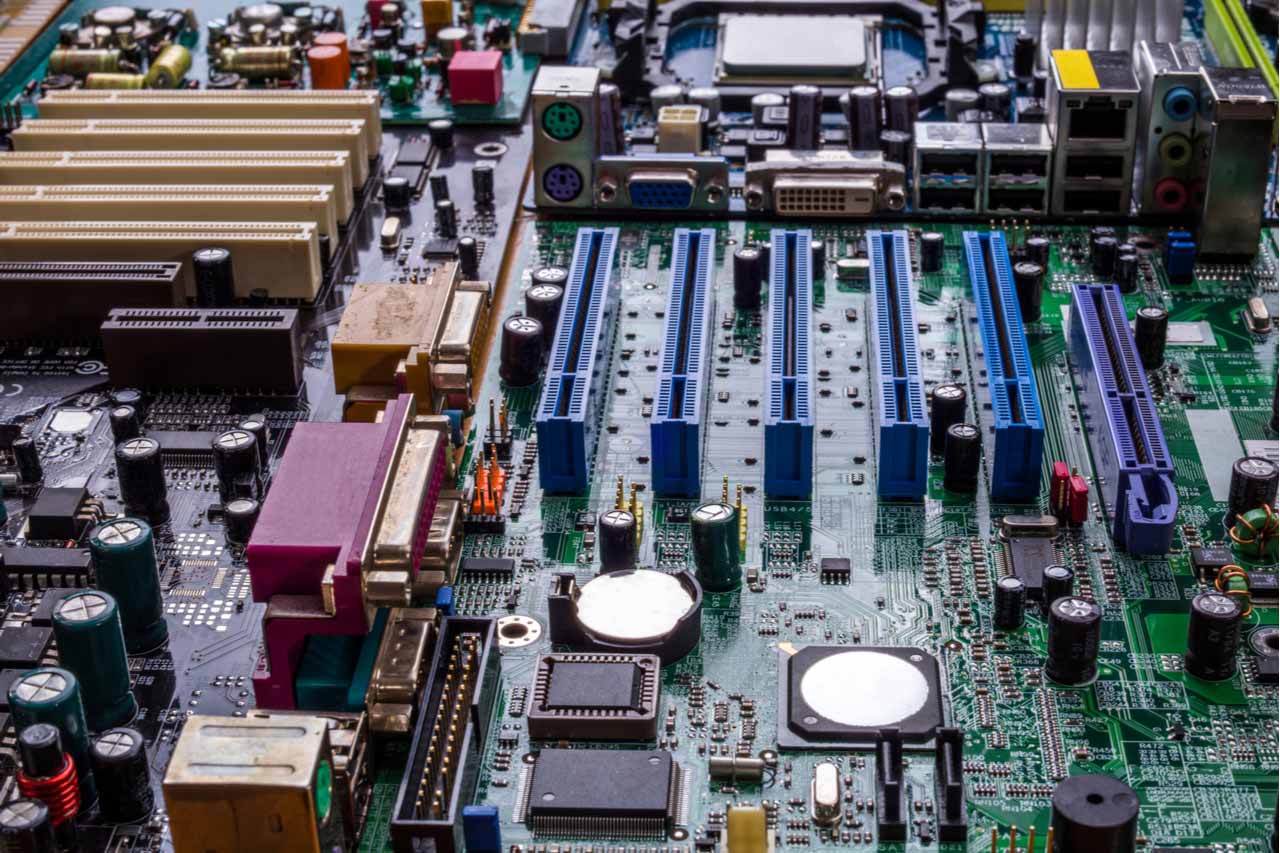

The E-Cycle Washington program reported that 93% of the materials collected in 2021 were recycled. | Huguette Roe/Shutterstock

Seven processors handled electronics under E-Cycle Washington’s program in 2021, sending recovered commodities to downstreams all around the globe.