China may be gearing up to further crack down on waste materials coming into the country, which could impact scrap imports.

China may be gearing up to further crack down on waste materials coming into the country, which could impact scrap imports.

China may be gearing up to further crack down on waste materials coming into the country, which could impact scrap imports.

China may be gearing up to further crack down on waste materials coming into the country, which could impact scrap imports.

China’s three-month-old import action has stalled shipments of some recovered materials from the U.S. and led to substantial import fee increases for shipments that do clear customs.

China’s three-month-old import action has stalled shipments of some recovered materials from the U.S. and led to substantial import fee increases for shipments that do clear customs.

OCC and other recovered fiber shipments to China will continue to face a 25% duty. | cybrain/Shutterstock

The U.S. and China signed a deal last week seemingly calming their trade war. But Chinese tariffs on OCC, recycled pulp and other materials will remain for the time being.

In April, the Chinese government will enact new requirements for pellet imports. | Piyathep/Shutterstock

Officials in Beijing are set to enact new requirements around the purity of recycled plastic pellets imported into China.

Continue Reading

India has substantially increased its imports since China banned mixed paper from entering the country. | SNEHIT PHOTO/Shutterstock

India, the largest overseas market for U.S. mixed paper, has tightened quality standards and reduced its recycled fiber import volume.

China published a permit list approving imports of 2.8 million metric tons of recovered fiber, its first permit list for 2020. That’s down from 5 million metric tons during the first permit round a year earlier. | hanohiki/Shutterstock

The latest permit figures from the Chinese government illustrate the country’s goals to continue reducing its recycled fiber intake.

This year, through October, just 9.8 million short tons of recovered fiber have been imported into China. | richard pross/Shutterstock

Recent actions by the Chinese government indicate the country will likely ban imports of OCC and almost all other fiber grades in 2021. Such a move would come in the wake of industry-shaking mixed paper and plastic prohibitions already in place.

U.S. recovered fiber exports to China will continue to face a 25% tariff, as they have since September 2018. | Surapol Usanakul/Shutterstock

The Chinese government will not implement a planned tariff increase on OCC and other recovered fiber imported from the U.S., nor scrap aluminum, after the two countries came to an agreement in recent trade talks. But existing tariffs will remain.

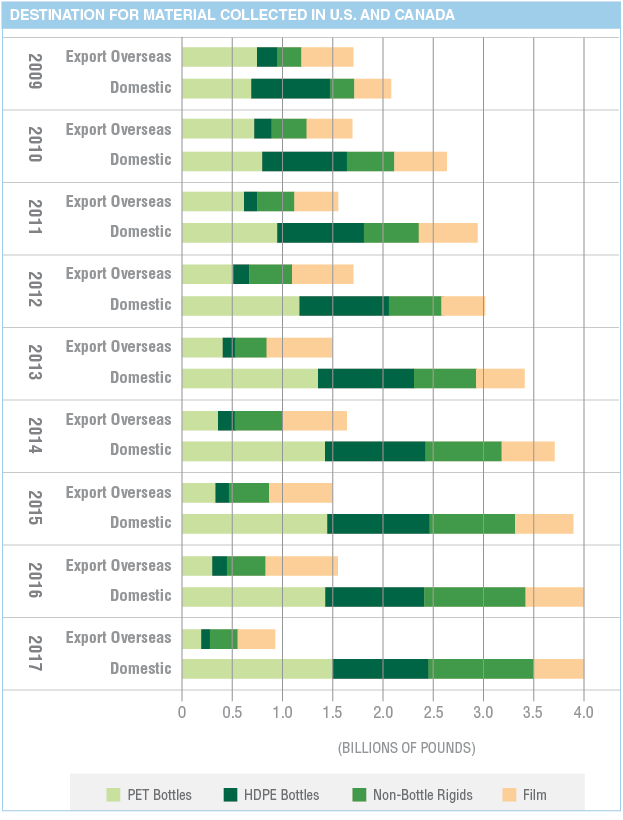

The graph below shows the downstream trends for four major plastic resins collected for recycling in the U.S. and Canada going back to 2009 (the graph stops at 2017 because that is the most recent year for which figures are available).

From 2009 to 2016, the total amount of post-consumer plastic exported to overseas markets from the U.S. and Canada stayed relatively stable, but that number dropped considerably in 2017. That fact is hardly surprising: China stated in 2017 that it was planning to implement its import ban on many grades of recovered material at the outset of 2018, and the announcement itself caused major market shifts.

On the domestic processing front, the total amount climbed steadily before plateauing between 2016 and 2017. With more material needing a home as many Asian markets enact restrictions, opportunity exists for continued domestic processing growth. The keys will be infrastructure improvements to deliver cleaner loads to plastic reclaimers and greater end market demand for the recycled resins.

This month’s Data Corner was produced by More Recycling.

This article appeared in the October 2019 issue of Resource Recycling. Subscribe today for access to all print content.