanadium slag by the end of 2017. Major exporters quickly begin analyzing the potential market disruption.

July 27, 2017: Specifying post-consumer materials

China elaborates on the ban, noting it will cover post-consumer plastics, unsorted mixed paper, textiles, select trace metals, and more. A policy document issued by the government also describes a larger plan to stop importing recovered materials that can instead be recovered domestically.

Late-July 2017: Impossible demands?

Chinese officials propose updates to national specifications known as Guobiao (GB) standards, which would set a maximum contamination level of 0.3 percent for imported loads of recyclables.

Mid-August 2017: Slowing bale movement

U.S. exporters report that their Chinese buyers have not received new import permits for any recyclable materials since May. This begins a dramatic slowing of shipments to China, including shipments of materials not named in the WTO ban filing.

Late-September 2017: Repercussions at the curb

The fallout from the import restrictions reaches municipal programs and materials recovery facilities (MRFs) in the U.S. Some companies report they are stockpiling materials without a downstream outlet. Others seek changes to contracts with local governments to minimize financial risk.

Early-October 2017: Landfilling recyclables

Without an alternative downstream outlet, companies in the Pacific Northwest turn to landfilling some recyclables. Some programs stop accepting certain mixed plastics and seek exemptions to landfill bans. In other cases, municipal programs hesitate to make major changes to the materials they accept, due to the efforts that would be needed to reintroduce those materials in the future.

Early-October 2017: Falling fiber values

Prices for old corrugated containers (OCC) plummet dramatically due to the lack of import permits. OCC was not named by China as a material that will be banned, but it is impacted because import permits have not been renewed in nearly five months.

Throughout October 2017: Word gets out

The impact of China’s regulatory changes hits the mainstream media in a big way, with CNN, Reuters, The Wall Street Journal and countless local news outlets nationwide devoting space to the topic. The import restrictions also receive attention from the U.S. World Trade Organization delegation and the U.S. Department of Commerce.

Late-October 2017: Sortation response

MRF operators report they are pushing for quality, and doing so by hiring more workers, installing new equipment or slowing their sort lines.

November 2017: To the limit

China proposes – and later finalizes – an allowable limit of 0.5 percent contamination for most recyclables that are not named in the ban. Industry experts almost universally describe this as an unattainable level and therefore basically a ban on those materials as well.

December 2017: Swirl of perspectives

Chinese environmental regulators publicly reaffirm their commitment to the ban, and a top official says there will be a campaign similar to National Sword enacted each year through 2020. Meanwhile, after a visit to Asia, ISRI officials report that China is not ready to implement the ban and doesn’t understand the impact it will have.

January 2018: Chinese eye options

Plastics recycling operations in China announce they are looking to invest in processing infrastructure in the U.S. and elsewhere in order to stay in business. Many exporters of material to China also announce they are shifting shipments to Southeast Asia. In a related development, trade statistics show Vietnam, Malaysia and India all significantly increase scrap plastic imports from the U.S.

December 2017 to January 2018: Key permit details

The first five rounds of 2018 import permits are issued for Chinese importers. Plastic imports are extremely limited.

Late-January 2018: California reeling

CalRecycle, the state agency in charge of California materials diversion, devotes significant time to China’s import policies at a monthly meeting, and data and perspectives shared during the discussion make it clear significant impacts are being felt in the Golden State. “It’s a day-to-day battle of moving this material,” says one MRF operator. “We can only warehouse it so long and then it has to go to landfill.”

Feb. 1, 2018: Industry giants open up

The import issue takes center stage at Waste Management’s annual Sustainability Forum. WM recycling chief Brent Bell notes the hauler and MRF operator is making investments to garner cleaner material, and Myles Cohen of Pratt Recycling calls for a “moratorium on new items” added to curbside programs.

Late-February 2018: Haulers feel the pain

In earnings reports detailing 2017, the nation’s largest publicly traded hauling and materials processing companies note significant revenue slides at the end of the year as a result of China’s restrictions on recyclable imports.

March 1, 2018: Contaminant crackdown takes effect

The 0.5 percent contamination limit in imported loads takes effect for most recyclables that are not banned outright. Since 2005, this has officially been the limit for plastic imports, and it’s a relatively modest reduction from the previous official 1.5 percent contaminant limit for paper imports. But the previous standard was not tightly enforced, and it’s widely acknowledged that actual contamination in imports ran much higher. This time, Chinese authorities say they will strictly enforce contamination limits.

Mid-March 2018: Enforcement evolves

Customs officials in China announce Blue Sky 2018, aimed at enforcing the import restrictions the country implemented this year. The China Scrap Plastics Association describes it as “further development of Green Fence and National Sword” in the crackdown on illegal scrap imports.

March 17, 2018: Impacts quantified by China

China’s top environmental official says import restrictions led to a 12 percent reduction in scrap imports in 2017. He also discusses the global market fallout and the criticism China has received for enacting its reforms.

Late-March 2018: Scrap caught in brewing trade war

The U.S. delegation to the World Trade Organization calls for China to dial back its scrap restrictions at a March 23 meeting. At the same time, tensions between the U.S. and Chinese governments are ramping up, as both countries announce tariffs on a variety of products. Against the backdrop of a brewing trade war, Chinese officials criticize U.S. complaints against its scrap import restrictions, dismissing the concerns as “hypocritical,” “unjustifiable” and “illegitimate.” It appears less likely than ever that the import restrictions will soften.

Late-March 2018: Investments take shape

Experts describe numerous plastics recycling facilities setting up speedily in Southeast Asia, where countries have been dramatically increasing their scrap imports. A small but growing number of Chinese companies announce U.S. projects that are in development, including two plastics-focused operations in the South. New investment has been far slower on the fiber side, and experts attribute the dearth in part to the higher price tag for recovered paper capital investments. However, they also describe interest among paper mills in converting equipment to allow more mixed paper usage.

Early-April 2018: Looking ahead

Regional and national recycling organizations, including the National Recycling Coalition and the Northeast Recycling Council, hold events aimed at increasing domestic end markets for recycled materials. The conversations touch on quality improvements, financing opportunities, extended producer responsibility, secondary MRFs and more. At the same time, state organizations across the country strategize on how to address the market downturn in their upcoming annual conferences.

Mid-April 2018: Data pours in

As the year progresses, monthly customs reports continue to show the extent of the volume decline for material flowing into China. Meanwhile, analysis of export volumes out of a major U.S. port show massive changes from a year earlier, including a 99 percent reduction in PET shipments to China.

April 19, 2018: Ban expands

China announces additional materials it plans to prohibit from import by the end of the year. The new list includes post-industrial plastics, which means virtually all unprocessed recycled plastic will be banned from entering the country. The list also includes a variety of scrap metals. At the same time, the country declares that even more materials, including scrap stainless steel, will be banned by the end of 2019.

Early-May 2018: Constraints continue

China ratchets up inspection requirements for recyclables imported from the U.S., requiring every load to be opened for inspection and announcing a one-month shutdown of the China Certification and Inspection Group (CCIC), the only organization providing pre-shipment approval in the U.S.

May 8, 2018: Diversion targets in question

California’s recycling agency reports concerns from local governments that they will be penalized for failing to meet mandatory diversion targets due to the market disruption from China’s restrictions. CalRecycle assures local programs the state agency will take market factors into consideration when determining whether a program has met its recycling obligations.

Mid-May 2018: Regulatory changes announced

Chinese authorities announce a number of regulatory changes related to scrap imports. The country’s Ministry of Ecology and Environment declares that clean PET flake will be allowed into the country, rather than being considered a waste material that’s banned from import along with unprocessed scrap plastic. Chinese authorities also announce they’ll allow the Canadian branch of the China Certification and Inspection Group (CCIC) to inspect U.S. loads bound for China, effectively ending the month-long suspension of pre-shipment inspections in the U.S. Meanwhile, officials issue the 12th round of import permits for scrap materials, and the approved import tonnage for paper is at its lowest volume for the year.

Late-May 2018: Vietnam's overload prompts action

The large increase in scrap plastic imports into Vietnam leads authorities to take action. Customs officials report discovering numerous permit violations that have increased in 2018. Several key Vietnamese ports report becoming overloaded with scrap materials, and they announce they’ll temporarily stop accepting loads of recovered plastic beginning in June.

May 28, 2018: 'Largest' crackdown to date

Chinese customs agents perform what they describe as the “largest scale” operation cracking down on waste imports to date. Nearly 1,300 customs agents conduct simultaneous inspections and enforcement actions in 17 provinces or municipalities, including Beijing. Customs officers “arrested the involved suspects, searched the involved companies or places, and seized the warehouses or dens storing or processing smuggled-in solid wastes, consequently wiping out 39 smuggling groups at one blow,” according to officials.

June 6, 2018: Restrictions ripple across SE Asia

Indonesia, Malaysia and Thailand join Vietnam in either enacting restrictions or considering them. As a whole, the countries have substantially increased the volume of scrap paper and plastic they import this year, and in some cases they’ve doubled or tripled their scrap imports in recent months. The influx is a growing concern for local authorities.

June 2018: Chinese producers take downtime

Amid an ongoing shortage of recovered fiber imports, major Chinese companies take downtime at mills that use recycled content. Nine Dragons and Lee & Man temporarily idle paper machines at their recycled content mills.

June 19, 2018: China responds to U.S. concerns

Multiple entities submitted letters to the World Trade Organization expressing various concerns about China’s scrap import policies. In an official response, the Chinese government indicates it has a clear understanding of the impact of its policies. China’s response says the change in global markets will spur U.S. job growth through increased processing infrastructure, and promote environmentally sound waste management practices by keeping material within the country that generated it.

June 24, 2018: Thailand bans scrap plastic imports

A month after Vietnamese ports announce a temporary ban scrap plastic imports, Thailand’s government does the same. Officials say they want to make the ban permanent. The move comes after the country has exponentially increased its scrap plastic imports in 2018: U.S. exporters shipped 132.8 million pounds of scrap plastic to Thailand in the first four months of 2018, up from 4.6 million pounds shipped during the same period a year earlier.

June 25, 2018: Inspection requirements ramp up

As of June 4, the U.S. arm of China Certification and Inspection Group (CCIC) was allowed to resume pre-shipment inspections for China-bound loads. The agency had been suspended from performing such inspections for a month, creating a new logjam for materials still allowed to be imported into China. But despite the suspension ending, a new wrinkle has exporters worried. The Chinese government issues a decree that every load exported from the U.S. to China must receive an in-person inspection prior to shipment. Previously, physical inspections were only occasional, and companies in good standing were allowed to go through an expedited self-inspection process. The new requirement and its quick imposition has industry insiders concerned there will be a shortage of inspectors, increasing the amount of waiting time before inspections can occur.

July 11, 2018: China quantifies import reduction

According to China’s Ministry of Ecology and Environment, there was a 57 percent decline in scrap material imports during the first quarter of 2018 compared with the same period in 2017. Scrap plastic imports remain extremely low, with official Chinese figures stating fewer than 20,000 metric tons of scrap plastic imported this year. However, U.S. export figures state the U.S. alone has sent nearly 22,000 metric tons of scrap plastic to China this year.

July 18, 2018: Total ban proposed

A new proposal from the Chinese government would completely ban imports of recovered fiber and every other form of “solid waste.” Earlier reports had suggested a 2020 implementation date for the plan, but the government is reportedly accelerating that timeline, with the draft to be reviewed in December.

Late-July 2018: August downtime for Chinese mills

Due to a shortage of recovered fiber, six major companies announced 40 recycled paper and board machines will take downtime through August. It is estimated that this will equate to 360,000 metric tons in cut production, including recycled containerboard, recycled cartonboard, newsprint and other grades.

Aug. 8, 2018: Deeper ties to trade war

The Chinese government announces plans to target scrap and virgin plastic directly in a growing tariff battle with the U.S. Proposed is a 25 percent tariff on U.S. shipments of scrap and virgin plastics, as well as all recovered paper.

Summer 2018: Restrictions spread beyond China

The Vietnamese and Malaysian governments follow through on plans to clamp down on recycled material shipments by discontinuing new import permits for certain materials. The Malaysian action is reportedly a temporary, three-month measure for authorities to establish “pollution controls.” Meanwhile, facing a backlog at ports in the country, Vietnamese authorities announce that they will no longer grant new licenses for waste material imports. Data from the U.S. Department of Commerce shows Vietnam imported 28.7 million fewer pounds of scrap plastic in June, representing a drop of nearly 74 percent compared with the previous months. The data also shows that even with China’s import restrictions, the country remains among the largest importers of both recovered paper and plastic.

Aug. 21, 2018: More barriers in Southeast Asia

Two months after announcing a temporary ban, Thailand authorities announce a plan to completely ban imports of scrap plastics within two years. The announcement comes in light of dramatic import figures: The country imported 757 million pounds of scrap plastic from January through June, compared with 118 million pounds imported during the same period in 2017. Also facing a sharp increase in scrap material imports, the Taiwanese government proposes import restrictions, including a ban on mixed paper.

Aug. 28, 2018: Hauler impacts continue

The head of Waste Connections says the Chinese import restrictions are a “huge deal” for his company, and that the commodity sales from recycling will be down by about $65 million in 2018 as a result. Waste Connections CEO Ron Mittelstaedt described the impact during a session at WasteCon in Nashville, Tenn.

Late-Summer 2018: Chinese investment ramps up

Two Chinese plastics companies enter the U.S. recycling market in September. Yunnan Xintongji Plastic Engineering announces plans to open a plant in Montezuma, Ga., where the company will take in scrap plastic and process it into pellet form. Separately, Tianjin Sheng Xin Non-Financing Guarantee Co. says it will open a Blacksburg, S.C. plant called Green Tech Solution, which will process plastics, scrap metal, electronics and more.

September 2018: Trade data shows policy impact

The latest trade figures from the U.S. government paint a picture of declining scrap plastic exports to certain Southeast Asian countries. The data confirms that policy changes in Thailand and Vietnam are having their desired effect of reducing imports.

Late-September 2018: Malaysia takes action

After experiencing skyrocketing levels of recyclables imports, officials in Malaysia announce plans to add a tax of about $3.62 per metric ton of recovered plastic. It’s unclear, however, whether that action will be enough to actually slow the stream of loads headed to the country.

Oct. 8, 2018: More Chinese investment in U.S.

Chinese fiber giant Nine Dragons announces it will spend $300 million to add recycled pulp production lines at two U.S. virgin fiber mills it purchased earlier in the year, and both will consume mixed paper and OCC.

Oct. 18, 2018: Permit updates from Beijing

In its 22nd round of import permits for 2018, the Chinese government ramps up the volume of recycled paper it is allowing into the country to levels not seen since March. Scrap plastic permit numbers remain extremely low, however.

November 2018: Mixed news on material movement

Export data shows China ramped up its purchases of U.S. OCC during the third quarter of the year. Meanwhile, Southeast Asian restrictions continued to stifle scrap plastic movement.

November 2018: Aggressive policies continue

As a year of turbulent export markets nears its close, export challenges show no sign of slowing. Top scrap paper and plastic destinations across Southeast Asia add new restrictions for incoming recyclables, and some countries ban certain materials outright. Meanwhile, China confirms it will expand its scrap import ban at the end of the year to cover post-industrial plastic and a variety of metals; OCC is still not targeted for a complete ban.

Mid-December 2018: Markets and MRFs evolve

Export data shows that mixed paper is still moving to overseas markets, but, year-to-date, mixed paper exports are down 24 percent compared with 2017. Meanwhile, on the OCC front, exports are up as traders rush to purchase the last volumes available under their Chinese import permits. Also, in different corners of the U.S., recycling facility operators report they have upgraded their lines amid shifts in markets and the materials stream.

January 2019: Paper permits on the rise

The new year kicks off with a high volume of recycled paper import permits issued by the Chinese government – higher than in any single release throughout 2018. Although the move suggests a positive start to the year for fiber exports, analysts continue to predict lower recovered fiber shipments overall throughout 2019. On the plastic side, the Chinese government does not issue any plastic import permits, remaining consistent with its vow to add post-industrial plastic to the list of banned imports.

January 2019: Policies prove effective

Trade statistics from the Chinese government indicate the country’s recycled plastic imports fell by 99 percent in 2018 compared with the previous year. Meanwhile, paper imports fell by a third. The figures indicate China’s recyclable material trade policies have been extremely effective.

January 2019: Paper exports flat as plastic shipments decline

Trade figures indicate that China consumed more U.S.-generated scrap fiber than any other country in January. Meanwhile, on the plastics side, U.S. exports hit a 14-year low.

February 2019: Investing to adapt

Waste Management, the largest U.S. hauler, announces the company invested $110 million into its recycling system in 2018, even as the company experienced an estimated $100 million revenue impact from the recycling market upheaval. The investment was directly tied to the market fluctuations, and the company also indicates it will make its largest residential recycling investment yet in the year to come. The hauler also pointed to its relationships with domestic material processors as vital to weathering the market downturn.

February 2019: Haulers hit hard

The largest haulers in North America report significant declines in 2018 year-end recycling revenue, citing the tumultuous recycling markets. Waste Management, Waste Connections and Republic Services all detail their financial bruises in earnings reports, but they also announce investments in new technology that will help the companies weather the storm in the future. Additionally, Casella Waste Systems and Advanced Disposal Services report tumbling recycling revenues for 2018.

Late February 2019: MRFs upgrade as OCC shipments lag

Recycling facilities continue to install new equipment to improve output quality. MRFs across North America bring in robotic systems, infrared optical sorters and other state-of-the-art technology, spending millions of dollars to improve their situation in the recycling market.

Meanwhile, although export figures from late-2018 show upticks in recovered fiber exports, reports indicate falling OCC exports as 2019 gets underway. Experts point to a slowing Chinese economy as one key factor in the lower export volumes. A paper mill equipment supplier notes that an initial burst of Chinese mill construction activity, following the import restrictions, has recently slowed.

February 2019: Exports slide down further

U.S. exports of scrap paper and plastic continued to drop in February, marking the fourth straight month of declining shipments for both commodities.

March 2019: Another key plastic market closes the door, but delays ban implementation:

India, which was among the top importers of U.S. scrap plastic in 2018, announces it will prohibit scrap plastic from being imported into the country. The country cites environmental problems associated with importing the material, as well as government interest in boosting domestic industry. Early reports suggested the ban would take effect immediately, but the government clarifies that the policy will be delayed until late summer.

March 6, 2018: The fallout in 2018

The U.S. government releases export data that indicates overall scrap plastics exports from the U.S. dropped 35 percent from 2017 to 2018. The numbers also show China went from receiving 33.4 percent of recovered plastic exported from the U.S. in 2017 to just 4.5 percent in 2018.

March 19, 2019: Full-year impact becomes clear

Year-end export figures indicate that, despite a year of market uncertainty, U.S. recovered paper exports increased in 2018, driven largely by OCC shipments. However, scrap plastic exports were down 35 percent as countries enacted stringent trade policies.

March 2019: Media narrative spurs industry push-back

After a recent slew of mainstream news articles framing the market crisis as evidence of the “end of recycling,” industry experts offer another side of the story. They point to recent major investments in recycling infrastructure and end markets, developments that indicate optimism about the future of recycling.

March 2019: Highlighting Chinese-U.S. partnerships

Closed Loop Partners, an investment firm putting money into the recycling industry, offers an in-depth look at opportunities for U.S. and Chinese recycling stakeholders to work together in the wake of disruptions to the global scrap trade flow.

Late-March 2019: Overseas market considers restrictions

The Vietnamese government says it will end scrap plastic imports by 2025. Vietnam has become a larger downstream destination for U.S. recycled plastic since China’s restrictions took effect.

April 2019: China approves more import permits but maintains long-term ban plans

Chinese import permits for recovered paper are down 13% year-over-year, and paper is still moving into the country. But the country is adamant about its ultimate goal to eliminate all scrap imports in the long run. The country also expands on its definition of “solid waste,” which has been interpreted differently around the world.

April 2019: Commodity strife impacts contract negotiations

The changing economics of recycling are increasingly influencing how municipal recycling contracts are written, according to several experts speaking at the ISRI2019 conference. The cost shift means municipalities are paying more and the recycling providers are lowering their risk exposure. Ultimately, recycling is moving toward a “fee for service” model rather than relying on commodity values to cover costs.

April 2019: Lower values lead to hauler recycling pains

As key residential recycling commodities draw lower and lower prices, the largest publicly traded haulers in North America report ongoing recycling revenue decreases for the first quarter of 2019. But one major hauler reports a recycling revenue increase during the quarter, attributed to renegotiated contracts that include recycling fees.

May 11, 2019: Another global policy change

Governments around the world approve major plastics-related changes to the Basel Convention, a global waste treaty that aims to limit trade in hazardous wastes. The changes, which will impact how and where plastics exporters can ship material around the world, are anticipated to generate further significant disruption to movement of recyclables around the world.

May 21, 2019: Municipal program decisions

Three communities of varying size are forced to take action due to rising recycling costs. One region cuts paper collection from its recycling program; a larger city scales back the list of plastics it accepts; and a county program cuts its entire curbside program, but then reverses the decision after public push-back.

May 2019: First-quarter trade data comes in

Export figures covering January through March 2019 show dramatic declines in plastic exports but relative stability in paper shipments. On the paper side, the trend was largely driven by ongoing Chinese demand for U.S. OCC, as well as alternative markets upping their fiber intake.

June 25, 2019: Combined pressures drive facility closure

A perfect storm of industry pressures, including declines in commodity prices and rises in freight costs, lead a Canadian waste and recycling firm to close its doors.

July 9, 2019: Optimism on the horizon

With overseas import restrictions, tariff impacts and domestic market volatility, an erratic environment has become the norm for recycling operators around North America. But amid that turmoil, experts identify plenty of factors that seem destined to push markets back up in the years ahead.

Summer 2019: Paper mill announcements continue

Throughout the summer, recovered paper end users make significant announcements. These include Crossroads Paper in Utah, Phoenix Paper in Kentucky, Verso Corporation in Minnesota and North Pacific Paper Company in Washington. Resource Recycling began charting these expansions on a map.

Summer 2019: Overseas regulations continue to evolve

India readies a ban on scrap plastic imports, and Indonesia continues to revise its plan to bring in only the cleanest recovered fiber loads. These moves come after the first half of the year saw U.S. scrap plastic exports plummet by 43% compared with that period in 2018, while paper exports remained relatively stable. As the overseas regulatory changes keep unfolding, countries such as Cambodia increasingly take to sending problematic loads back to their country of origin.

August 2019: Haulers adapt as communities cut collection

The latest financial reports show the top recyclable material haulers experiencing lower revenues due to commodity price pains. To offset this, haulers are increasingly charging communities recycling collection fees. The higher costs for communities, in turn, is leading some cities, even larger ones, to cut recycling collection altogether. MRFs are feeling the market pressures, as well: According to one survey, MRFs in the Northeast are receiving an average of $46 per ton, while they are having to spend $82 per ton to process those materials.

August 27, 2019: More tariffs on recyclables

As the wider trade war between the U.S. and China escalates, China announces it will increase existing tariffs on OCC and other recovered fiber grades. The country remains the largest market for U.S. OCC. Experts say the trade war is having global economic effects and creating an uncertain business environment.

Sept. 2, 2019: Seeds of a recession?

A report in The Wall Street Journal indicates the trade war between the U.S. and China is creating uncertainty among small businesses and exacerbating a global manufacturing slowdown.

Early October 2019: Paper movement slows further

Data from China shows the country imported around 8 million short tons of recovered fiber in the first eight months of 2019, down from the 10.9 million tons imported during the same period in 2018. Meanwhile, regulatory moves hint the country could be moving toward banning recyclable imports completely in 2020.

November 2019: Domestic strength as export decrease continues

Amid overseas policy changes, the third quarter of 2019 brings lower export volumes for both recycled paper and plastic. But in North America, recycling operators report stability in material movement, even if pricing is less than desirable.

December 2019: Evidence builds for China's all-out fiber ban

Despite taking steps seemingly to facilitate more imports, numerous developments suggest the government intends to implement an all-out ban on recovered fiber imports in 2021. These signals include a meeting between officials and top paper companies in China, confirmation of the ban from a trade association within China, and significant preparation for future fiber sourcing by the largest Chinese paper firm.

Winter 2020: Trade War Truce

The American and Chinese governments come to an agreement that halts planned tariff increases on numerous products, including recycled fiber, and eventually sign a deal that seemingly calms the escalating trade dispute between the two countries. Existing tariffs on hundreds of billions of dollars in exports between the two countries, however, stay in place.

January 2020: China Decrease Continues

The Chinese government begins issuing import permits for 2020, and early indications suggest the country will allow in less recovered fiber than it did in 2019.

January 2020: India Follows Suit

India, which has become the largest export market for U.S. mixed paper, announces major quality restrictions on imports of the material, threatening to further restrict recycled fiber movement.

Early 2020: Ongoing export decline

Trade figures show further decreases in exports from the U.S. to all countries, and Chinese import figures indicate the country is continuing to reduce the volume of recovered fiber coming into its borders. The country’s permitting actions suggest that decrease will continue in the coming year.

March 2020: Another country cracks down

Citing contamination in imported loads of mixed paper, the South Korean government says it will tighten up import criteria and increase quality requirements. The country also moves to restrict recycled PET bottle imports.

Spring 2020: Enter COVID-19

Asian markets for recovered materials experience yet another disruption as governments enact widespread restrictions and close ports in response to the coronavirus pandemic. The lockdowns spawn “chaotic market conditions,” according to one recycling trade group.

May 2020: Ongoing exports tumble

Government trade statistics show that in the first quarter of 2020, shipments of recycled paper and plastics out of the U.S. continued to fall. As was the case in previous quarters, China’s falling appetite for recyclables drove the decreases. On the scrap plastics side, U.S. exports in Q1 of 2020 totaled 311 million pounds; in the first quarter of 2018, that number had been 711 million.

June 2020: Shipper shift

Citing Chinese government plans to curb scrap imports entirely, ocean carrier Mediterranean Shipping Company (MSC) stops accepting loads of recovered fiber, plastics, metals and chemicals headed for China. MSC is the world’s second-largest shipping line (next to Maersk).

June 2020: Contamination clarity

Indonesian officials announce paper and plastic shipments to the country will be allowed a maximum of 2% contamination. The 2% limit follows months of uncertainty during which Indonesia offered mixed signals about how it would modify scrap import rules.

2021: Full-year data shows lasting impact of 'National Sword'

U.S. Census Bureau data shows U.S. companies exported nearly 18 million short tons of recovered fiber in 2021, up 13% from the prior year. The upward move marks a reversal of two years of declines, as other countries have more than made up for the collapse in trade with China. Plastics, however, continued a downward trend, with 1.21 billion pounds of scrap plastics exported by U.S. companies. The numbers show how China’s National Sword policy has utterly reshaped the global trade of recovered commodities.