Even as the vast majority of municipalities have not made changes to recycling service, the coronavirus impact has been felt in programs around the country. | VO IMAGES/Shutterstock

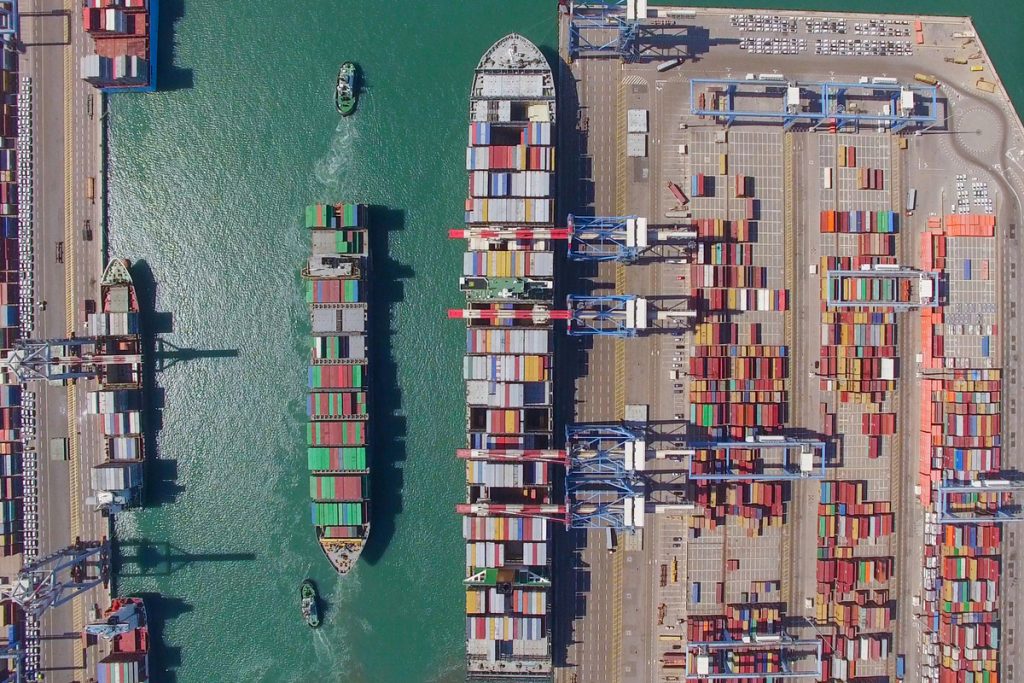

The global escalation of COVID-19 is hampering some North American recycling programs, impacting Chinese users of U.S. recovered fiber, constraining global shipping, denting stock prices and threatening an economic recession.

Despite a year of market uncertainty, U.S. recovered paper exports increased in 2018, driven largely by OCC shipments. However, scrap plastic exports fell substantially as countries enacted stringent trade policies.

Despite a year of market uncertainty, U.S. recovered paper exports increased in 2018, driven largely by OCC shipments. However, scrap plastic exports fell substantially as countries enacted stringent trade policies.

The growing smiles you see among recycling collectors and processors are because of continuing market improvement.

The growing smiles you see among recycling collectors and processors are because of continuing market improvement.