The price of PET took a dive over the past month, but the value of natural HDPE climbed substantially. Continue Reading

The price of PET took a dive over the past month, but the value of natural HDPE climbed substantially. Continue Reading

Pepsico has a 25% recycled content goal for the company’s plastic packaging. | LuqmanLutfi Photography/Shutterstock

It’s clear the current recycling system can’t deliver sufficient resin for brand owners to hit their increasingly ambitious recycled-content goals. A PepsiCo executive recently discussed that supply gap.

A number of companies received approval to use their recycling technology to produce recycled plastic for use in food and drink packaging.| Somsak21/Shutterstock

A company was given the go-ahead to recycle post-consumer PET into multi-layer reheatable food trays. Meanwhile, a global packaging company was OK’d to recycle LDPE films into reusable bags.

Unifi identified a number of factors that accounted for lower profits last fiscal year. | Recycle Man/Shutterstock

A major U.S. consumer of RPET enjoyed higher sales figures but suffered significantly lower net income last fiscal year. One reason was cheap polyester imports from China and India.

Indorama Ventures plans to make significant investments in its recycled PET production capabilities. | Kwangmoozaa/Shutterstock

Citing the need to meet rising demand in the near future, plastics producer Indorama is investing $1 billion in its recycling division.

PET and HDPE bales are fetching lower prices than they were a month ago, but PP and high-grade film have shown stability.

PET and HDPE bales are fetching lower prices than they were a month ago, but PP and high-grade film have shown stability.

Sonoco has pledged to boost the post-consumer content in its plastics packaging to 25% by 2025. | Janthiwa Sutthiboriban/Shutterstock

A packaging giant has notched upward the amount of RPET it uses in its food containers.

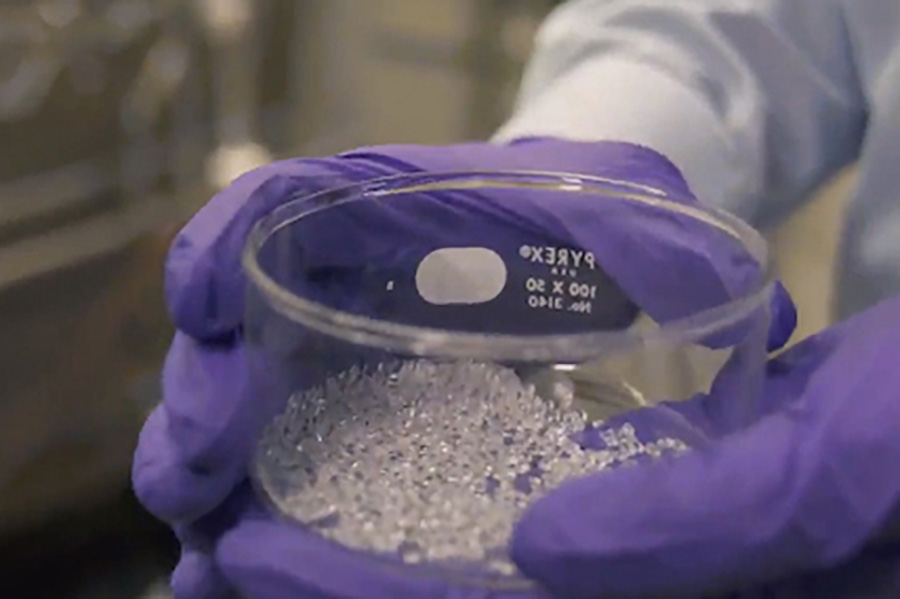

IBM has a goal to recover more PET from highly contaminated streams. | Credit: Wall Street Journal video.

Three different chemistry-based processes for recovering plastics have recently grabbed attention, illustrating the wide range of stakeholders working to find solutions beyond mechanical recycling.

A market analyst projects that PET collection rates in the U.S. would need to double to provide enough supply for consumer goods companies to meet their goals. | Myibean/Shutterstock

Market analysts say PET collection rates are insufficient to reach the amount of material brand owners will need to hit their recycled-content objectives.

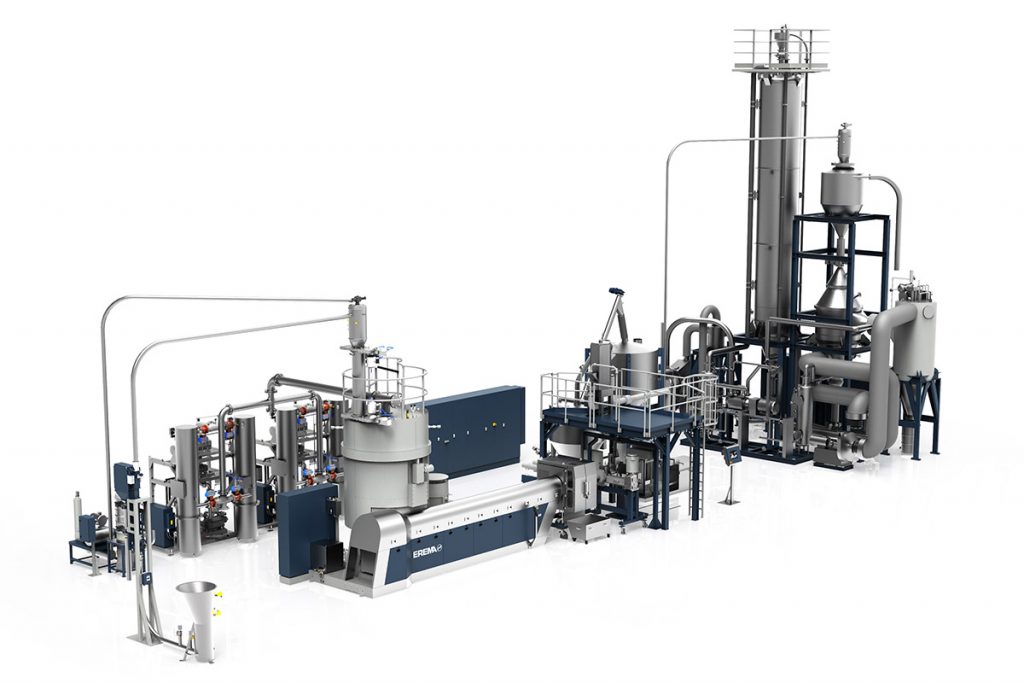

A new PET recycling system combines decontamination approaches from two different European equipment providers.

A new PET recycling system combines decontamination approaches from two different European equipment providers.