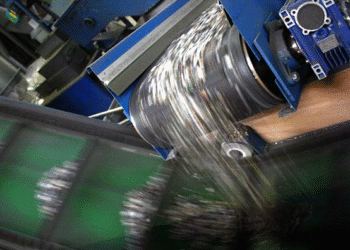

As trade strife between the U.S. and China heats up once again, the Chinese government has restricted exports of some key metals alongside retaliatory tariffs. Given China’s position as the world’s largest supplier of those metals, the move could spur more interest in U.S. recycling.

President Donald Trump this month followed through with his threat to levy a 10% tariff on Chinese goods entering the U.S., even as he paused larger tariffs on Canada and Mexico. In response, the Chinese government issued its own tariffs on U.S. products, calling to mind the trade war that erupted in 2018.

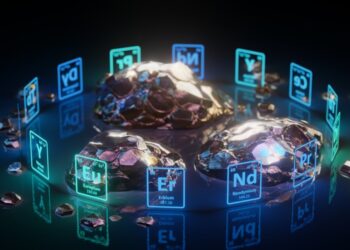

On Feb. 4, China’s Ministry of Commerce also announced new export controls on five types of critical minerals: tungsten, tellurium, bismuth, molybdenum and indium. The country didn’t ban those exports but added a new permitting requirement to export them.

The move doesn’t directly affect the e-scrap world, but it could have some indirect effects. Indium, for example, is largely sought after for LCD display manufacturing. The metal has been a focus of electronics recovery research in recent years, and the U.S. military has funded research into indium recovery from electronics as a way of reducing Chinese supply reliance. The critical mineral restrictions join come on top of China’s existing restrictions on exporting some rare earths to the U.S., and on top of the rising import duties levied by both countries.

“If the tariff leads to China refusing to export these metals to the U.S., demand will be much higher than supply. This will make devices harder to get and more expensive if you do,” nationwide processor ERI recently wrote, adding a plug for e-scrap recovery as a solution: “Instead of relying on mining and limited supplies, ERI’s electronics recycling makes it possible to recover rare earth metals for reuse.”

Additionally, critical minerals recovery appears to be a bipartisan area of interest. Indium, rare earths and numerous other metals were among the electronics-related feedstocks included on a “critical minerals” list in 2018, which was created in response to an order Trump signed the previous year during his first term. The order also directed federal efforts to examine recycling technologies for such metals.

When President Joe Biden took office in 2021, his administration continued and expanded federal interest in exploring e-scrap as a critical mineral supply channel, including through the U.S. military research funding and the E-SCRAP prize, which awarded funding to a handful of rare earth recycling operations.

Now in Trump’s second term, it’s unclear how much of a priority supporting recycling technologies will be. He has already paused some clean energy-related funding programs for review, potentially hampering the substantial funding the Biden administration provided to lithium-ion battery recycling operations.

But Trump’s focus on promoting domestic energy production could feasibly connect with electronics recycling. Mentions of critical minerals in his first-day executive order titled “Unleashing American Energy” were largely focused on deregulation to allow greater mining. But it also called for the Department of Energy to “ensure that critical mineral projects, including the processing of critical minerals, receive consideration for Federal support.”