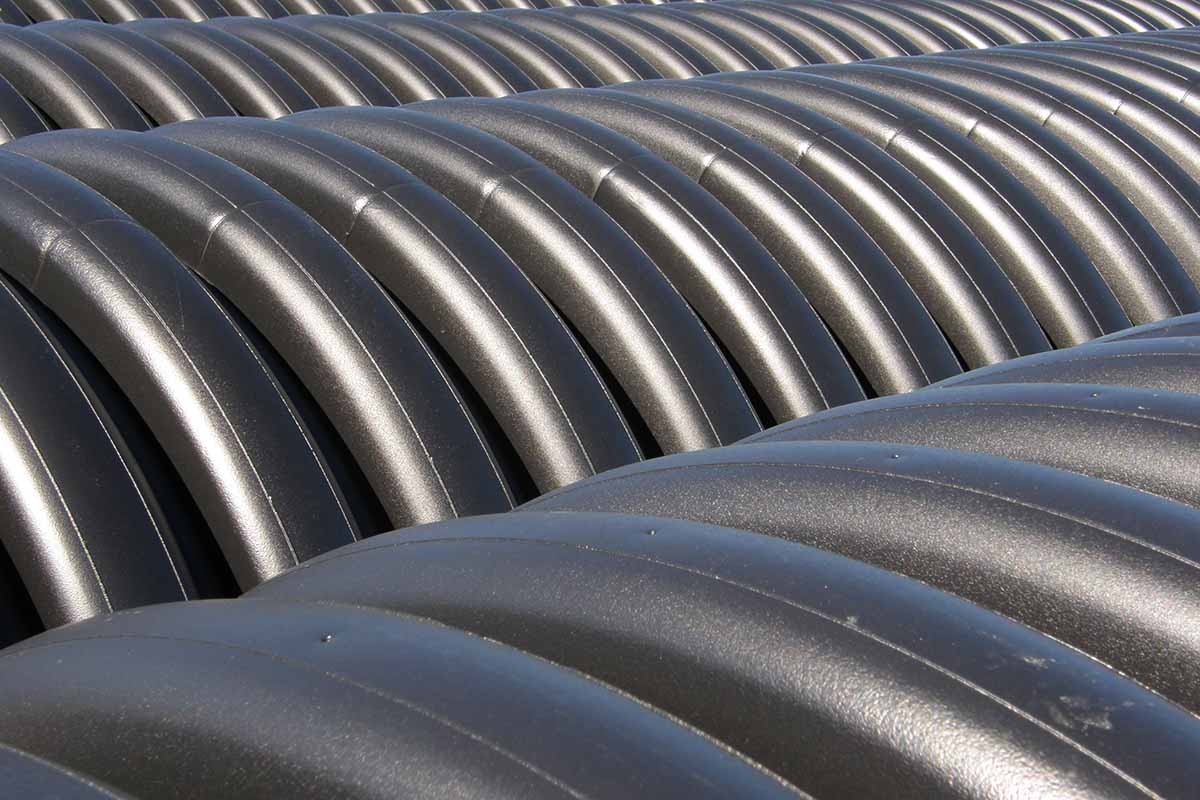

Volatile pricing in resin markets has presented challenges for Advanced Drainage Systems over the past year. | Chris Tennant/Shutterstock

Using recycled plastic is good business for Advanced Drainage Systems, but recent reports and interviews make clear that it’s not always painless.

Hilliard, Ohio-based Advanced Drainage Systems (ADS) recycles hundreds of millions of pounds of post-consumer polyolefins each year into piping and septic system products. The second largest plastics reclaimer in North America, the company produces post-consumer resin (PCR) at its processing plants and buys PCR from outside suppliers.

But with volatile recycled and virgin plastic pricing over the past couple of years, it hasn’t always been smooth. High PCR prices and limited availability have constrained ADS’ efforts to boost the recycled content of its products, even as the company has invested large sums in expanding its recycling abilities, particularly with its $49 million acquisition of Jet Polymer Recycling in December.

The company’s recently released sustainability report for the 2021 fiscal year (April 1, 2020 to March 31, 2021) showed ADS purchased 510 million pounds of recycled plastic, down about 50 million pounds, or 9%, from the prior year. During the 2021 fiscal year, recycled resin made up about 47% of overall direct material purchases (with the rest virgin), down from 51% the prior year.

“This was primarily due to availability of virgin material at a more competitive price, as well as a decrease in overall inventory levels,” according to the report.

Erratic pricing affects end user

Most of what ADS uses is HDPE, and during the 2021 fiscal year, prices for HDPE bales rose dramatically.

According to RecyclingMarkets.net, the average price of bales of natural HDPE was over 33 cents a pound in April 2020, and that rose steadily to exceed 77 cents in March 2021.

The rise for colored HDPE was even more dramatic. ADS is a huge consumer of colored HDPE, which can easily go into its black-colored products (ADS estimates it consumes about 28% of the pigmented HDPE bottles available in the U.S.). According to RecyclingMarkets.net, colored HDPE bales increased from about 4 cents a pound in April 2020 to nearly 24 cents in March 2021, a rise of about six times.

Since then, the market has become even more wild, said Brian King, executive vice president of product management and marketing.

“The year of our sustainability report was pretty stable. Pricing through that period was much more stable when you compared it to this year,” he said in an interview with Plastics Recycling Update. “This year has been a lot more volatile.”

RecyclingMarkets.net data shows HDPE climbed to record high prices in September 2021 – $1.08 per pound for natural and 58 cents for color – only to collapse to 56 cents and 22 cents, respectively, in January 2022.

What it presents for a large manufacturer such as ADS is difficulty planning the timing and amount of purchases. At the same time, ADS saw virgin HDPE prices rise from about 40 cents per pound in January 2021 to over $1 a pound in September, which King described as a lot of inflation in a short period of time. The curve was similar for prime PP.

In an interview, Nicole Voss, ADS’ director of sustainability, noted that the winter storm that knocked out power for much of Texas a year ago helped drive tightness in virgin plastic supply, which pushed prices upward. The tight supplies have persisted, she said.

Pricing is certainly one factor affecting ADS’ use of recycled plastic, but “I don’t think we consciously made a decision to say, ‘Hey, we’re not going to go after recycled,'” Voss said. That being said, “You’re not going to significantly overpay for recycled content.”

Voss said the procurement department did comment last year that several new buyers in the recycled resin marketplace were submitting higher bids to some reclaimers that would have supplied ADS than ADS’ contracts typically allow.

King noted that, for ADS’ feedstock purchasing, recycled plastic has remained cheaper than virgin plastic (including off-spec), even as prices for both rose. But one challenge has been where in the country the PCR is produced, King said, adding that ADS doesn’t want to be trucking recycled resin all around the country, particularly during a time of widespread supply chain disruptions.

“It was more of an availability challenge at certain times through last year,” he said.

As most businesses and consumers are likely aware, inflation hasn’t been limited to the plastics markets. According to The Washington Post, year-over-year inflation was up 7.5% in January 2022, for example.

Learn more in person

At next month’s Plastics Recycling Conference outside Washington, D.C., attendees will get an inside look at all the forces in plastics recycling markets in the “What to Expect in Resin Pricing” session. The discussion, which will feature expert analysts from IHS Markit, takes place Tuesday, March 8 at 3:00 p.m. Eastern. Register today!

The construction market, which ADS sells into, was no exception. When plastic feedstock prices increased, ADS passed on some of those costs to customers in the form of higher prices. The higher prices were a big deal to the company, he said, but ADS found relative acceptance in the market.

“I think our ability to manage, our ability to price the way that we need to to have a healthy supply chain, I think people got up to speed with that very quickly,” he said.

Still, ADS didn’t pass on all its higher costs, and the profit margin was squeezed. The company has also experienced higher costs from transportation and labor.

According to the publicly traded company’s latest quarterly report, ADS’ adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin, which is a key measure of profit margin, was 24.3% during the nine-month period ending Dec. 31, 2021. That was down from 30.7% during the same period the year before. Overall earnings were up substantially, however, driven by an increase in total sales volume and higher prices for its products.

The new recycling line at ADS.

Strategies to unlock supply

Rather than strictly PCR pricing, King pointed to more competition for limited supplies of PCR as a major factor in ADS’ decreased purchases in the 2021 fiscal year. Consumer product brand owners striving for greater recycled content in plastic packaging contributed to the crunch, he noted.

“We could use a lot more recycled content if we could get a hold of it,” he said.

Vertical integration up the recycled resin supply chain is one strategy ADS has used to secure a steady stream of recycled feedstock.

ADS has long owned an HDPE recycling facility in Waterloo, Iowa. In 2019, ADS acquired Infiltrator Water Technologies (IWT), a $1 billion deal that brought IWT’s Winchester, Ky. recycling facility under ADS’ umbrella.

More recently, on Dec. 3, 2021, ADS bought Jet Polymer Recycling, which is based in Fort Payne, Ala. and has three plastics recycling facilities in Alabama and Georgia. At the time, the purchase price wasn’t disclosed, but a quarterly financial report submitted by ADS to the Securities and Exchange Commission (SEC) on Feb. 3 shows the acquisition was valued at $49.4 million. Jet Polymer Recycling is the largest supplier of recycled PP to IWT, which produces septic systems.

Voss said that ADS now produces about half of its recycled plastic needs internally, buying the rest from outside reclaimers.

Voss and King also pointed to other recycled resin possibilities. They said post-industrial scrap presents an opportunity for ADS. Additionally, the company is supporting industry efforts to help increase U.S. recycling rates and divert a greater supply of HDPE and PP scrap from the waste to recycling streams. One of those efforts is working with The Recycling Partnership, King said.

“There’s a lot of opportunities to use more recycled plastics if we could get them out of the waste-to-landfill stream,” he said. King in November authored an op-ed for Resource Recycling arguing that federal infrastructure investments are also an opportunity to improve the country’s recycling infrastructure.

Voss pointed to work that The Recycling Partnership has done in her backyard: partnering with the Solid Waste Authority of Central Ohio (SWACO) to increase apartment and condo building access to recycling services.

Voss said that, in the long term, chemical recycling technologies may also play a role in ADS achieving its recycled-content goals. The company’s goal is to use 1 billion pounds of recycled plastic annually by the 2031 fiscal year.

Chemical recycling technologies may unlock sources of post-consumer plastic that are difficult to recycle through mechanical processes, she said, emphasizing that they should not be used to recycle plastic items that are mechanically recycled today.

“We’re always going to go for mechanically recycled first, because it’s lower carbon footprint,” she said, “but if that market’s not there, that’s still a potential option.”

Ultimately, King emphasized that ADS uses recycled plastic not only because of the environmental benefits, but also because it’s a financial driver for the company. Some other companies sign on to sustainability commitments, only to find themselves later trying to determine how to pay for them.

“We know that using recycled product is good business for ADS,” he said.

More stories about markets

- Analysis: Import tariffs could support struggling PET

- Aduro loss widens as pilot plant nears commissioning

- Report shows $5B in materials saved from landfills