A recent Greenpeace report noted companies are increasingly calling a wider variety of products “recyclable.” | Marko Rupena/Shutterstock

Several recycling industry reports were recently released, including a Greenpeace indictment of recyclability labeling, the latest updates from Closed Loop Partners, and one state’s investigation of food waste in public schools.

U.S. recovered fiber exports fell by roughly 3 million tons from 2018 to 2019. | StockStudio Aerials/Shutterstock

In 2019, recovered fiber exports from the United States experienced their largest year-over-year decline on record. U.S. scrap plastic exports also continued a substantial fall.

A report from plastics industry group NAPCOR indicated the U.S. PET bottle recycling rate was 28.9% in 2018, down from 29.2% in 2017. | pook jun/Shutterstock

The U.S. recycling rates for both PET bottles and all plastic bottles have fallen slightly, according to two reports released by industry groups.

The recycling rate for containers and packaging was 50.1% in 2017. | Arturs Budkevics/Shutterstock

The overall U.S. recycling rate was 35.2% in 2017, but underneath that number is a more complicated picture of material-specific recovery.

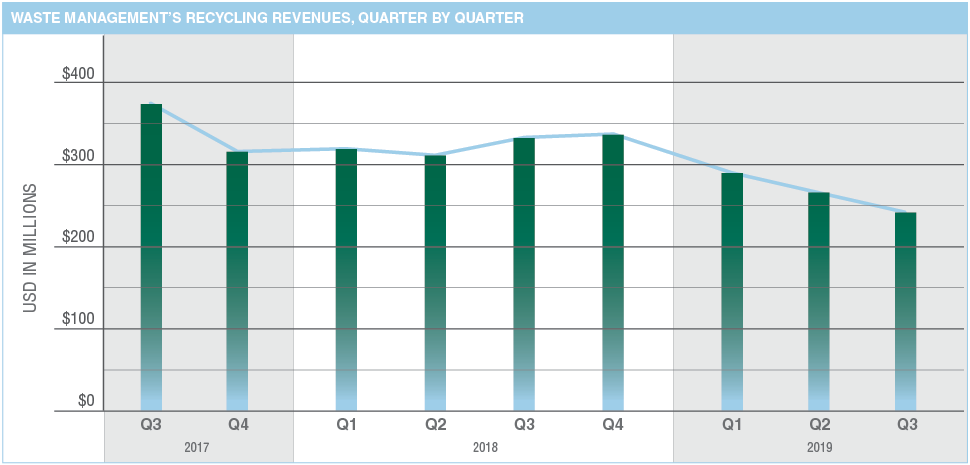

The impact of the seismic shift in recycling markets over the past two-and-a-half years can be clearly seen in the quarterly recycling revenue numbers of Waste Management, which operates roughly 100 materials recovery facilities in North America.

The publicly traded company has seen its quarterly recycling-related revenue decline 35% (from $375 million to $245 million) since the third quarter of 2017. In July of 2017, China announced its intention to ban many categories of recyclables, and the policy was implemented at the start of 2018.

Values for many key curbside materials have dropped significantly since then.

Information for this month’s Data Corner came from Waste Management’s publicly available earnings reports.

This article originally appeared in the November 2019 issue of Resource Recycling. Subscribe today for access to all print content.

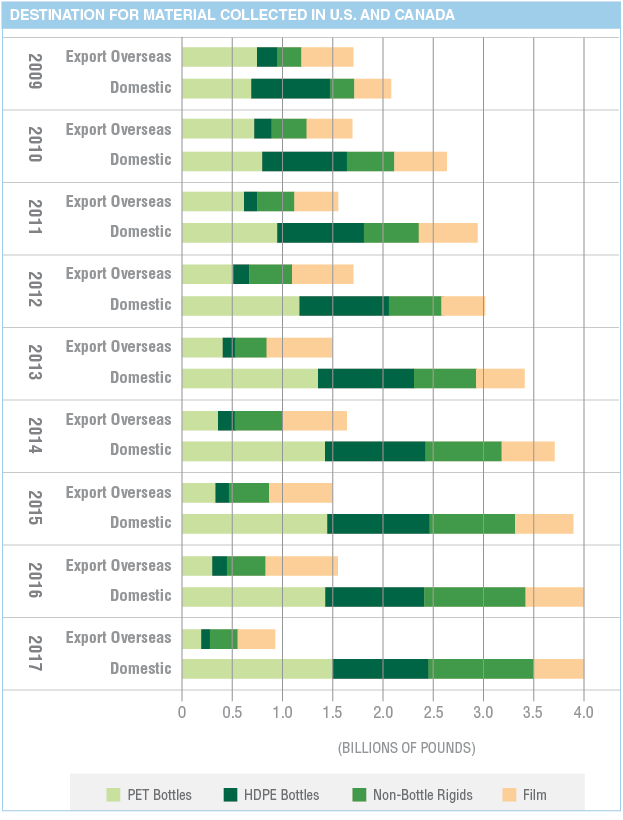

The graph below shows the downstream trends for four major plastic resins collected for recycling in the U.S. and Canada going back to 2009 (the graph stops at 2017 because that is the most recent year for which figures are available).

From 2009 to 2016, the total amount of post-consumer plastic exported to overseas markets from the U.S. and Canada stayed relatively stable, but that number dropped considerably in 2017. That fact is hardly surprising: China stated in 2017 that it was planning to implement its import ban on many grades of recovered material at the outset of 2018, and the announcement itself caused major market shifts.

On the domestic processing front, the total amount climbed steadily before plateauing between 2016 and 2017. With more material needing a home as many Asian markets enact restrictions, opportunity exists for continued domestic processing growth. The keys will be infrastructure improvements to deliver cleaner loads to plastic reclaimers and greater end market demand for the recycled resins.

This month’s Data Corner was produced by More Recycling.

This article appeared in the October 2019 issue of Resource Recycling. Subscribe today for access to all print content.

The U.S. recycling and composting rate inched up to 35.2% in the most recent EPA analysis. | Huguette Roe/Shutterstock

The national recycling and composting rate has inched above 35%, according to the U.S. EPA.