For MRFs in the Northeastern U.S., the average value of a ton of recyclables was $42.41 during the fourth quarter of 2019.

Curbside recyclables pricing in the Northeastern U.S. was fairly flat late last year, but processing costs for recycling facilities increased noticeably, according to a Northeast Recycling Council survey.

This year’s Resource Recycling Conference is providing much-needed insight on a range of critical recycling issues. And on the event’s first day, the National Recycling Coalition named its new executive director.

This year’s Resource Recycling Conference is providing much-needed insight on a range of critical recycling issues. And on the event’s first day, the National Recycling Coalition named its new executive director.

Lower recovered metals prices hurt revenue at a waste-to-energy company, and a group urges a major magazine to use recycled paper.

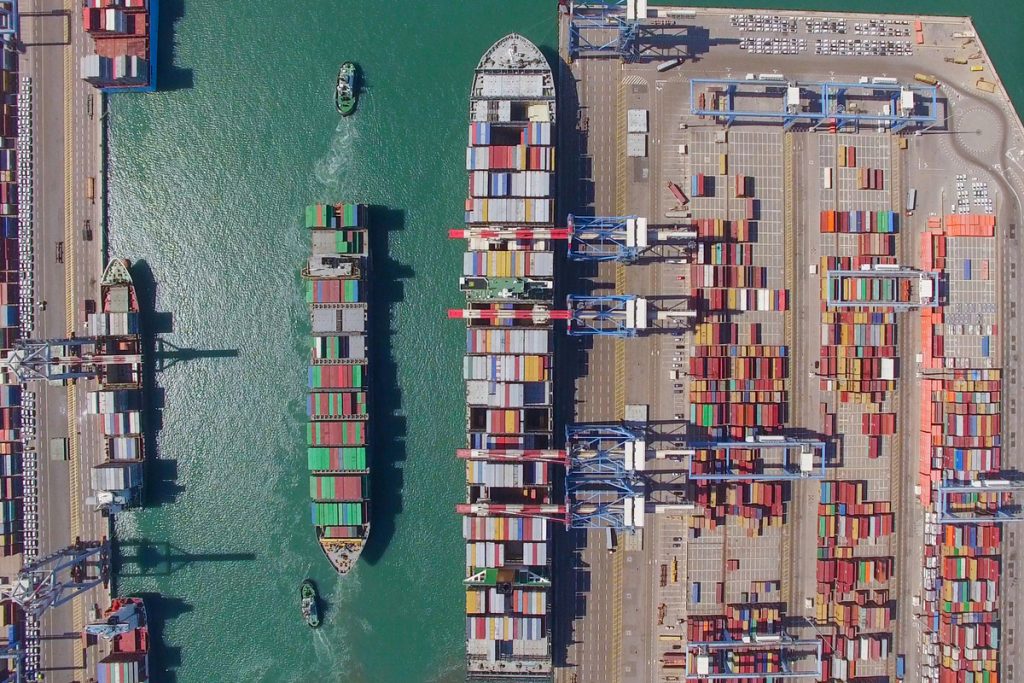

Lower recovered metals prices hurt revenue at a waste-to-energy company, and a group urges a major magazine to use recycled paper. Despite a year of market uncertainty, U.S. recovered paper exports increased in 2018, driven largely by OCC shipments. However, scrap plastic exports fell substantially as countries enacted stringent trade policies.

Despite a year of market uncertainty, U.S. recovered paper exports increased in 2018, driven largely by OCC shipments. However, scrap plastic exports fell substantially as countries enacted stringent trade policies.

Recovered materials processors have received a little holiday cheer. The value of most recyclables moved higher at the start of this month.

Recovered materials processors have received a little holiday cheer. The value of most recyclables moved higher at the start of this month. The growing smiles you see among recycling collectors and processors are because of continuing market improvement.

The growing smiles you see among recycling collectors and processors are because of continuing market improvement. The past few months have seen significant upticks in the value of recovered materials.

The past few months have seen significant upticks in the value of recovered materials. The value of curbside-collected paper and steel is down slightly at the start of April, though some plastics have experienced boosts.

The value of curbside-collected paper and steel is down slightly at the start of April, though some plastics have experienced boosts.