The top destination for exported U.S. fiber, India, took in 37% less this year than it did last year. | StockStudio Aerials/Shutterstock

Exports of both recovered fiber and plastics fell during the first six months of 2023, newly released federal trade statistics show.

U.S. companies exported 16% less fiber during the first half of 2023 than they did during the corresponding period of the prior year. Scrap plastic shipments dropped by 7%.

The Census Bureau recently released data for June exports, allowing Resource Recycling to compare statistics from the first half of 2023 to those from the prior year.

Recovered fiber exports fall

U.S. companies exported 7.29 million short tons of fiber scrap in the January-June period, not including recycled pulp.

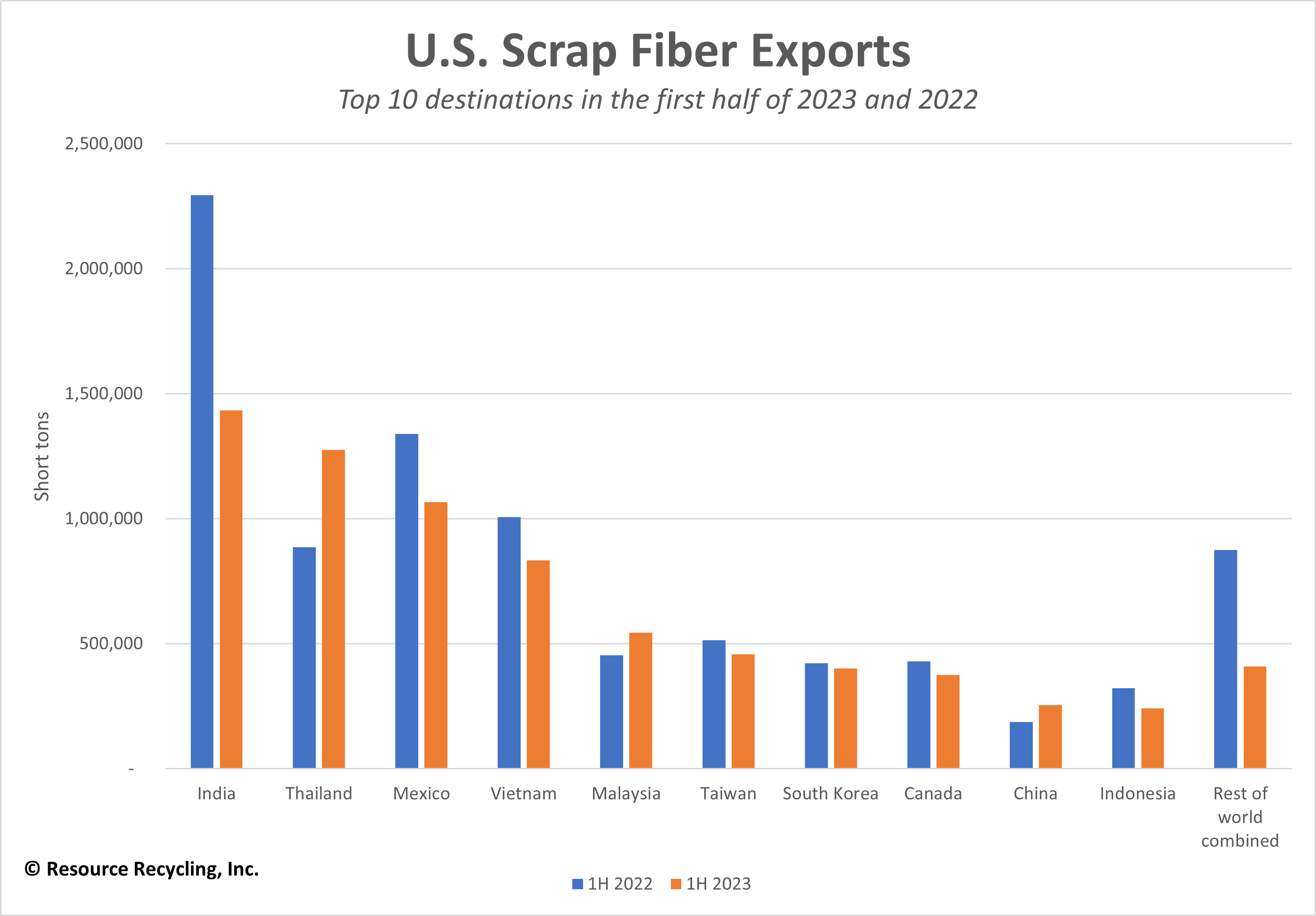

Among the top 10 destinations, most reduced their purchases of U.S. bales, although there were some notable exceptions in East Asia. For example, shipments to Thailand surged, rising 44% year over year and making the Southeast Asian country the second largest downstream destination for U.S. fiber bales during that period.

The chart below shows the changes in shipments to the top 10 destinations year over year (story continues below chart):

The following were the top 10 destinations for the first half of 2023 (all tons are metric):

- India received 1.43 million tons (down 37% year over year).

- Thailand received 1.27 million tons (up 44%).

- Mexico received 1.07 million tons (down 20%).

- Vietnam received 833,000 tons (down 17%).

- Malaysia received 545,000 tons (up 20%).

- Taiwan received 459,000 tons (down 11%).

- South Korea received 401,000 tons (down 5%).

- Canada received 374,000 tons (down 13%).

- China received 254,000 tons (up 36%).

- Indonesia received 242,000 tons (down 25%).

- The rest of the world combined took in 409,000 tons (down 53%).

To skirt China’s import restrictions on scrap bales, which the country calls “waste,” some companies, most notably box manufacturer Nine Dragons, are recycling scrap fiber into recycled pulp at U.S. mills and then exporting the pulp for further processing into paper. The practice picked up after China began imposing its National Sword imports restrictions campaign in 2018.

But the amount of recycled pulp exports remains relatively small. During the first half of 2023, companies exported 152,000 metric tons of recycled pulp from the U.S. That was down 48% year over year.

During the first quarter of 2023, U.S. companies exported 8% less fiber year over year.

The reduction in fiber exports comes as corrugated container manufacturers are feeling the financial pinch from softening consumer demand. As a result, some U.S. mills are taking downtime. At the same time, some major domestic mills have opened recently, including Domtar’s containerboard plant in Kingsport, Tenn., and Cascades’ Bear Island linerboard mill in Ashland, Va. Others are on their way, including Pratt Industries’ sixth recycled paper mill in Henderson, Ky., scheduled to come on-line this fall.

Scrap plastic shipments

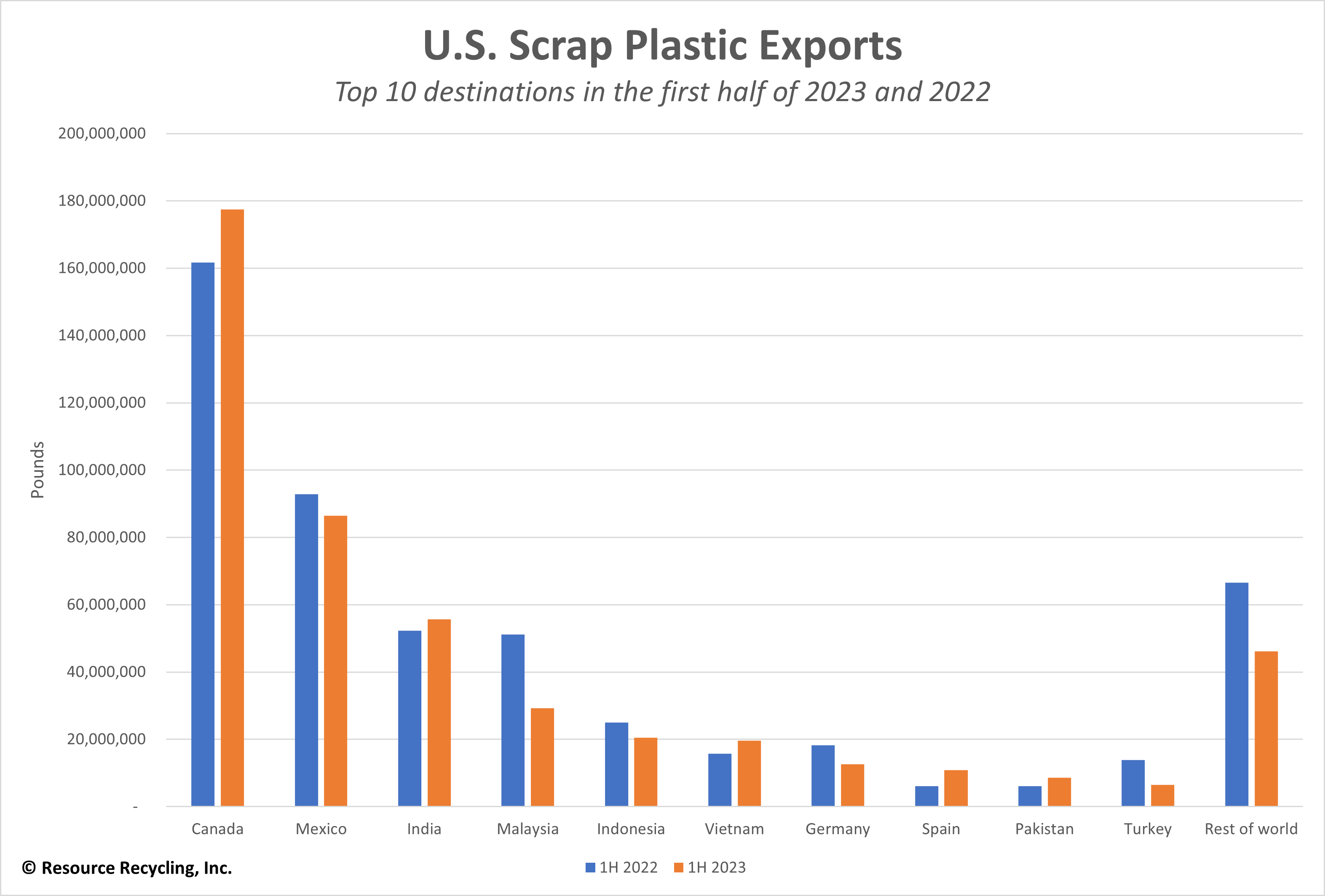

The U.S. exported 474 million pounds of scrap plastic during the first half of 2023, down 7% year

over year.

The top 10 destinations experienced some notable swings in the amount of material they took from the U.S. For example, shipments to Malaysia dropped 43%, but Vietnam boosted its consumption by 25%.

The chart below shows changes in the top 10 destinations (story continues below chart):

The following were the top 10 destinations in the first half of 2023:

- Canada received 177 million pounds (up 10%).

- Mexico received 86 million pounds (down 7%).

- India received 56 million pounds (up 6%).

- Malaysia received 29 million pounds (down 43%).

- Indonesia received 21 million pounds (down 18%).

- Vietnam received 20 million pounds (up 25%).

- Germany received 13 million pounds (down 31%).

- Spain received 11 million pounds (up 78%).

- Pakistan received 9 million pounds (up 41%).

- Turkey received 7 million pounds (down 53%).

- The rest of the world combined received 46 million pounds (down 31%).

During the first quarter of 2023, plastic exports dropped by 10% year over year.