This story has been corrected.

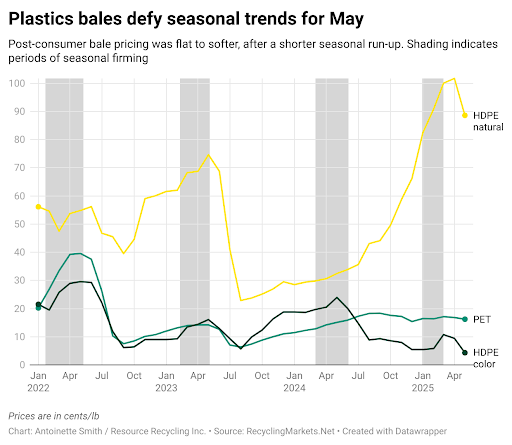

Post-consumer plastics bales are defying typical springtime trends, with average pricing in May reported flat-to-softer on the month as the peak summer season nears.

Although still slightly higher on the year, average PET bale pricing for May eased, while color HDPE bales dropped by 55% on the month and HDPE natural bales lost 13%, according to RecyclingMarkets.Net data.

Post-consumer bale prices typically start firming in mid- to late March, as PET buyers stock up ahead of the peak summer beverage bottling season and color HDPE buyers accumulate material to make agricultural drainage pipe. Especially for PET, the uptick in prices tends to last until June or even July, when bale demand begins to taper and supply increases.

Natural HDPE tends to be less seasonal, seeing steady demand throughout the year due to its versatility, though pricing is prone to rising swiftly and then crashing as the market perhaps corrects itself about every other year.  This year, macroeconomic influences are particularly pronounced, with the PET and HDPE markets subject to different drivers but seeing similarly dampened demand.

This year, macroeconomic influences are particularly pronounced, with the PET and HDPE markets subject to different drivers but seeing similarly dampened demand.

PET – consumer spending

Since January, average PET bale pricing has stayed within a 16-17 cent range, according to analysis by Plastics Recycling Update using RecyclingMarkets.Net data. A year ago, prices rose by 32% – nearly 4 cents a pound – between January and May, and continued to rise through September.

Chris Goger, senior director of recycling at brokerage BlackBridge Recycling, described May PET bale demand as steady, despite softening prices.

Consumption of both virgin and recycled PET closely correlates with consumer spending, which increased in two of the three months the U.S. Bureau of Economic Analysis has reported so far. However, consumer confidence reached a 13-year low in April, according to the Conference Board, a bipartisan think tank that tracks sentiment monthly.

This is despite a better-than-expected jobs report for April as well as an unexpected drop in the Producer Price Index and a slowing inflation rate.

The ongoing tariff back-and-forth is driving uncertainty, as well as an initial rush of import activity ahead of what could be long-term implementation. The busiest U.S. container port, Los Angeles, reported an increase of 6.2% in container volumes compared to the first four months of 2024. But “moving forward — at least for the short term — we will see a softening of global trade during this period of elevated tariffs and uncertainty,” said port Executive Director Gene Seroka in a May 19 briefing.

First-quarter PET imports, which include both recycled and virgin resin, were 428,111 metric tons, higher on the year by 15%, according to U.S. International Trade Data. PE exports rose by 5% on the year to 3.98 million metric tons.

However, first-quarter scrap plastic exports fell by 9% to 98,831 metric tons, and scrap imports dropped by 23% to 99,716 metric tons.

Looking ahead, an early heat wave in the southern U.S. could increase demand for bottled beverages and possibly lead to an increase in collection. And the Atlantic hurricane season is June 1-Nov. 30, bringing with it the potential for an increase in demand for bottled water if a major storm hits the U.S. and affects public water quality. In addition, hurricane damage could impact production of virgin polymers, which is concentrated in the Southeast.

HDPE – housing/construction

HDPE natural bales sank on the month, in what Goger termed a correction after reaching record highs. They remain nearly three times higher on the year, however.

Color HDPE bales also fell dramatically, which he attributed to weak demand in the agricultural sector. In contrast to the natural bales, color bales are lower by 82% on the year. When domestic demand for color HDPE is weak, bales often are exported to Southeast Asia.

Overseas buying interest, specifically in Southeast Asia, for color HDPE bales, mixed rigids and LDPE film bales picked up immediately following the May 12 trade deal with China, James Derrico, vice president of new business at distributor Cellmark, told Plastics Recycling Update. However, he said it was unclear whether the uptick in interest would translate into higher prices. “With no real conclusion on the tariffs and constant change, we’re still seeing overall instability.”

In addition to tariffs, uncertainty about federal funding has put some infrastructure projects in doubt, touching recycled plastics sellers with those end uses, a North American seller told Plastics Recycling Update. Also, North American companies that send finished products containing recycled plastics into the U.S. have seen a drop in shipments, which affects demand as well. The seller requested anonymity, to candidly discuss sensitive trade matters.

Domestic demand for HDPE bales correlates with construction activity, both for housing and for infrastructure projects.

For May, builder confidence dropped by 6 points to 34 in May, according to the National Association of Home Builders/Wells Fargo Housing Market Index. A number above 50 indicates overall optimism in the housing market, while numbers below 50 indicate pessimism. The index started the year at 47 in January.

April building permits fell by 3.2% on the year to 1.412 million, while housing starts fell by 1.7% on the year to 1.361 million, according to U.S. Census Bureau data.

Looking ahead, a particularly active hurricane season can both hinder construction projects and provide opportunities for rebuilding.

North American trade partners aim to minimize risk

In February, when tariff talk started getting serious, sales volumes dropped by nearly three-quarters, said the North American seller, but when the tariffs didn’t go into effect, buyers returned. “That was the first time everybody was a little bit wary, and didn’t react as fast,” the seller said, and this pattern repeated in April.

Even if recycled plastics are exempt from tariffs, “the problem is really the uncertainty. Nobody can make a decision; everybody just kind of lives day by day. Our customers can’t plan anymore, so it’s much more difficult for them to commit and to send out purchase orders and to get the commitment long term,” the North American seller said, adding that no one is willing to expose themselves to any more risk than is necessary.

In its May North America market update, global shipping giant Maersk noted that two ways to manage risk were to ship in “Less than Container Loads,” or LCL, to avoid overstocking that could incur high fees, and to avoid using Delivered Duty Paid, or DDP, shipping terms.

During gaps in tariffs, foreign sellers can move volumes into U.S. warehouses, filling them up with “whatever we think we can sell.” Beyond that, companies don’t have much of a strategy, the seller said. Nevertheless, with the continuing U.S. uncertainty, the seller said they were looking more at Latin America, as well as Europe, to help diversify the buying roster.

“It’s kind of sad, because, I mean, there’s good relationships, there’s good ties between both countries, and you see everybody kind of pulling back.”

Asia courts European buyers

The ongoing U.S. uncertainty has opened the window for recycled resin imports to increase into the EU, Matt Tudball, UK-based senior editor of recycling at commodity intelligence firm ICIS, told Plastics Recycling Update. And for both virgin and recycled PET, the Asia-to-Europe trade route is well established.

But for recycled PE and PP, “there’s a lot more hesitation on bringing Asian material in, partly because of lead times, but partly because those trade routes are being established in a very different world than it was 10 to 20 years ago, where they’re worried about the optics of bringing material long distance,” Mark Victory, UK-based senior editor of recycling at ICIS, said.

Overall, the impact to European recycled plastics pricing is expected to be secondary, Victory and Tudball both said. For example, the euro has strengthened against the dollar, making Asian products priced in U.S. dollars cheaper.

Recycled polyolefins do not see significant flows in or out of Europe, Victory said, but these markets could see a secondary impact from a reduction of U.S.-origin virgin PE coming into Europe.

“This actually could potentially have a positive impact for recycling, because if it pushes the virgin price up higher, it could relieve some of those margin strains on some of the non-packaging applications that compete directly, but also it could make people make that transition to recycling quicker and earlier.”

In addition to the recently enacted Packaging and Packaging Waste Reduction legislation, other regulations, such as EU 2022/1616, apply to food-contact applications, Tudball said. The result is that there’s a lot of focus on traceability of recycled material, “so it remains to be seen if these cheap imports end up really taken up by European buyers, or if they’re still a little bit cautious.”

Even so, the new EU mandate of 25% RPET content in beverage bottles “is not really being enforced,” Tudball said. “It’s kept prices pretty stable, so the demand has not dropped, but it’s not probably risen to the levels expected this year.”

The name of BlackBridge Recycling was incorrect in a previous version of this story.