Artificial intelligence and cryptocurrency are contributing to positive market conditions in the ITAD industry, and a number of company leaders anticipate the upward trend will continue.

Although they’re both hot topics in the general economy, they have key impacts in the ITAD sector: AI is driving exponential growth in the data center market, and cryptocurrency mining is providing a boost to used device markets — particularly welcome news for ITAD operators after a couple years of depressed component pricing.

E-Scrap News spoke with a few ITAD firms and analyzed publicly traded company reports to learn about the trends shaping the ITAD market.

“There are a lot of really great tailwinds that we’re riding here,” said Keith Layton, vice president of hyperscale remarketing at TES. “I see nothing but positive, not only for us but really for the whole ITAD industry.”

Industry-wide push into a growing market

E-Scrap News first wrote about data center decommissioning in 2019, when Sims Recycling Solutions — now Sims Lifecycle Services — and ITRenew — since purchased by Iron Mountain — described plans to move into this emerging sector of the industry.

A lot has changed since then. Far from being a niche in the industry, data center decommissioning has become a central portion of some major ITAD firms’ business activities. Back in 2019, it was being driven by the continuing growth in cloud computing. That, of course, skyrocketed during the COVID-19 pandemic and continues to grow all the time. Artificial intelligence is the latest force driving growth in the data center industry.

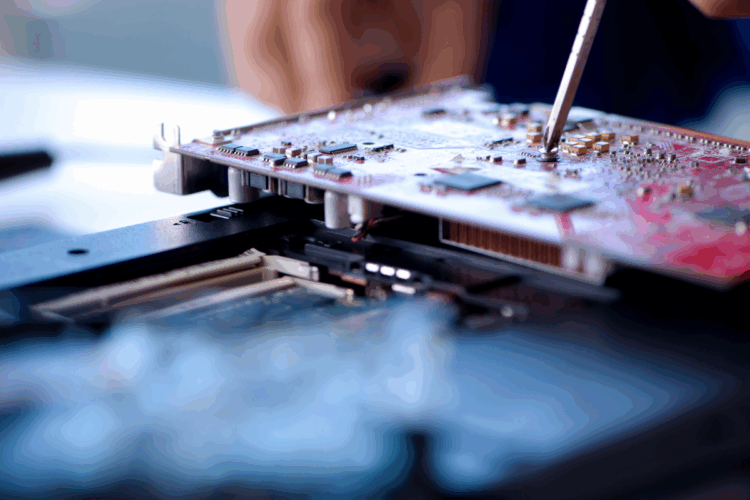

There are some obvious reasons ITAD companies like handling the devices housed within data centers.

“They’ve been run in a controlled environment, they’re not banged up like a laptop gets,” Layton explained. “They’re well-maintained, so they’re pulled as working units, not, ‘It’s broken, so I’m replacing it.'”

TES is among the major ITAD players that has pushed into the data center decommissioning space, most recently opening up a new facility in Virginia to focus specifically on that business segment.

“That’s definitely much more material now than it was a year or 18 months ago as part of our overall volume,” said Eric Ingebretsen, chief commercial officer at TES. That growth has come as the company has seen stability, but not significant increases, in its laptop and desktop business.

Other major players have continued their push into the space as well. Data center decommissioning is now a core part of Sims’ ITAD business — the company even relocated a precious metals division out of its asset recovery business and into Sims Metal last summer, noting that the move reflects the ITAD operation’s “strategic focus on repurposing data centers.”

Iron Mountain has also continued its data center work: In the company’s first-quarter earnings call on May 2, CEO Bill Meaney reported Iron Mountain recently won a contract to handle data center decommissioning for a “multinational conglomerate company.” Company leaders said the data center work is driving up total volume handled through the company’s ITAD segment, and they expect that will continue.

The TES leaders noted smaller ITAD firms are also testing the waters of data center work, although Layton pointed out larger players have the advantage of global reach. That’s attractive to customers operating in multiple markets, who often like to work with a single provider. Iron Mountain hinted at that advantage in describing its recent data center deal, noting it was “pleased to be able to provide a holistic global solution” to meet the customer’s needs.

The increase in companies entering this space isn’t necessarily translating into fierce competition just yet, because the data center industry itself is also growing.

“The pie continues to get bigger,” said Bill Vasquez, general manager of TES Americas. He noted the data center space exploded from 2017 through 2020 and grew even more during the pandemic. Now AI is driving further data center growth, not only increasing demand for data centers but also changing how data center operators design and outfit the facilities.

All of that points to ongoing and increased equipment turnover to meet the changing demands of the data center world.

There are some challenges in retiring assets from a growing and fast-evolving market like the data center space. The useful life of data center assets has gone from what used to be three to five years, up to five to eight years and even longer, Layton said. Having a longer gap between equipment refreshes creates a bit of a crunch for ITAD companies that handle that material. But the growth in the overall number of data centers could offset that lag time.

Component prices continue to rebound

The last few years were a rollercoaster ride for resale values. Early in the pandemic, ITAD firms saw unprecedented demand for their refurbished devices, leading to a runup in prices even as they saw their inbound device stream dry up.

But that boost in pricing paved the way for a hard fall.

“Everything that goes up must come down,” said Anuar Garcia, CEO of GreenTek Solutions, a Texas-based ITAD firm, in a recent interview.

The pricing collapse for used devices and components played out throughout 2022 and 2023. Data from ITAD firm Cascade Asset Management tallied a 40% drop in used laptop pricing in 2022. Garcia noted it was equally or even more challenging for ITAD operators than the height of the pandemic because of the fast price decrease. Demand for ITAD services also lagged below its pre-COVID-19 levels, Garcia added, but that has begun to change in 2024.

“This year has been very interesting, because we feel the demand for ITAD services has come back to where it was before COVID,” Garcia said.

Component pricing has also been on a steady recovery, beginning at the end of last year and moving into 2024, Cascade reported in February. TES leaders similarly described strong growth. Vasquez noted laptops and desktops saw a consistent rise throughout 2023, while CPU and memory drives spiked significantly at the end of the year.

Layton says cryptocurrency plays a big part in those component prices improving. The SEC in January approved rule changes that allow cryptocurrency exchange-traded funds, or ETFs, to be listed on U.S. stock exchanges, a move the federal authority had rejected for years. That move corresponded with a surge in cryptocurrency prices, which means more people mining crypto, which is typically driven by either a computer’s memory or graphics card. So when crypto rises in value, those components become highly sought after, and the demand leads to rising prices.

“That directly correlates to the secondary market,” Layton said.

Crypto mining also correlates with demand for peripheral components like device power supplies, Layton added. TES also saw a recent spike in demand for SSD hard drives.

Iron Mountain reported similar component pricing improvement in its earnings report last week. The company described “strong organic growth” in its ITAD business “driven by a combination of increased volume and component price recovery leading to a strong quarter.”

In the company’s earnings call, Iron Mountain Chief Financial Officer Barry Hytinen said the company’s ITAD division revenue came in about $10 million higher than the company had projected in its first-quarter guidance, largely because of those improving prices. The company saw prices especially increase late in the first-quarter, he said, and they have continued to rise into the second quarter. Hytinen said the company expects prices will continue that trend throughout the year.