There’s a growing worry among MRF operators, and it has nothing to do with commodity markets: Lithium-ion batteries are causing fires and explosions at facilities nationwide.

There’s a growing worry among MRF operators, and it has nothing to do with commodity markets: Lithium-ion batteries are causing fires and explosions at facilities nationwide.

Colin Staub was a reporter and associate editor at Resource Recycling until August 2025.

Colin Staub was a reporter and associate editor at Resource Recycling until August 2025. There’s a growing worry among MRF operators, and it has nothing to do with commodity markets: Lithium-ion batteries are causing fires and explosions at facilities nationwide.

There’s a growing worry among MRF operators, and it has nothing to do with commodity markets: Lithium-ion batteries are causing fires and explosions at facilities nationwide.

Industry experts say numerous recovered plastics processing facilities are popping up worldwide, as the global market shifts away from shipping raw material into China.

Industry experts say numerous recovered plastics processing facilities are popping up worldwide, as the global market shifts away from shipping raw material into China.

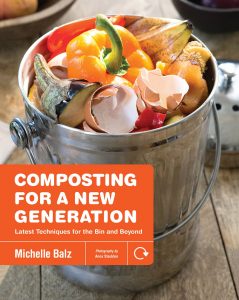

A recycling program coordinator for an Ohio county has authored a backyard composting book, encouraging home composting and providing a one-stop shop for professionals who are educating others about the practice.

A recycling program coordinator for an Ohio county has authored a backyard composting book, encouraging home composting and providing a one-stop shop for professionals who are educating others about the practice.

The U.S. has become a focus of investment for a small yet growing portion of the Chinese scrap processing industry. Backers of two in-development operations note they are looking for regulatory stability and a strong supply of recyclables.

The U.S. has become a focus of investment for a small yet growing portion of the Chinese scrap processing industry. Backers of two in-development operations note they are looking for regulatory stability and a strong supply of recyclables.

Chinese officials have accused the U.S. of hypocrisy for denigrating the scrap imports ban amid a brewing trade war between the two nations.

Chinese officials have accused the U.S. of hypocrisy for denigrating the scrap imports ban amid a brewing trade war between the two nations.

A rendering of the planned Millville Plastics facility in New Jersey.

A $20 million New Jersey plastics recycling facility is in development, and project leaders say it will process roughly 100 million pounds of scrap plastics per year for sale into a variety of end markets.

The 2018 spending bill approved by lawmakers and signed by the president last week contains good news for the U.S. EPA and its recycling-related programs: The agency avoided significant budget cuts that were proposed last year.

The 2018 spending bill approved by lawmakers and signed by the president last week contains good news for the U.S. EPA and its recycling-related programs: The agency avoided significant budget cuts that were proposed last year.

A shuttered Alabama facility that was built to separate recyclables from trash could reopen in October, and city leaders are leaning toward trying the mixed-waste approach again.

Li Ganjie, China’s minister of environmental protection

China’s top environmental official has quantified the reduction in scrap materials flowing into the country as a result of recent restrictions. He also spoke publicly about the market fallout and the criticism China has received for enacting its reforms.

Parties working to reopen an idled plastics recovery facility in Maryland are going back to the drawing board after a possible investor withdrew from talks.

Parties working to reopen an idled plastics recovery facility in Maryland are going back to the drawing board after a possible investor withdrew from talks.