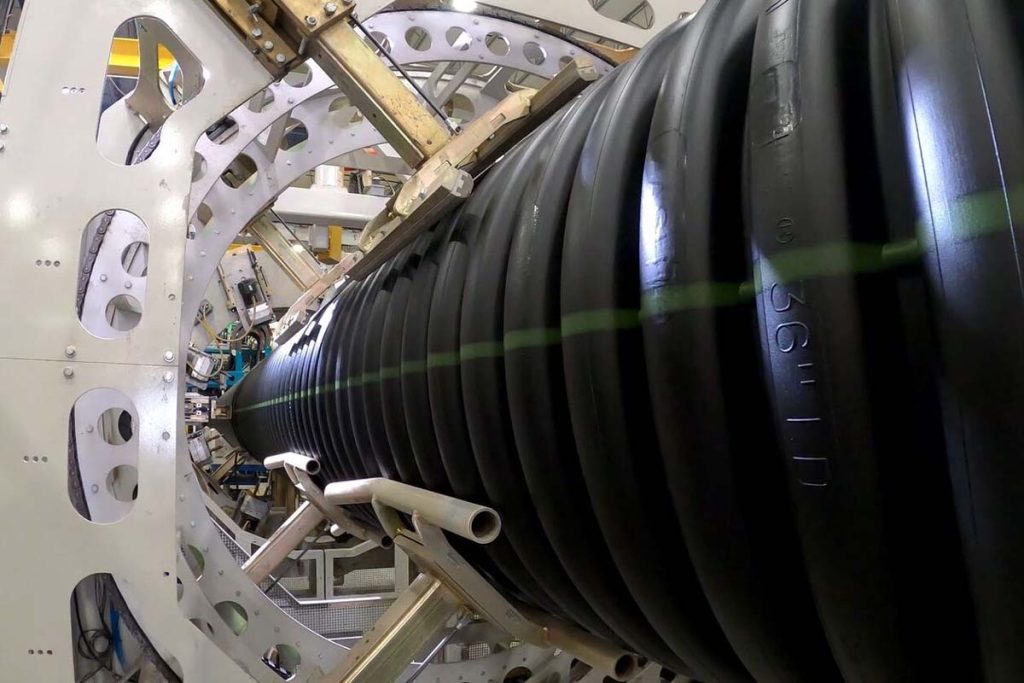

Advanced Drainage Systems (ADS) recycles over half a billion pounds of plastics, including a large portion of the color HDPE produced by U.S. recycling programs, into pipes, septic systems and other water-management products. | Courtesy of ADS

Economic conditions are taking their toll on two huge end users of recycled plastic, Advanced Drainage Systems and Unifi.

Recent financial filings show depressed sales for Advanced Drainage Systems (ADS), which recycles polyolefins into pipes and septic systems, and Unifi, which recycles PET bottles into the Repreve brand of polyester fiber.

Both companies reported they are cutting costs to mitigate the drop in demand. Unifi’s CEO noted that the company has reduced feedstock purchases and extended production downtime, and ADS’ CEO said his company will close three plants, among other measures.

ADS plant closures

ADS, which is now the largest plastics recycling company in North America, reported sales of $655 million during its fiscal third quarter (the last three months of calendar year 2022). That was down over 8% year over year.

In a press release, the company pointed to a December slowdown in domestic construction, which is a huge driver of demand for ADS products. ADS recycles post-consumer HDPE into piping and PP into septic systems.

But the Hilliard, Ohio-based company increased profitability during the quarter. The company’s net income was $83 million, a year-over-year increase of 12%.

“Importantly, though we are facing a challenging demand environment, our market leading position, value proposition and execution enabled us to manage costs, maintain favorable price/material cost and generate significant cash flow,” Scott Barbour, the company’s president and CEO, stated in a press release.

In explaining the increased profits, ADS pointed to higher prices for the company’s pipe, on-site septic and allied products, according to the release, as well as the benefits of lower feedstock material costs.

In the release, he said the company expects the lower demand to persist, owing to higher interest rates and inflation, which have affected construction activity. In response, the company plans to manage its costs, including by reducing its staff headcount, closing plants and improving its manufacturing, among other steps, Barbour said during a Feb. 2 conference call with investors.

“We are optimizing the network, closing three facilities by the end of March,” said Barbour, who didn’t identify the plant locations. “From our peak, we are taking out approximately 15% of the manufacturing and transportation workforce through reduction in attrition.”

Despite the closures, the company is still working to build a $65 million engineering and technology center, which will include research on new recycled-resin materials. Plastics News reported the company is also looking to build a major manufacturing location in Florida, where trains would bring in recycled PE pellets for processing into stormwater pipes.

During the 2022 fiscal year, ADS consumed about 1.3 billion pounds of feedstock, of which about 45%, or nearly 590 million pounds, were recycled materials, according to a company presentation.

Repreve sales nearly cut in half

Unifi, a Greensboro, N.C.-headquartered company, reported $136 million in sales for its second fiscal quarter, which consists of the last three months of the 2022 calendar year. That was down over 32% year over year. The impact was primarily due to slow clothing sales.

Nearly one-third of the Unifi’s sales came from the Repreve brand of fiber, which is made of recycled PET bottles. For the quarter, sales of Repreve totaled $43 million, down 47% year over year.

Overall, the company’s gross profits – or in this case, losses – totaled negative $8 million for the quarter. That compares with a profit of $17 million during the same period the year before.

“Last quarter, we cautioned that the higher than normal inventory levels across the world’s largest brands retailers would negatively impact our results in the second quarter. The magnitude of these macroeconomic trends was unforeseen, and the resulting adverse impacts to our business worsened in November and December, far beyond what we had anticipated,” Eddie Ingle, Unifi’s CEO, said during a Feb. 2 conference call with investors.

“In the U.S. in particular,” he continued, “demand disruption caused by destocking efforts from retailers, became more and more severe. This demand decline caused a slowdown in apparel production globally, and led to results that fell below our expectations.”

In response to the business conditions, Unifi has reduced labor hours, curtailed discretionary spending, extended production shutdown periods and delayed hiring in open positions, according to a company presentation.

During the call, Ingle said that the cost-cutting measures included reducing raw material purchases. Unifi also noted that raw materials prices starting in mid-2022 affected profits in the Americas, but that those prices stabilized through January.

The presentation also noted that in January the demand seemed to trend upward.

“In the last few weeks, we’ve already seen in the U.S. … notable improvements in weekly demand trends compared to the levels we experienced in November and December, which leads us to believe that demand levels bottomed out in the December quarter, and we are optimistic that our business is on the road to recovery,” Ingle said.