To keep up with the top export destinations for U.S.-sourced recyclables, Resource Recycling examined the latest shipping data from the U.S. Department of Commerce.

To keep up with the top export destinations for U.S.-sourced recyclables, Resource Recycling examined the latest shipping data from the U.S. Department of Commerce.

The figures offer a snapshot of exports in June, at a time when some Southeast Asian countries began enacting import restrictions. The data also shows that even with China’s import restrictions, the country remains among the largest importers of both recovered paper and plastic.

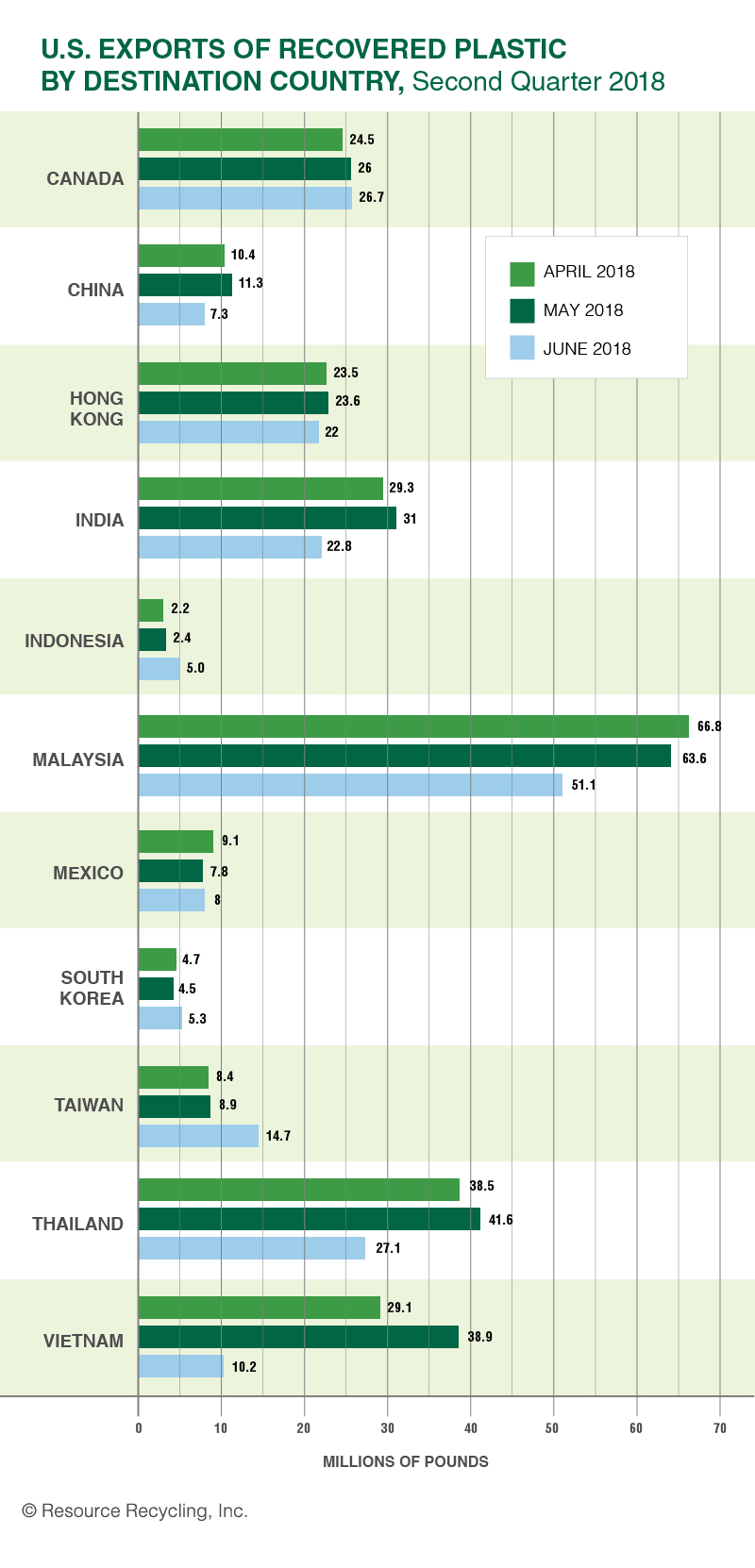

Plastic down across the board

U.S. exporters shipped nearly 25 percent less recovered plastic worldwide in June compared with the previous month. That was largely because some Southeast Asian nations scaled back the volume they import.

Vietnam imported 28.7 million fewer pounds of scrap plastic in June, representing a drop of nearly 74 percent compared with the previous months. The decline corresponds with a decision by major Vietnamese ports to stop accepting containers of scrap plastic beginning in mid-June. The ports cited overcapacity problems and said the plastic ban would be in effect for four months while the country figures out how to handle the influx.

Thailand decreased its plastic imports by 14.5 million pounds, a drop of about 35 percent. Similar to Vietnam, the Thai decrease correlates with a late-June decision by government officials to immediately suspend all plastic imports due to a backlog of material at ports.

Malaysian imports dropped by about 20 percent, equating to 12.4 million pounds. Still, Malaysia was the largest single importer of U.S.-sourced scrap plastic during June. Although the country did not issue any sweeping decrees, it has experienced temporary disruptions since the beginning of the year. In July, the country announced it would temporarily stop issuing import permits for scrap plastic.

All told, the U.S. shipped 213 million pounds of scrap plastic in June, down 32 percent – or about 99.9 million pounds, from June 2017.

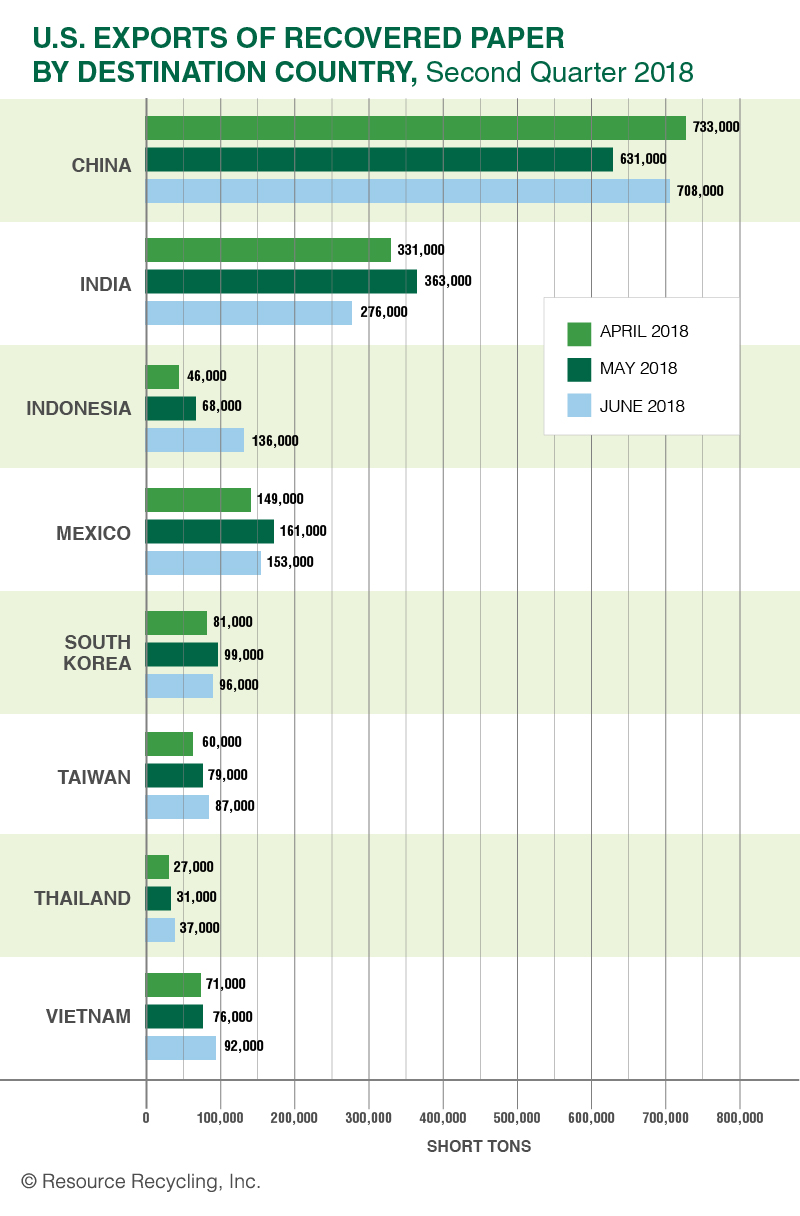

Paper shipments on the rise

In contrast with scrap plastic, U.S. recovered paper exports increased by about 42,000 tons from May to June. And May’s number was up 39,000 tons over April’s.

By country, volumes varied significantly.

For instance, China brought in 77,000 more tons in June than in May, although exports to China had dropped by more than 100,000 tons from April to May. The drop in May came as Chinese officials stopped allowing China Certification and Inspection Group (CCIC) North America to perform pre-shipment inspections for a month. The move was expected to heavily disrupt recovered fiber exports to China, as the inspections are mandatory.

Indonesia doubled its imports, bringing in 68,000 more tons in June than May. Taiwan, Thailand and Vietnam all modestly increased paper imports.

But the increases were partially offset, largely by India importing 87,000 fewer tons from the U.S. in June, compared with the previous month.

Overall, U.S. recovered paper exports in June totaled 1,764,000 tons, up 2.7 percent year over year.

Photo credit: GERARD BOTTINO/Shutterstock

More stories about exports

- Malaysia fully halting US plastic scrap imports

- Some tariffs suspended, metal duties coming this week

- Tariffs on Canada and Mexico take hold