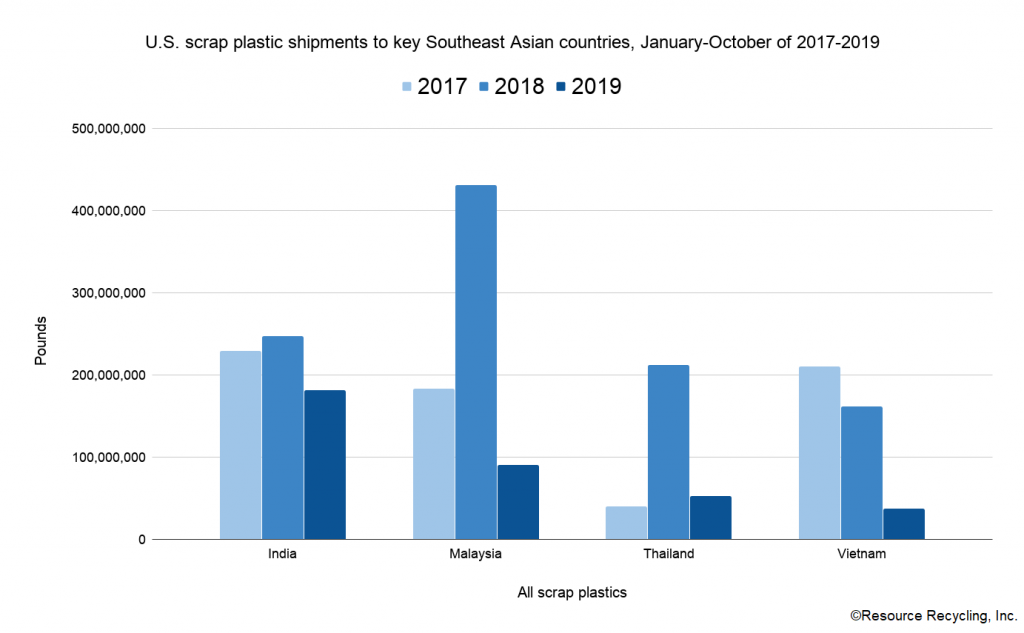

Export figures continue to show the power of recycled plastic import restrictions in Southeast Asia. Countries that were previously the largest overseas markets have seen massive decreases in U.S. plastic imports since mid-2018.

Indian scrap plastic imports from the U.S. in October dropped to their lowest single-month volume since at least 2002, the earliest time for which records are available. That’s according to trade data released this month by the U.S. Census Bureau (part of the U.S. Department of Commerce).

The U.S. sent 2.3 million pounds of scrap plastic to India in October, slightly down from September and significantly down from earlier in the year – in March 2019, for instance, India brought in 28.7 million pounds from the U.S. The March volume was on par with monthly imports throughout 2018.

The decrease indicates India’s import ban, which was officially implemented Aug. 31, has been largely effective. Overall, India imported 181.6 million pounds of U.S. scrap plastic in the first 10 months of this year, down 27% from the same period in 2018.

Malaysia, Thailand and Vietnam, all of which also enacted policies limiting their imports since mid-2018, continue to bring in relatively low volumes of scrap plastic.

(Story continues below chart.)

Malaysia, which saw the largest increase in imports of U.S. scrap plastic following China’s 2018 ban on the material, decreased those imports by 79% during the first 10 months of this year compared with the first 10 months of 2018. The country imported 90 million pounds during that period, down from 431 million pounds during that time in 2018. The country enacted significant import restrictions in 2018.

Thailand imported 52.2 million pounds of U.S. scrap plastic from January through October, down 75% from that period in 2018. The country began reducing imports in July 2018.

Finally, Vietnam lowered imports by 77%, bringing in a total of 37.2 million pounds in the first 10 months of 2019 compared with that period in 2018. Vietnam has implemented a handful of import policy changes in the past two years and has announced further plans to ban all scrap plastic imports by 2023.

Monthly volumes to Thailand and Vietnam have fluctuated, however, and generally increased since the initial restrictions took hold.

For instance, Thai imports from the U.S. fell from 27.1 million pounds in June 2018 to 1.5 million pounds the following month, as the import policy was enacted. But since then, they’ve slowly climbed up to hit 7.5 million pounds in October 2019. In Vietnam, after plummeting from 38.2 million pounds in May 2018 to less than 1 million pounds in August of that year, U.S. scrap plastic imports have slowly increased, hitting 4.6 million pounds in October 2019.

Malaysia, meanwhile, saw a substantial increase in imports of one resin in October 2019. From January through September, Malaysia imported 6.2 million pounds of scrap PVC from the U.S. But in October alone, the country brought in 12.6 million pounds. That made up 65% of all scrap PVC exported from the U.S. during October.