Prices for curbside natural high-density polyethylene have climbed even higher over the past month. Paper prices remain painfully low.

Prices for curbside natural high-density polyethylene have climbed even higher over the past month. Paper prices remain painfully low.

Prices for curbside natural high-density polyethylene have climbed even higher over the past month. Paper prices remain painfully low.

Prices for curbside natural high-density polyethylene have climbed even higher over the past month. Paper prices remain painfully low.

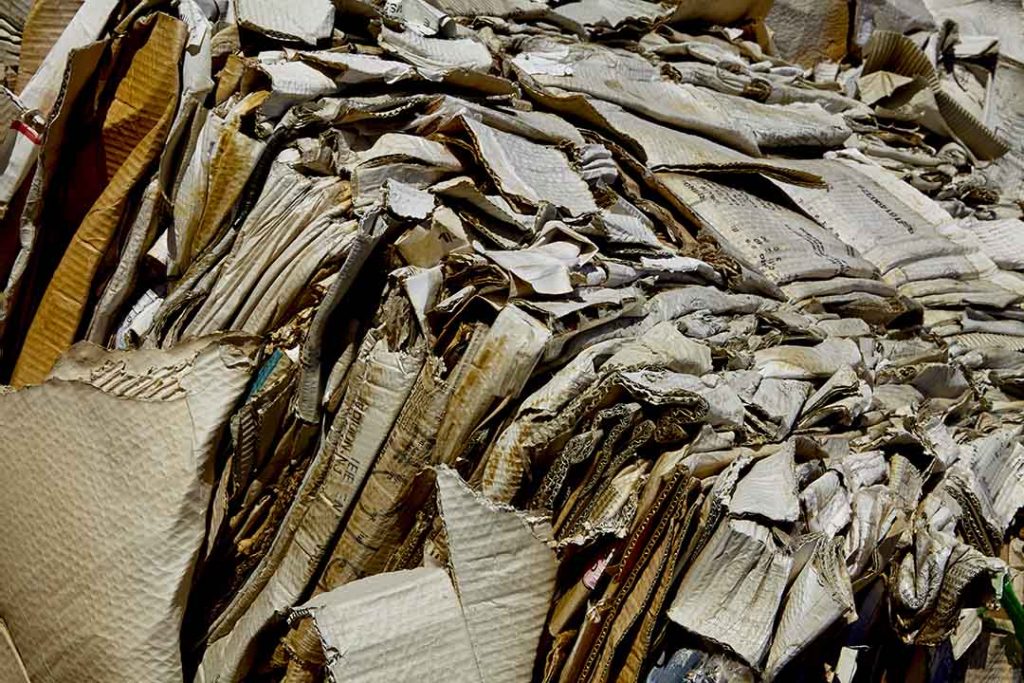

KDC and Celadon noted that in North America e-commerce trends are driving higher OCC generation in the residential recycling stream. | ja images/Shutterstock

A technology company and investment firm say they will develop two North American facilities processing more than 800,000 tons per year of mixed paper and OCC into recycled pulp and paper.

The price of recovered natural HDPE has climbed again, in some areas breaking recent records. The price of OCC dropped further, however.

The price of recovered natural HDPE has climbed again, in some areas breaking recent records. The price of OCC dropped further, however.

U.S. exporters shipped 4.5 million short tons of recovered fiber from July through September. That’s the lowest third-quarter volume since 2006. | MAGNIFIER / Shutterstock

Overseas appetite for scrap plastic dwindled in the third quarter. On the domestic side, operators report stable movement for common curbside materials, although fiber pricing remains a challenge.

Denmark-headquartered Baltic Control was approved as an inspector of U.S. exports to China earlier this year | Bullstar/Shutterstock

China has approved the first non-Chinese-government-affiliated entity to inspect U.S. recovered fiber shipments to the Asia country. The move raises questions about the country’s long-term plans for recovered fiber imports.

Waste watchdog Basel Action Network tracked containers of mixed paper that were shipped from the U.S. to Indonesia and were rejected. | Naruedom Yaempongsa/Shutterstock

Contaminated bales of recycled paper stonewalled at Indonesian ports were not returned to the U.S. as promised, according to environmental organizations.

Packaging Corporation of America will add 350,000 tons per year of OCC pulping capacity at its Wallula, Wash. mill. | Google Earth

Packaging Corporation of America will begin consuming OCC at a mill in the Pacific Northwest, citing customer demand, feedstock availability and cost savings.

OCC has traded for consistently lower prices each month this year. | create jobs 51/Shutterstock

Executives from paper manufacturers that consume major tonnages of OCC and mixed paper recently offered their thoughts on where the recycled-material market is headed.

Around 50% of box manufacturer U.S. Corrugated’s total paper sourcing comes from post-consumer materials. | John McLenaghan/Shutterstock

U.S. Corrugated, a box manufacturer that uses recovered fiber, is opening a “super plant” in Indiana in coming months, with more new capacity coming in the future.