After riding high since last fall – even hitting an all-time record – the price of natural HDPE bales decreased 8% this month.

After riding high since last fall – even hitting an all-time record – the price of natural HDPE bales decreased 8% this month.

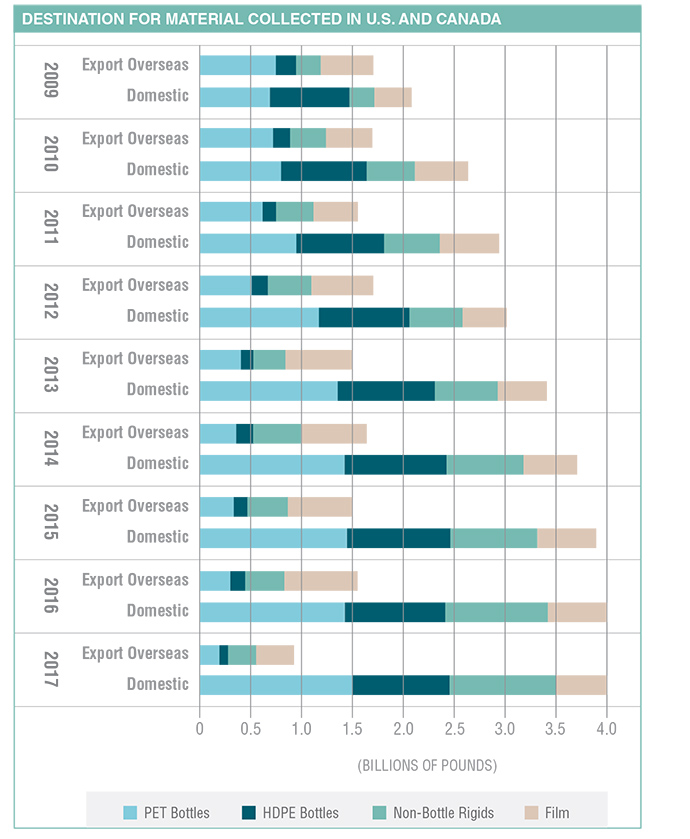

The graph below shows the downstream trends for four major plastic resins collected for recycling in the U.S. and Canada going back to 2009 (the graph stops at 2017 because that is the most recent year for which figures are available).

From 2009 to 2016, the total amount of post-consumer plastic exported to overseas markets from the U.S. and Canada stayed relatively stable, but that number dropped considerably in 2017. That fact is hardly surprising: China stated in 2017 that it was planning to implement its import ban on many grades of recovered material at the outset of 2018, and the announcement itself caused major market shifts.

On the domestic processing front, the total amount climbed steadily before plateauing between 2016 and 2017. With more material needing a home as many Asian markets enact restrictions, opportunity exists for continued domestic processing growth. The keys will be infrastructure improvements to deliver cleaner loads to reclaimers and greater end market demand for the recycled resins.

Data Sort is produced each quarter by More Recycling. For additional information, go to morerecycling.com.

Data Sort is produced each quarter by More Recycling. For additional information, go to morerecycling.com.

This story originally appeared in the Summer 2019 issue of Plastics Recycling Update. Subscribe today for access to all print content.

Prices for natural HDPE bales have remained at record highs this month, but color HDPE bale prices have fallen.

Prices for natural HDPE bales have remained at record highs this month, but color HDPE bale prices have fallen.

Post-consumer PET prices have remained steady over the past month, but HDPE grades have slipped.

Post-consumer PET prices have remained steady over the past month, but HDPE grades have slipped.

Prices for curbside natural high-density polyethylene have climbed even higher over the past month.

The price of recovered natural HDPE bales has climbed again, in some areas breaking recent records. Continue Reading

The price of recovered natural HDPE bales has climbed again, in some areas breaking recent records. Continue Reading

The price of natural HDPE has skyrocketed over the past month, roughly doubling in some areas to a high of 52 cents per pound. Color HDPE also took a notable jump.

The price of natural HDPE has skyrocketed over the past month, roughly doubling in some areas to a high of 52 cents per pound. Color HDPE also took a notable jump.

The price of PET took a dive over the past month, but the value of natural HDPE climbed substantially. Continue Reading