Although depressed plastics prices have caused some companies to revise their earnings projections, many in the sector are optimistic about an upcoming rebound. | Golden Dayz/Shutterstock

This story has been updated.

Recycled plastics prices are at their lowest levels in some time, putting significant strain on material processors. Meanwhile, some resin buyers are abandoning PCR to purchase virgin plastic instead.

The lower prices can be seen in the scrap bale market and, to varying degrees, in the recycled resin market.

“The price of resin has definitely dropped significantly and it all boils down to supply and demand,” noted Tony Moucachen, who leads a family of plastics recycling companies, including prominent Pacific Northwest reclaimer Merlin Plastics.

“The supply of virgin PE, PP and PET is currently significantly higher than the demand,” Moucachen added, “and this is leading to a steep decline in market prices. This also has a negative impact on the whole supply chain.”

In some cases, the market is such that it’s leading to landfilling of recyclables.

“It’s not a fantastic time. We all know that,” Andrea Bassetti, senior analyst for plastics recycling at consulting and research firm ICIS, said during the 2023 Resource Recycling Conference earlier this month.

“The demand is just not there and the supply is high,” she added. “We have a lot of recyclers calling us, telling us, ‘You know what, we have bales in our warehouses. It’s cheaper for us to send it to the landfill with a one-time fee rather than selling it at these prices at which they are now.'”

Feeling the pinch at the curb

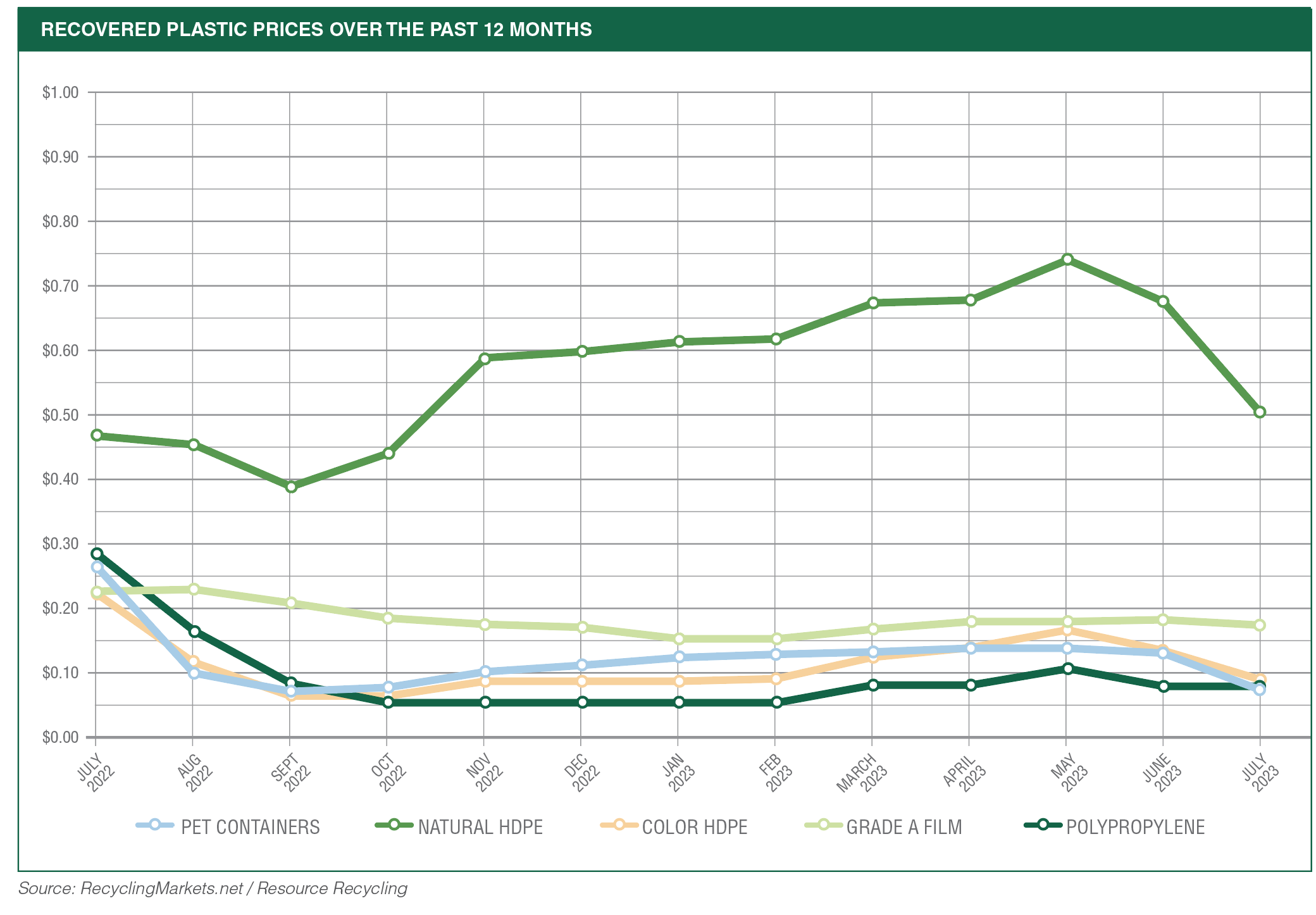

A number of data sources can be used to illustrate the steep drop in bale pricing that’s been experienced in recent months.

For example, according to RecyclingMarkets.net, bales of PET, natural HDPE, color HDPE and PP from municipal recycling programs are averaging around 6.3 cents, 22.9 cents, 5.7 cents and 5.1 cents per pound, respectively. Those prices, which reflect the average across the U.S. (with some Canadian facilities also reporting) are down 55%, 69%, 65% and 51% since May, only three months ago.

Specific geographies are also showing the same general trend.

The Solid Waste Authority (SWA) of Palm Beach County, Fla. sends out the monthly results of bidding on bales from its publicly owned MRF. The details of these bids are publicly available.

For SWA shipments this month, Cellmark won several PET bales with its bid of 3.8 cents per pound and Gama USA won several PET bales with a bid of 4 cents per pound. Five months ago, in March, GP Harmon Recycling won PET with its bid of 16.5 cents per pound, roughly four times today’s price.

And this month, GP Harmon Recycling had the highest bids for both natural and color HDPE at 27.8 cents and 10.6 cents, respectively. Back in March, Cellmark won natural HDPE at 74.6 cents per pound and Nathan H. Kelman Inc. won color HDPE at 17.3 cents per pound.

Canada is seeing the same dynamics. A price sheet produced by EcoCompass Inc. for the Continuous Improvement Fund (CIF), which is part of Ontario’s extended producer responsibility (EPR) system, noted that PET averaged 12.9 cents U.S. per pound during the first half of 2023, down 39% from the average last year.

The largest garbage and recycling companies in North America are feeling the pinch.

Waste Management (WM) is North America’s largest operator of materials recovery facilities (MRFs), which sort and bale curbside recyclables. When the company released its second-quarter earnings earlier this month, executives noted that depressed plastics pricing had forced them to re-evaluate their commodity sales expectations for the whole year.

The plastic impact on WM is particularly notable because paper and corrugated cardboard make up the largest percentage of weight handled by those companies, and markets for those materials have been slowly but steadily climbing this year.

“If you think about our fiber pricing, we’re expecting a slow ramp in fiber pricing, and that’s really being driven by some mill capacity coming on-line domestically,” Tara Hammer, WM’s chief sustainability officer, stated during a July 26 conference call with investors. “The bigger story really is on the non-fiber pricing and related to plastics, which is a smaller part of our volume but a higher-value commodity. And we’ve seen prices decline roughly 30% to 55% from May to July. So that’s what’s driving our recycled commodity price outlook for the second half of the year.”

Hemmer pointed to low virgin plastics prices pressuring the recycled resin pricing.

Republic Services, the second-largest garbage and recycling company on the continent, is also seeing volatility in bale pricing. Pete Keller, Republic’s vice president of recycling and sustainability, told Plastics Recycling Update that a few factors are affecting PET pricing, including slowing of the U.S. textiles and carpet sector. Europe, which has historically imported PET, has reduced its consumption, he said.

Abandoning recycled for virgin

In recent years, some observers have pointed to lingering high prices for some post-consumer resin (PCR) at times when virgin prices are low as evidence of market decoupling caused by brand owner PCR goals and minimum-recycled-content mandates.

At the Resource Recycling Conference, Bassetti of ICIS refuted the idea that recycled and virgin PET markets have fully decoupled. She showed a pricing chart demonstrating that RPET pellet prices roughly followed virgin over the past five years.

“This just means that we have to keep an eye on what the virgin prices are and keep following those, because that’s going to deeply affect where the recycled prices go,” Bassetti said.

That being said, RPET continues to trade at a premium to virgin, evidence of a partial decoupling, she noted, and right now prices for recycled plastics are so much higher that is driving down demand for them. RPET tends to be more expensive than virgin, and buyers have been willing to pay extra, but only to an extent.

“Often the buyers are willing to pay the 10%-20% premium on the recycled plastics. That’s what we’ve seen,” she said. “But when it starts getting past that 20% is where we start having that cost sensitivity substitution. So if you look where we are now, the price difference is about 30%.”

That’s an issue Greg Janson has seen firsthand.

“We have seen orders literally disappear.”

– Greg Janson, President and CEO of Granite Peak Plastics

Janson, who is president and CEO of St. Louis-based reclaimer Granite Peak Plastics, pointed to wide-spec virgin plastic pricing as luring converters away from recycled resin. His company specializes in polyethylene and polypropylene.

“Many molders have decided to replace recycle with wide spec. When this happens, liquidity is sucked out of the market and many small reclaimers cannot survive,” said Janson, who wrote about the wide-spec issue in March. “We have seen orders literally disappear.”

The next issue is the actual price. If reclaimers can get orders, converters are offering to pay a price that’s below the reclaimers’ feedstock costs and operating expenditures, he noted.

“It is my opinion that this is why many molders are reluctant to sign contracts for recycle,” Janson said. “Even though the average cost of many recycled grades will beat the average cost of wide-spec and prime grades over time, molders don’t want to lose the option of switching back and forth from wide spec to recycle solely on price.”

As a result of the tough markets, Granite Peak Plastics has reduced operations and is focusing on producing the resin grades that are going to customers who are committed to using recycled plastic, Janson said. Overall, he added, what’s needed are contracts for recycled resin that are pegged to indicators that float with the market, with hard pricing floors and soft ceilings.

The complications aren’t just affecting reclaimers who produce mechanically recycled PCR. They’re also impacting negotiations with large chemical recycling operations.

Executives at chemical company Eastman noted during their recent earnings call that demand for the company’s chemically recycled PET remains strong globally, but low pricing for virgin and recycled PET is slowing the signing of offtake agreements with brand owners.

“They’re very complicated contracts. And the current market conditions, I would say, are sort of slowing those discussions down a little bit,” CEO Mark Costa said during a July 28 conference call with investors. “So, if you’re looking at the PET market, whether it’s VPET or RPET, those market prices have come off in a pretty significant way.”

Optimism looking forward

Industry players expressed optimism that markets would improve, with some pointing to minimum-recycled-content mandates as driving brand owner demand for PCR over the longer term.

Bassetti pointed to legislation being implemented in California, New Jersey, Washington state, Maine and Connecticut as helping to drive brand owner demand. The laws in those states require varying levels of PCR in PET beverage containers, with some requiring PCR in other products, as well.

California’s mandate requires 15% PCR in bottles covered by the state’s beverage container redemption program starting in 2022, with enforcement starting this year. The requirement rises to 25% in 2025.

“The demand is going to start moving slowly but surely back up and those prices are going to come back up.”

– Andrea Bassetti, Senior Analyst at ICIS

Bassetti predicted such requirements would impact demand over the short term, defined as the next six months to a year.

“The demand is going to start moving slowly but surely back up and those prices are going to come back up,” she said. “So we really see all of these legislations that have already been passed having a really big impact on the market in the near term.”

Keller of Republic Services said he isn’t seeing a nosedive in polyolefin pellet pricing. His company recently signed an agreement with plastics producer Ravago to build and operate four polyolefins recycling plants around the U.S. in coming years.

The companies are setting up a joint venture called Blue Polymers. At the same time, Republic is boosting its ability to sort scrap and produce RPET pellets with the planned opening of several Republic Polymer Centers around the country.

“From a trend line perspective, we feel good about pellet pricing,” Keller told Plastics Recycling Update.

He said off-spec virgin has historically been a factor affecting PCR markets to some degree, but he predicts a decoupling of virgin and recycled resin markets.

“It’s less of a concern over time as we see brands stepping up to their voluntary goals and we see more minimum-content standards in legislation,” Keller said.

WM, which has also taken steps to vertically integrate in plastics recycling, sees stable longer-term demand from consumer product brand owners.

“We think long term, if you think about what’s happening with brands, they all have commitments to buy recycled content, and we think that will come back, they are going to come back into the market to buy to meet their commitments,” Hemmer said.

“It’s one of the reasons why we’re excited about some of our investments that we’ve made in plastics recycling and advancing those,” she added.

With over three decades of experience in plastics recycling, Moucachen of Merlin Plastics pointed to the longer-term fluctuations in commodity prices, with an inevitable rise.

“What I see is that this is just the same cyclical pattern that we have seen repeated over and over again these past 30 years,” he said. “It will again correct itself at some point and we just have to weather the storm as best we can.”

Bassetti said she and her analysts see reason for optimism among recycling companies.

“I know we’re rock bottom, but I do want to finish on a positive note in saying that we really see that there’s going to be a lot of space and a lot of growth that needs to happen in this near term,” she said, “and so we’re hoping and we’re predicting that that demand is going to drive back up.”

Dan Leif contributed to this story.

This story has been updated to better reflected ICIS’ perspective on decoupling of virgin and recycled resin prices.