WasteExpo is set for June 28-30 at the Las Vegas Convention Center.

After months apart, industry stakeholders this month have one of their first opportunities to gather in a conference setting at a three-day event in Las Vegas.

Readers were drawn to news that paper products manufacturer Georgia-Pacific has opened a processing unit to recover fiber from contaminated streams. | Courtesy of Georgia-Pacific.

Articles about markets for recycled paper and plastics drew lots of clicks last month. Readers were also drawn to our coverage of container deposit and EPR legislation.

Readers last month were drawn to news of the latest example of the industry trend of fires caused by improperly disposed batteries and electronics. | BlurAZ/Shutterstock

News about a battery fire that shut down a city’s MRF drew readers last month, along with a mix of stories touching on markets, policies and investments.

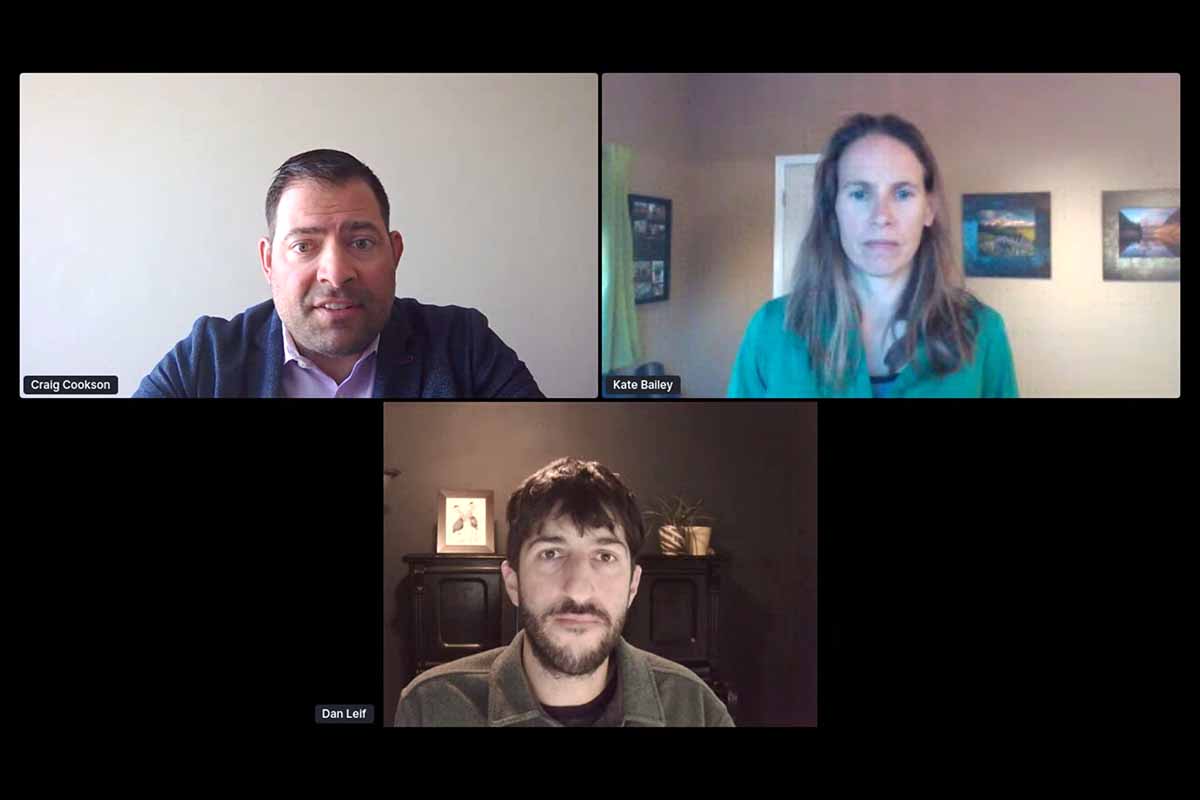

Craig Cookson of the American Chemistry Council and Kate Bailey of Eco-Cycle spoke during a session moderated by Dan Leif of Plastics Recycling Update at the 2021 Plastics Recycling Conference. | Screenshot from the 2021 Plastics Recycling Conference.

The recent Plastics Recycling Conference, held online, featured eight sessions over two days. Here are some of the talking points that caught our team’s attention.