This article appeared in the Winter 2022 issue of Plastics Recycling Update. Subscribe today for access to all print content.

At this point, most industry stakeholders have heard the statistic: Just 8.7% of plastic in America is recycled, according to the U.S. EPA.

One of the reasons for this low number is the diversity of polymers and difficult-to-recycle applications, such as flexible films, which pose challenges for conventional mechanical recycling technology. Chemical recycling, or advanced recycling, refers to a range of processes that can complement mechanical recycling to increase the overall recycling rate of plastic and help address circularity for flexible films and more.

Among the chemical recycling technologies coming on-line are pyrolysis and gasification, which break down plastics at high temperatures to produce feedstocks to make new polymers.

As these develop, the industry is confronting some key questions:

- What is a common feedstock specification for chemical recycling processes? What are the key contaminants? And to what extent can these technologies provide a recycling solution for hard-to-recycle plastics?

- How does the feedstock specification for chemical recycling compare with that for mechanical recycling processes – are they complementary or competitive?

- How might chemical and mechanical recycling work alongside each other to drive up recycling rates of plastic as well as meet recycled content requirements for both food and non-food grade applications?

Recently, the sustainability consultancy Eunomia Research & Consulting carried out research on the feedstock specifications outlined by chemical recycling operators. The research, commissioned by the Alliance to End Plastic Waste, explores the feedstock considerations for chemical recycling technologies that provide plastics-to-plastics recycling opportunities for polyolefins and provides a model feedstock specification for pyrolysis.

By understanding feedstock requirements for chemical recycling and how technologies can complement mechanical recycling, new approaches to collecting and sorting materials can be developed. This work can help ensure stable and appropriate feedstocks and markets for all plastic processors, allowing stakeholders to move closer to plastic circularity.

Promise in pyrolysis

Two primary chemical recycling technologies were the focus of the Eunomia study: pyrolysis and gasification. In this article, we will focus on the results around pyrolysis.

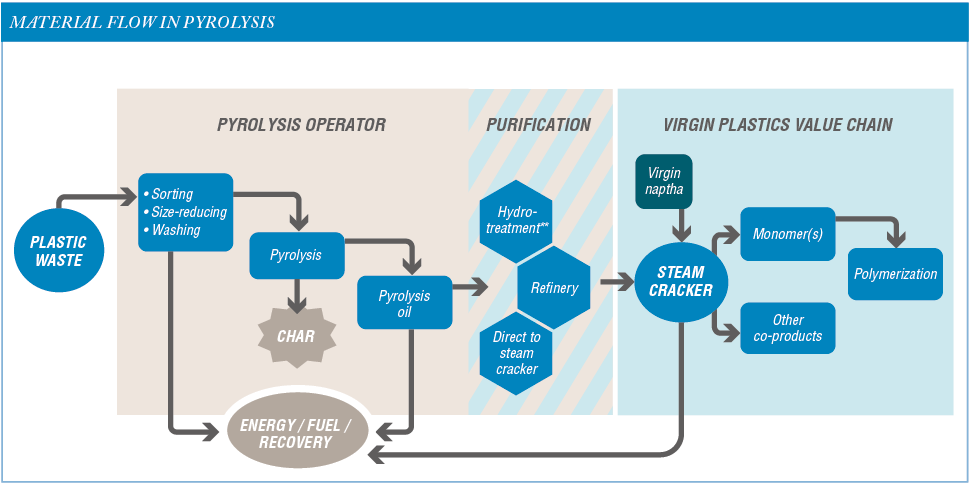

Pyrolysis is the process of breaking down plastic waste at high temperatures with minimal oxygen to produce pyrolysis oil, which can be used in the production of new plastics (see graphic on page 26). Gasification, which is not as widespread as pyrolysis, is a thermal depolymerization technology that is capable of decomposing waste plastics into hydrocarbons and syngas. The syngas byproduct primarily consists of hydrogen, carbon monoxide and small amounts of carbon dioxide.

Pyrolysis in particular is seen as a promising outlet for the flexible polyethylene (PE) and polypropylene (PP) plastics that are usually used in film applications. These plastic types do not have the same uptake from mechanical recyclers as rigid PE and PP plastic packaging due to issues of sortation capability (contamination and quality). This provides an opportunity for chemical recycling to complement mechanical recycling.

However, many PE and PP film applications are multi-material, with the packaging including non-PE or PP materials that, if present in significant quantities, can pose issues for the chemical recycling process. This reality highlights the need for feedstock specifications to ensure that the correct material arrives at chemical recycling operators.

Data and information gathered through interviews with chemical recyclers, secondary research methods and Eunomia’s previous relevant projects, including the report “Chemical Recycling: State of Play” for CHEM Trust, enabled Eunomia to dive into the market in multiple ways.

First, the research helped us understand the feedstock requirements and the factors that influence what can and cannot be accepted. We were also able to identify types of contaminants, process tolerances and related impacts on operational performance and product yield.

From there, the research team could develop a model specification based on information currently available, noting that many operators are still refining processes. Lastly, we could summarize current market challenges and opportunities in both North America and Europe as well as future needs and actions.

Only chemical recyclers that were past the experimental phase and leveraged technology in scope – that is, they are accepting polyolefin inputs with outputs going back into polymer production – were shortlisted for interviews and distributed a questionnaire.

Feedstock specification and contaminants

Bringing these elements together, Eunomia developed a model feedstock specification for pyrolysis.

According to the research, the pyrolysis model feedstock should contain a minimum 85% PE and PP, targeting items such as containers, trays, cups, films and bags, which should be free of contents or free flowing liquids and be rinsed. There should also be a maximum moisture content of no more than 7%.

The following specified thresholds were determined for individual contaminants, which together should exceed no more than 15%:

- Polyvinyl chloride (PVC) / polyvinylidene chloride (PVDC): 1%

- Polyethylene terephthalate (PET) / ethylene vinyl alcohol (EVOH) / nylon: 5%

- Polystyrene: 7%

- Rigid metal/glass/dirt/fines: 7%

- Paper/organics: 10%

Each contaminant has a different impact on the pyrolysis process. PVC and PVDC, predominantly used in multi-layer films, are essentially prohibited because they introduce chlorine atoms into the pyrolysis process, which can cause corrosion to equipment and persist into the finished hydrocarbon product, with operators having limited means to remove them.

Meanwhile, PET (highly desirable for mechanical recyclers) as well as EVOH and nylon (which are not expected to be present in significant amounts) introduce oxygenated molecules into the process. Such molecules reduce yield and negatively impact the quality of pyrolysis oil.

The presence of paper and other organic materials is also costly to operators, as these materials contain oxygen and can reduce the quality of the end product – hydrotreatment to remove impurities is a costly process step.

The presence of metal, glass, dirt and fines also presents a significant cost burden to pyrolysis operators because these contaminants tend to be abrasive and can damage equipment. In addition, they are relatively heavy, which increases front-end costs (feedstock is purchased on a per-unit-weight basis). Operator tolerances vary, depending on the pre-sorting technologies in use, with some operators preferring a tolerance of 1% or less for each sub-category.

Individual operator tolerances for polystyrene vary significantly, with some operators actually viewing it as a process aid, though limits on the amount of polystyrene are common among operators.

Current challenges and looking to the future

The outlook for chemical recycling is promising, but issues in the market will need to be navigated to unleash the full potential of pyrolysis and other approaches.

Primary among the challenges are collection and sortation realities. PE and PP films do not currently have the same uptake from mechanical recyclers as rigid PE and PP packaging due to a perceived lack of valuable end markets.

There are also physical recycling challenges linked to the sorting of film. Film plastics often cause problems at materials recovery facilities (MRFs), wrapping around sorting equipment and leading to costly disruptions. In addition, optical sortation equipment might struggle identifying multi-material films from other films. These machines tend to take in information only on the outermost layer of an item on the belt.

For these reasons, chemical recycling operators currently struggle to secure the right quality of feedstock and in sufficient quantities.

Extended producer responsibility (EPR) legislation, which is evolving in Europe and Canada and being introduced in the U.S., could potentially drive higher collection and recycling targets for polyolefins, particularly post-consumer films.

Meanwhile, though many brands are making voluntary recycled-content commitments, mandatory recycled-content mandates could further drive demand for recycled outputs from chemical recycling among brands and packaging producers and shift the market.

A continuing conversation

Chemical recycling clearly has the potential to drive up the recycling of plastics, increasing the supply of recycled content on the market and supporting a circular economy, but it is important to bear in mind that chemical recycling is not a silver bullet to the world’s plastic recycling problems.

There appears to be a perspective that chemical recycling will be able to take all plastics that mechanical recyclers cannot, regardless of quality or polymer types. Eunomia’s research demonstrates that this is not the case, at least not in the near term – consistency in feedstock is key, and further research will be required to provide more accurate feedstock specifications and understand where chemical and mechanical recycling both complement and compete with one another.

Chemical recycling technologies are evolving quickly, and conversations over these key elements need to catch up if pyrolysis and other processes are to fulfill their promises.

The Eunomia report outlined in this article, “Feedstock Quality Guidelines for Chemical Recycling of Polyolefins,” was commissioned by the Alliance to End Plastic Waste.

Sarah Edwards is the North America director of Eunomia Research & Consulting Inc. She can be contacted at [email protected].

This article appeared in the Winter 2022 issue of Plastics Recycling Update. Subscribe today for access to all print content.