Refurbished device marketplace Back Market has added several major financial backers who are funding the company with $120 million.

The French company, which has a global presence, on May 6 announced the investment from Goldman Sachs, Aglaé Ventures and Eurazeo Growth. The investors join venture capital investment firm Daphni in supporting the online device sales platform.

In a release, Back Market said the new capital is a further sign of maturity for the refurbishment industry. It follows a $48 million investment in Back Market that was announced in 2018. The company cited changing consumer mindsets about refurbished devices, as well as greater public interest in more sustainable consumption of goods, as factors supporting its ongoing growth.

Back Market provides a platform through which refurbishers sell their devices straight to consumers. The company launched in France in 2014 and steadily expanded to other European countries, before entering the U.S. market in 2018. Although Back Market plans to continue growing, the recent capital will be prioritized on strengthening the company’s position in its existing markets, particularly the U.S., U.K. and Germany, according to the release.

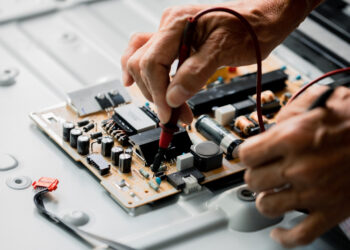

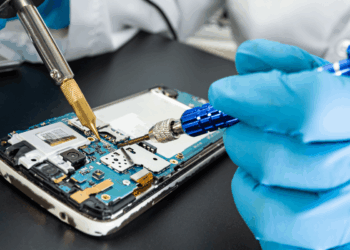

The company’s online platform currently hosts about 1,000 sellers, all of whom go through a rigorous evaluation process before being approved to list on the site. This includes reviewing how the refurbisher tests and repairs products, among other quality assurance measures.

Back Market in 2018 told E-Scrap News the platform’s work to vet sellers is its key value for buyers. Refurbishers listed on the site are guaranteed to offer warranties and provide customer service.

With the new investment, Back Market plans to bolster its quality control system, “ultimately growing its quality team up to three times its current size,” according to the recent announcement. Specifically, the company plans to build a “dedicated machine learning team” to improve the company’s evaluation algorithms.

Funds will also go toward adding services for both buyers and sellers. For example, the company has plans to help companies with sourcing devices, spare parts, test protocols and more, according to the release.

Goldman Sachs said it was drawn to Back Market for its work “supporting the world’s transition to more sustainable consumption,” a sentiment shared by Aglaé Ventures.

Eurazeo Growth, meanwhile, pointed to Back Market’s performance during the current coronavirus pandemic as indicative of its future prospects.

“The current crisis proves the incredible resiliency of Back Market’s model which, in combining value for money, stable local supply chains, and a strong sustainability mission, has allowed it to respond to consumers’ needs even through the surge brought on by these trying times,” the investment firm stated.

A Back Market spokesperson said the company has seen a significant increase in sales in recent weeks alongside the coronavirus pandemic, similar to recent demand growth reported by device refurbishers.

“The emergence of the COVID-19 crisis has made the relevance of this market even more obvious,” Back Market stated. “Refurbished electronics offer greater purchasing power, and have the benefit of more localized supply chains that are less prone to interruption.”