The price of curbside PET bales has continued to climb, rising 9% between January and this month. Continue Reading

The price of curbside PET bales has continued to climb, rising 9% between January and this month. Continue Reading

The price of curbside PET bales has continued to climb, rising 9% between January and this month. Continue Reading

The price of curbside PET bales has continued to climb, rising 9% between January and this month. Continue Reading

The price of curbside PET bales has continued to climb, rising 9% between January and this month. Continue Reading

The price of curbside PET bales has continued to climb, rising 9% between January and this month. Continue Reading

AZEK Company recycles post-consumer polyethylene into its TimberTech brand of composite lumber. | Courtesy of AZEK

AZEK Company has joined several other recycled resin end users in experiencing a softening of demand, resulting in falling sales. Continue Reading

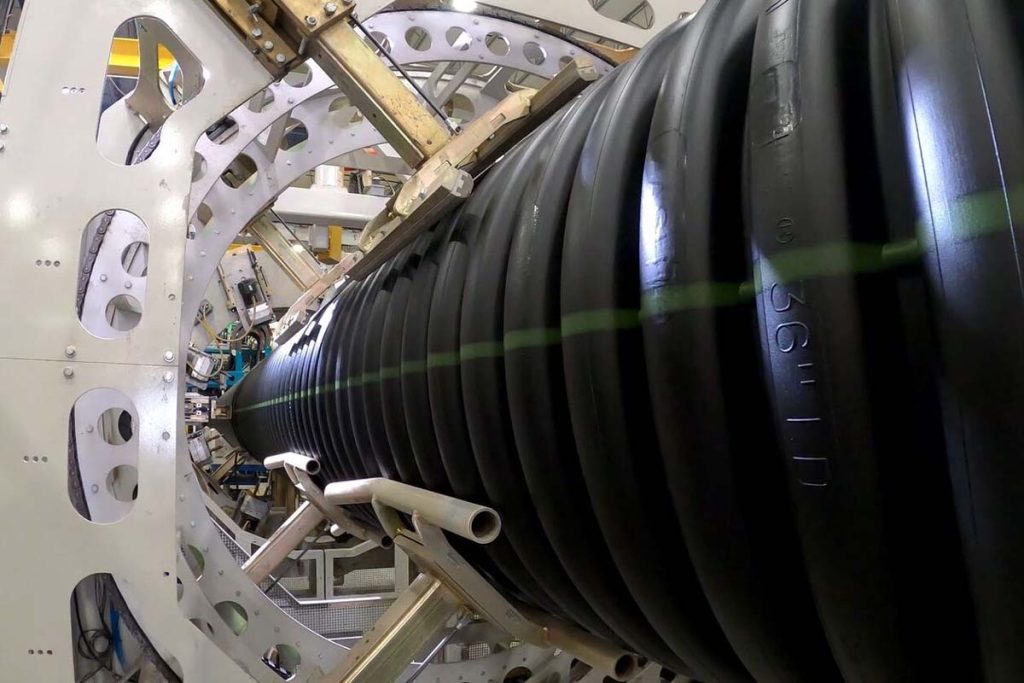

Advanced Drainage Systems (ADS) recycles over half a billion pounds of plastics, including a large portion of the color HDPE produced by U.S. recycling programs, into pipes, septic systems and other water-management products. | Courtesy of ADS

Economic conditions are taking their toll on two huge end users of recycled plastic, Advanced Drainage Systems and Unifi. Continue Reading

The seashell-inspired finish is the eighth patented dimensional wood grain pattern from Tangent Technologies. | Courtesy of Tangent Technologies

A major producer of recycled HDPE lumber has rolled out a product with a seashell-inspired wood grain pattern. Continue Reading

Calhoun, Ga.-based Mohawk Industries attributes weak demand for carpet to interest rate increases, high inflation and reduced consumer confidence in the U.S. and Europe. | Casimiro PT/Shutterstock

Flooring market conditions have worsened faster than Mohawk Industries expected, leading to longer-than-anticipated idling of its carpet factories, the company announced. Continue Reading

The leader of the nation’s largest recycling collector says the firm is continuing to push to strengthen its recycling business even as the industry shifts.

Compared with recent months, December has brought stable prices across the range of scrap plastics, with PET and natural HDPE bale prices rising only slightly.

Compared with recent months, December has brought stable prices across the range of scrap plastics, with PET and natural HDPE bale prices rising only slightly.

Michael Zamora, senior vice president of Product Solutions at ExxonMobil, and Ron Delia, CEO at Amcor, signed the agreement, through which ExxonMobil will sell increasing amounts of recycled resin each year to Amcor. | Courtesy of Amcor

One of the world’s largest packaging producers, Amcor, has signed a deal to buy huge amounts of chemically recycled resin from one of the world’s largest plastics producers, ExxonMobil.

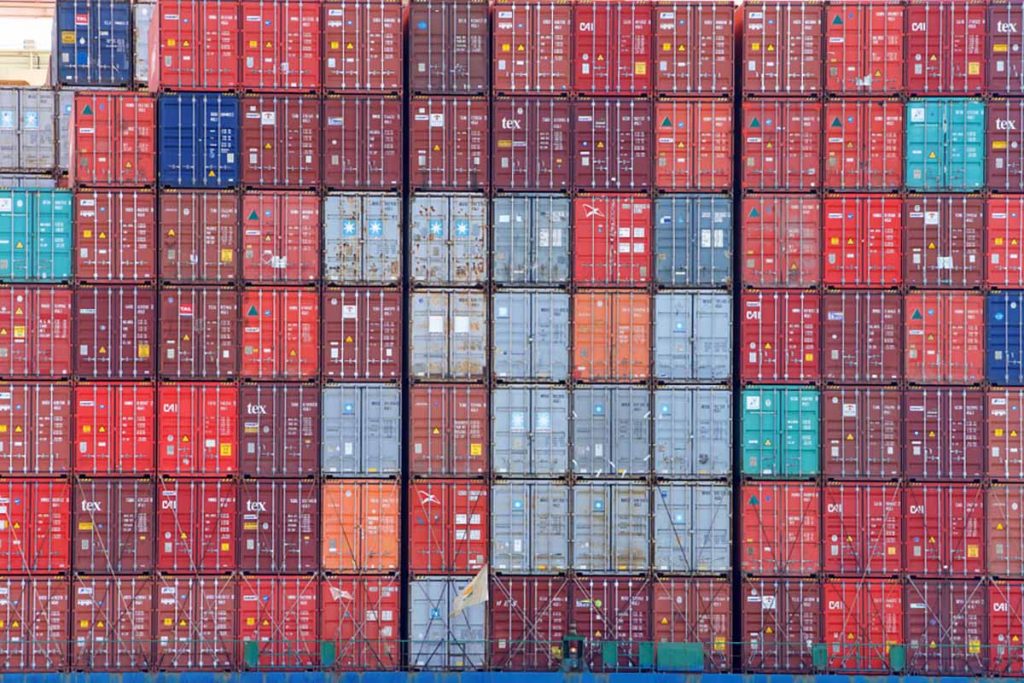

The U.S. exported about 737 million pounds of scrap plastic over the course of the first three quarters of 2022. | Sheila Fitzgerald/Shutterstock

U.S. companies exported about 22% less scrap plastic during the first nine months of this year, continuing a trend of decreased overseas shipments.

The partnership between the two companies will help LyondellBasell work toward its goal of marketing 2 million metric tons of recycled and renewable-based polymers annually by 2030. | Courtesy of LyondellBasell

LyondellBasell will buy food-grade post-consumer natural HDPE from Envision Plastics and incorporate that PCR into various blends for sale to packaging producers.