A U.K. telecom works to provide needy people with used phones, and Indian authorities intercept thousands of illegally imported used copy machines.

A U.K. telecom works to provide needy people with used phones, and Indian authorities intercept thousands of illegally imported used copy machines.

A U.K. telecom works to provide needy people with used phones, and Indian authorities intercept thousands of illegally imported used copy machines.

A U.K. telecom works to provide needy people with used phones, and Indian authorities intercept thousands of illegally imported used copy machines.

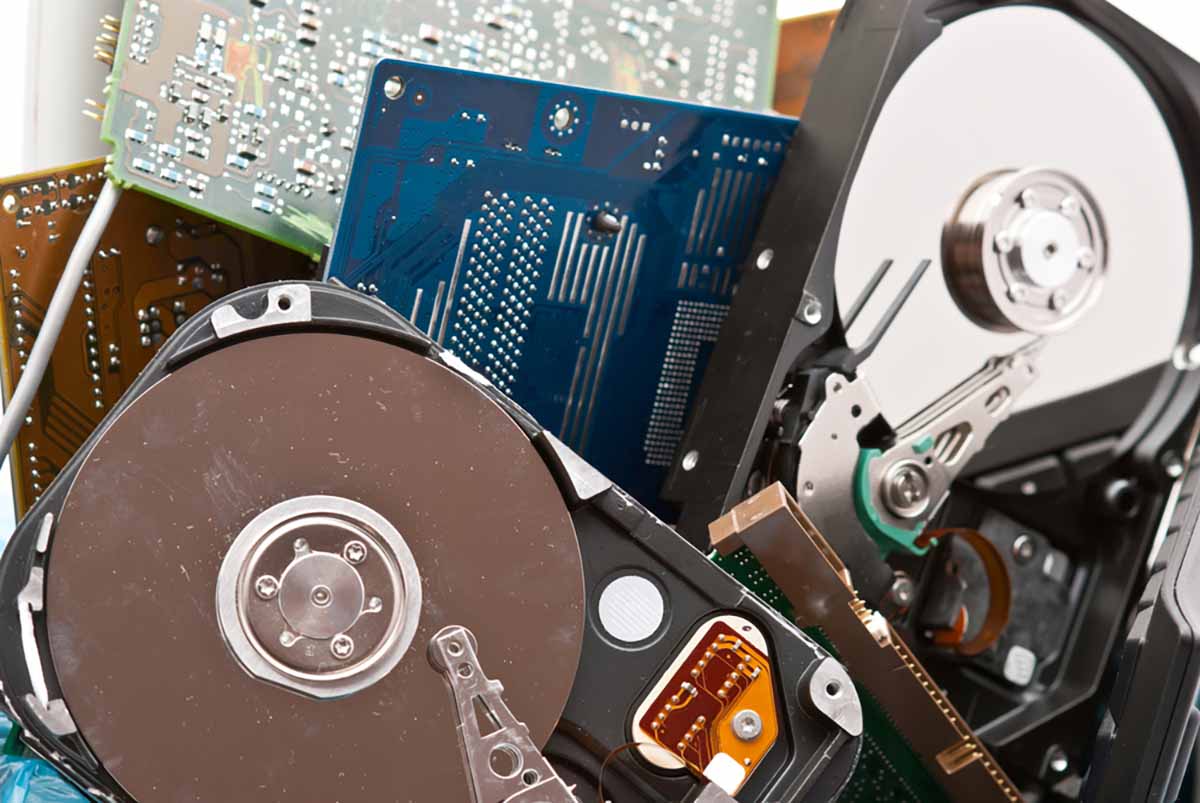

A bill limiting exports of scrap electronics has been reintroduced in Congress, after it failed to advance in 2016.

A bill limiting exports of scrap electronics has been reintroduced in Congress, after it failed to advance in 2016.

Morgan Stanley noted that Korea Zinc bought the remaining 24.5% of Igneo Holdings for $110 million. On July 11, Korea Zinc paid $332 million for a majority stake. | REDPIXEL.PL/Shutterstock

Korea Zinc now owns 100% of Igneo Holdings after purchasing a majority stake in July.

Continue Reading

Samsung operates an e-scrap collection system in 50 countries. | JHVEPhoto/Shutterstock

Samsung’s environmental strategy includes a focus on circularity, using recycled materials and collecting more e-scrap.

Korea Zinc’s deal creates a vertically integrated global e-scrap entity that will control material from collection all the way through to final smelting. | Pavel Kapysh/Shutterstock

Metals giant Korea Zinc is set to control e-scrap recycling and secondary processing operations in the U.S. and Europe, striking a $332 million deal to acquire a majority stake in Igneo Technologies.

Continue Reading

Newly acquired by SK ecoplant, TES was founded in Singapore in 2005 and has more than 40 facilities in 20 countries, including the Seattle location seen here. | Google Streetview

South Korean company SK ecoplant is expanding its footprint in the ITAD industry with an agreement to acquire TES for $1 billion.

Researchers are calling for more research into the toxicity and risks of new types of antioxidants that e-scrap workers can become exposed to. | Jared Paben/Resource Recycling, Inc.

E-scrap facility workers are being exposed to new types of synthetic antioxidants used in plastics and rubbers, with unknown health consequences, according to recent research.

Off a narrow, sun-bleached alley, where the early summer heat stuns by mid-morning, Sakib Malik sits behind a desk in near darkness. Beside him, stacks of plastic casings from old CRT televisions arch toward the ceiling. He’s on the phone, amid another deal.

France has begun requiring manufacturers to label their electronic products with a repairability score. | S.Dashkevych/Shutterstock

France has started requiring electronics OEMs to calculate and disclose repairability scores to consumers, and officials in Malaysia raise concerns about recent e-scrap importation in that country.

Industry group ISRI said that updated import guidelines are an acknowledgement from China that scrap materials are products, not waste. | Maha Heang 245789/Shutterstock

Chinese authorities have published updated standards for imports of recovered brass, copper and aluminum. They’re set to go into effect on Nov. 1.