In response to fiber market conditions, a manufacturer has started mixing OCC and white recovered papers together to create a cheaper line of tissue products.

In response to fiber market conditions, a manufacturer has started mixing OCC and white recovered papers together to create a cheaper line of tissue products.

Chris Cui on stage at the 2019 Plastics Recycling Conference and Trade Show.

Although the recycling relationship between the U.S. and China was hampered by scrap material restrictions, an expert says companies in both countries can help each other.

Industry stakeholders are pushing back against revived national media focus on the pressures facing U.S. recycling markets. Although those stresses are real, experts emphasize there is another side to the story.

Industry stakeholders are pushing back against revived national media focus on the pressures facing U.S. recycling markets. Although those stresses are real, experts emphasize there is another side to the story.

For decades, a pricing index has reported prices for recyclables in Canada’s most populous province. The group behind the sheet recently evaluated how it compares with other market reports.

A half-million dollars is up for grabs as part of a recycling market development competition launched in New York City. The entrepreneur behind the effort recently provided more details on the initiative.

Prices for OCC and aluminum cans continue to take a beating, and natural HDPE is now experiencing a slump as well. On a brighter note, PET has remained steady.

This story has been updated.

This story has been updated.

The Indian government says it will ban scrap plastic imports, a move that threatens to further disrupt the U.S. recycling industry by closing a growing market.

A Pacific Northwest paper mill will significantly increase its OCC consumption, and a 100 percent recycled fiber end user is building a new manufacturing facility for paper packaging products.

A Pacific Northwest paper mill will significantly increase its OCC consumption, and a 100 percent recycled fiber end user is building a new manufacturing facility for paper packaging products.

In late 2018, officials in the city of Walla Walla, Wash. (population 32,000) issued a report that showed the economics of the city’s single-stream curbside recycling program turned upside down over the course of 18 months.

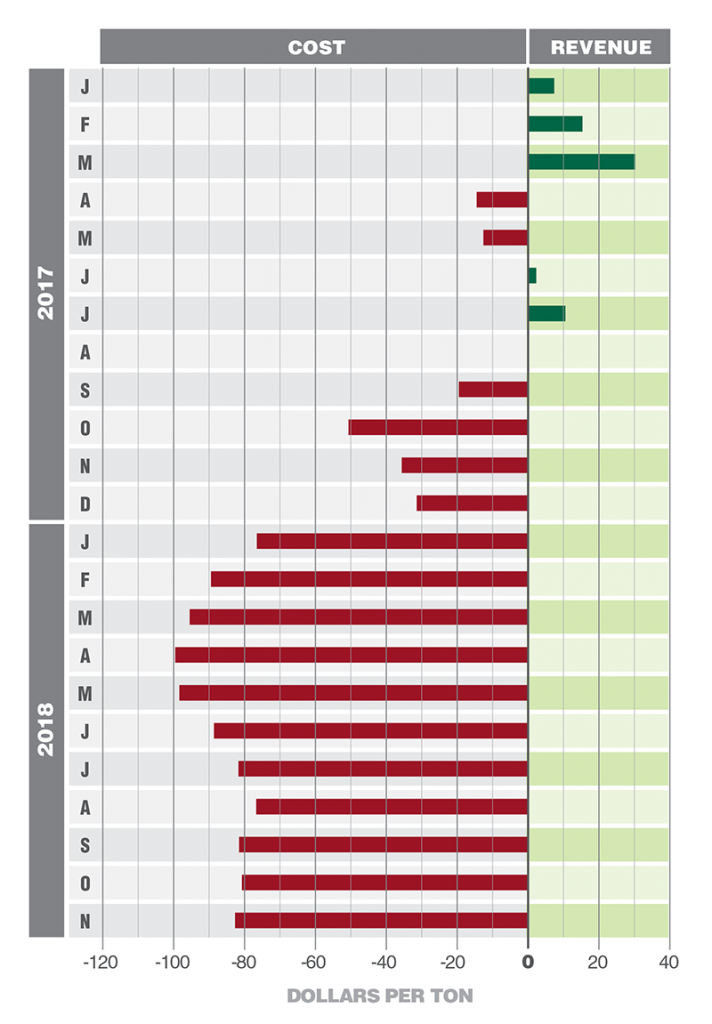

As the graph below indicates, the city went from earning up to $30 per ton for recyclables in early 2017 to paying as much as $100 per ton a year later. Over the course of 2018, the city’s program lost a total of $130,000.

Walla Walla, which attributed the financial flip primarily to China’s National Sword import policy, has instituted a monthly recycling surcharge on resident bills to help get the program back on solid financial footing. The city’s program collects standard fiber items and plastics Nos. 1 and 2. It does not accept glass.

Data source: City of Walla Walla, Wash.

This article originally appeared in the February 2019 issue of Resource Recycling. Subscribe today for access to all print content.