Editor’s Note: Resin markets will be featured in sessions at the 2026 Plastics Recycling Conference, Feb. 23-25 in San Diego, California. Register now for the best rates.

The sudden inclusion of PET resin in the list of imports subject to hefty tariffs is causing concern for some stakeholders and relief for others, even as a disappointing peak summer season draws to a close.

Domestic recyclers have struggled to keep pace with competitively priced imported resin since at least 2024, while also looking for ways to quantify the impact. For them, the tariffs are a positive development for the domestic industry. But for end users who rely on imports to meet recycled-content targets in an effort to remain profitable, the news has caused frustration.

Resin imported under the 3907.61.00 and 3907.69.00 harmonized tariff system (HTS) codes was already subject to a 6.5% duty, but now faces a higher, as-yet-unconfirmed tariff

Recycled PET does not have a separate HTS code, so the tariffs will apply to recycled resin as well as virgin PET.

The White House made the announcement in a Sept. 5 executive order, the latest development in a months-long back-and-forth that has fueled global uncertainty and shifted trade alliances.

Even before this week’s implementation, Asian recycling market participants were struggling amid lackluster global demand and depressed pricing. In an Aug. 29 market update, Steve Wong, CEO of Fukutomi Recycling, wrote, “The global outlook for recycled pellets remains fragile. With oversupply of prime [virgin] resins, muted demand, and mounting protectionist rhetoric, recyclers face rising uncertainty.”

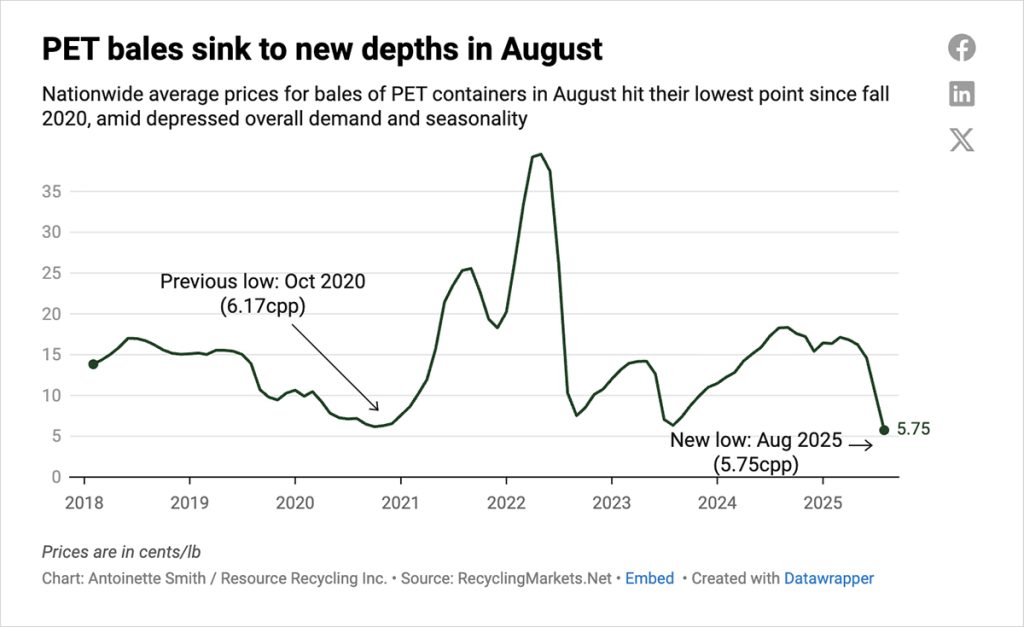

Record low bale pricing

Average monthly pricing for curbside PET bales in August fell to its lowest level since 2020, at 5.75 cents/pound, lower by 44% on the month and by 69% on the year. Click here for an interactive pricing chart.

Curbside post-consumer PET bale pricing typically softens around August and September, as supply grows and demand wanes seasonally. This year prices peaked at 17.13 cents/pound in March, according to RecyclingMarkets.Net data, amid a demand runup ahead of the summer beverage bottling season. However, prices softened slightly in April and May, then began a steep downward trajectory, shedding 60% of their value between June and August.

The sharp drop was attributed to disappointing demand caused by inexpensive imported resin, both virgin and recycled, as well as subdued consumer spending. PET demand has a strong correlation with consumer spending, as bottled beverages and takeout packaging is often consumed away from home, during travel or at events.

Even in periods of strong demand, US recyclers’ profit margins are constrained by fixed costs including labor that’s more expensive than in other regions and a lack of government support in the form of subsidies or recycled-content mandates.

Uneasy relationship with imported PET

The US historically has been structurally short on production to meet its demand for PET used in packaging, and as such relies on imported resin. PET imports from January through July rose 6.4% year on year, according to the most recent data from the International Trade Commission, at 975,420 metric tons.

Full-year imports of PET remained fairly stable at 1.5 million metric tons in 2021-2024, apart from a spike in 2022. That summer, domestic pricing reached historic levels as anticipated gasoline demand pushed values of paraxylene, an intermediate chemical used both as an octane booster and as a PET feedstock, to a record high.

New domestic PET production is unlikely to arise, given the high cost for labor and materials for the plant, as well as costly domestic paraxylene compared to imports from other areas. In June, Alpek announced it would close a North Carolina plant and in 2023, it announced the closure of its Cooper River plant in South Carolina and Monterrey polyester filament plant in Mexico.

Joint-venture partners Alpek, Indorama Ventures and Far Eastern New Century paused construction for a second time on a PET plant in Texas in 2023. During the 2025 Plastics Recycling Conference, Roberto Ribeiro, vice president of global ethylene oxide and derivatives and PET at Chemical Market Analytics said the plant is unlikely to be completed, because the technology is outdated and the capacity is small compared to new Asian plants.

Meanwhile, over the past few years China has become self-sufficient in PET, starting up massive new plants for both polyester and its feedstocks. As a result, countries that previously relied on the vast Chinese market to sell their resin – South Korea, India and Pakistan, to name just a few – have turned to other markets to offload their resin, including the US.

This has led to numerous global actions to address allegations of dumping, which the World Trade Organization defines at its most basic level as “international price discrimination, where the price of a product when sold in the importing country is less than the price of that product in the market of the exporting country.”

In North America, Canada determined preliminary anti-dumping duties in June on PET resin from both China and Pakistan, with a final determination expected Sept. 15. Mexico-based Alpek filed a complaint with the Canada Border Services Agencies to open the anti-dumping inquiry. And Mexico finalized anti-dumping duties, also in June, on Chinese PET, also the result of an inquiry initiated by Alpek and Indorama Ventures.

As for the most recent developments, how long the new tariffs are in place will provide clarity on whether they are overall a positive development for the industry.