India, Mexico and Vietnam are still the top three destinations for U.S. OCC and paper in the first quarter of 2022. | Siwakorn1933/Shutterstock

U.S. exports of recovered fiber held relatively steady during the first quarter of 2022, but scrap plastic shipments plunged by more than one-fifth.

U.S. companies exported 4.28 million short tons of recovered fiber (excluding recycled pulp) during the first three months of the year, down less than 1% year over year. During that same time period, U.S. exporters shipped 261 million pounds of recovered plastic, down 21% from the first quarter of 2021.

The numbers come from a recent Resource Recycling analysis of Census Bureau data.

Top fiber destinations relatively steady

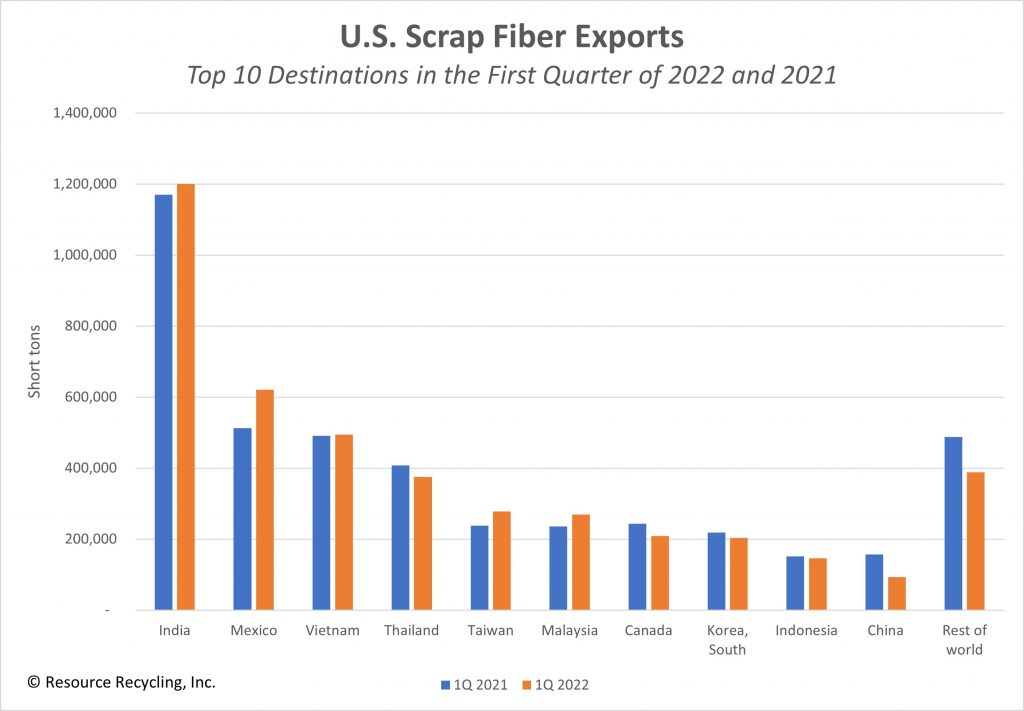

In terms of OCC and paper, the trade numbers show India, Mexico and Vietnam are still the top three destinations for U.S. material, although shipments to Mexico have increased substantially.

The numbers also reveal that China’s role as a downstream for U.S. material continues to dwindle. In the first quarter of this year, China slipped to No. 10 on the list of top destinations for U.S. fiber, down from No. 9 in the first quarter of 2021.

Before the country’s National Sword campaign began, it was by far the largest overseas consumer of U.S. fiber bales. For example, in 2016, the last full year before China started implementing facets of National Sword such as increased cargo inspections, the U.S. shipped 14.54 million short tons of recovered fiber to China. That was just over two-thirds of all recycled fiber exported by the U.S. that year. Last year, the weight sent to China totaled 541,000 short tons, only 3% of U.S. exports of the recovered commodity.

The first-quarter 2022 numbers show the top 10 destinations for fiber were as follows: India at 1.20 million pounds (up 3%), Mexico at 621,000 pounds (up 21%), Vietnam at 494,000 pounds (up 1%), Thailand at 375,000 pounds (down 8%), Taiwan at 278,000 pounds (up 17%), Malaysia at 270,000 pounds (up 14%), Canada at 209,000 pounds (down 14%), South Korea at 203,000 pounds (down 7%), Indonesia at 146,000 pounds (down 4%) and China at 93,000 pounds (down 41%).

The rest of the world combined took in 388,000 pounds, a year-over-year decline of 20%.

(Story continues below chart.)

The numbers above exclude recycled pulp. After National Sword, some companies began pulping scrap in the U.S. and shipping the pulp to Chinese factories for further processing into finished products. That was a way of circumventing Chinese restrictions on imports of what authorities termed “waste.”

But the process requires drying the pulp before shipment – otherwise the material would decay during the long trip across the Pacific – and then re-wetting it at the East Asian plants.

During the first quarter of 2022, U.S. firms exported nearly 122,000 short tons of recycled pulp, up 36% from the same period in 2021. During the first quarter of 2017, before the impacts of National Sword set in, U.S. recycled pulp exports totaled only 18,000 short tons.

Plastic numbers continue to drop

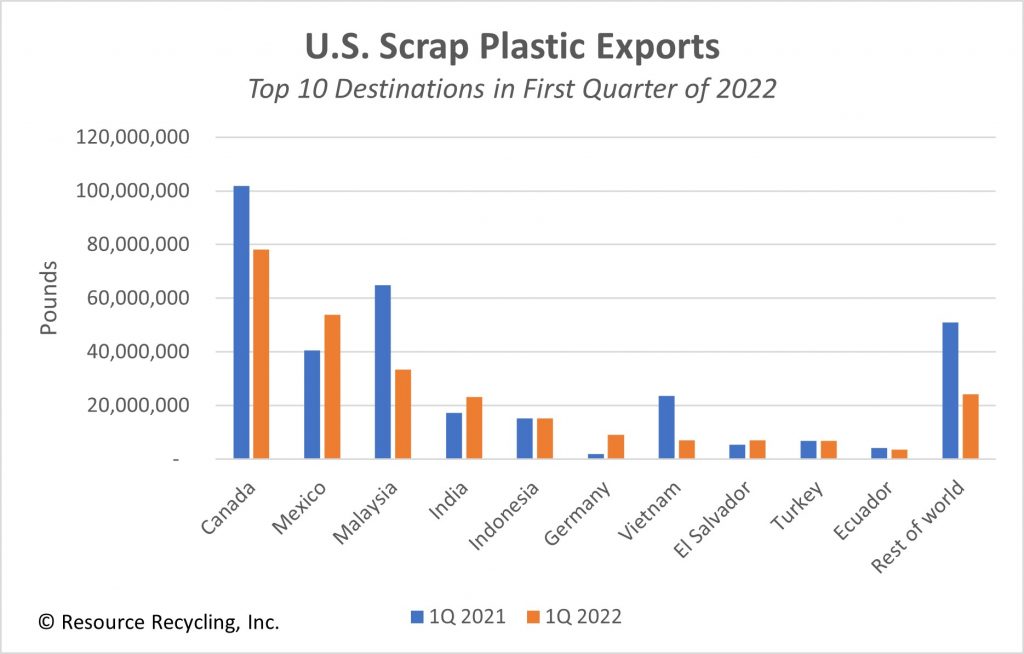

The 21% decline in scrap plastic shipments from the first quarter of 2021 to the first quarter of 2022 is part of a years-long trend.

During the first quarter of 2021, 333 million pounds were exported, which was actually up from 311 million pounds during the same period in 2020.

But that 2020 number was down sharply from first-quarter numbers of 374 million pounds, 711 million pounds and 1.12 billion pounds in 2019, 2018 and 2017, respectively. The most significant restrictions in China’s National Sword campaign went into effect in 2018.

The latest numbers brought some notable changes to the top 10 destinations for plastic recyclables: Canada at 78 million pounds (down 23% year over year), Mexico at 54 million pounds (up 33%), Malaysia at 33 million pounds (down 49%), India at 23 million pounds (up 33%), Indonesia at 15 million pounds (up 1%), Germany at 9 million pounds (up 374%), Vietnam at 7 million pounds (down 70%), El Salvador at 7 million pounds (up 30%), Turkey at 7 million pounds (flat year over year) and Ecuador at 3 million pounds (down 16%). The rest of the world took 24 million pounds, down 53%.

(Story continues below chart.)

Germany and Ecuador were new on the top 10 list for the first quarter of 2022. Taiwan and Hong Kong dropped off the list.

China used to be the biggest recipient of fiber bales from the U.S. As of the first quarter of this year, it was 21st on the list, just behind Latvia.

More stories about Markets

- ‘Operational readiness is high’ as Oregon rolls out EPR

- Pizza box demand declining, report says

- Paper operations close in Georgia, Texas