Recycled material shipments out of the U.S. have been on the decline for multiple years due to overseas regulatory changes. | MAGNIFIER/Shutterstock

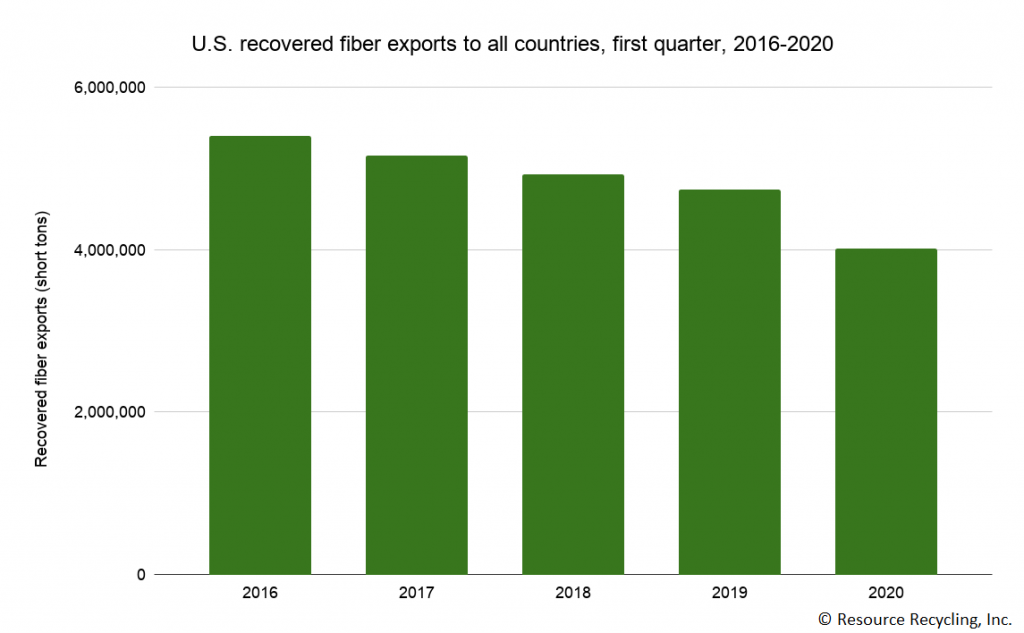

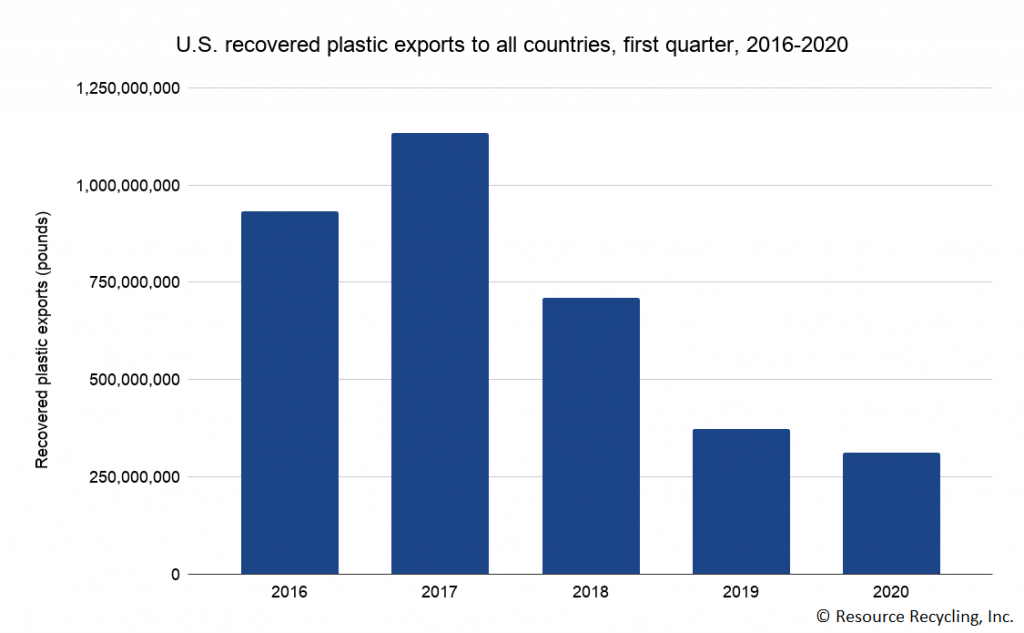

U.S. exports of recycled paper and plastic were down during the first quarter of 2020 compared with previous years, according to new export data.

The decrease in recovered material exports, detailed in U.S. Census Bureau trade data published this month, comes after 2019 marked a historic decline for exports of recycled commodities.

Paper down, but pulp up

U.S. companies exported 4.01 million short tons of recovered fiber during the first three months of the year, the lowest first-quarter export volume in years. That’s down from first-quarter tallies of 4.74 million in 2019 and 4.93 million in 2018.

As in previous years, China drove the decrease. The country imported 1.20 million short tons of recovered fiber during the first quarter, down from 1.49 million during that period in 2019 and 2.11 million in the first quarter of 2018.

Still, China was the largest buyer of U.S. recovered fiber. Other major importing countries were India (747,000 short tons), Mexico (309,000 short tons), Vietnam (297,000 short tons), South Korea (256,000 short tons), Taiwan (252,000 short tons), Canada (242,000 short tons), Indonesia (157,000 short tons), Thailand (126,000 short tons) and Malaysia (64,000 short tons).

Recycled paper pulp exports hit 87,000 short tons for the first quarter, up from 50,000 short tons in the same period in 2019 and 14,000 short tons during the first quarter of 2018.

This growth was driven largely by China, which accounted for 84% of recycled pulp imports during the 2020 period. The increase is in line with plans by major Chinese paper companies to source feedstock in pulp form, because unprocessed recovered fiber bales are difficult to move into the country.

(Story continues below chart.)

Policies drive plastics drop

Policies drive plastics drop

The U.S. exported 311 million pounds of scrap plastic during the first quarter of 2020, down from first-quarter tallies of 374 million in 2019 and 711 million in 2018.

Chinese imports remain virtually nonexistent, following the country’s 2018 ban on scrap plastic imports. Figures show China brought in 1 million pounds of U.S. scrap plastic in the first quarter of this year – four years ago, China imported 324 million pounds of scrap plastic during that period.

But the drop in global exports this year was driven by other countries enacting similar policies. For example, India, which imported 81 million pounds of U.S. scrap plastic in the first quarter of 2019, announced later in the year a ban on imports of the material. Accordingly, exports to India totaled just 10 million pounds during that period this year.

Other countries increased their imports this year, including Vietnam (up by 20 million pounds) and Malaysia (up by 31 million pounds), but those increases were not enough to offset India and other countries’ reduced imports.

The top importers of U.S. scrap plastic were Canada (81.3 million pounds), Malaysia (54 million pounds), Hong Kong (25 million pounds), Vietnam (25 million pounds), Mexico (21 million pounds), Turkey (16 million pounds) South Korea (11 million pounds), Taiwan (10 million pounds), India (10 million pounds) and Indonesia (8 million pounds).

Policies drive plastics drop

Policies drive plastics drop More stories about exports

More stories about exports