Scrap plastic exports fell to their lowest level in recent history, but domestic markets continue to be hungry for recycled resin, particularly natural HDPE. | BEST BACKGROUNDS/Shutterstock

Overseas appetite for post-consumer scrap plastic dwindled in the third quarter. But on the domestic side, the value of recovered natural HDPE has skyrocketed and RPET demand remains strong.

U.S. scrap plastic exports dropped to their lowest third-quarter volume on record this year, driven largely by major Asian buyers continuing to constrict import volumes while other overseas markets did not grow enough to fill the void.

The U.S. Department of Commerce released September 2019 export numbers this week, creating the opportunity for third-quarter analysis.

From July through September, recycled plastic exports were down compared with every prior third quarter since at least 2002, the earliest point for which U.S. quarterly export figures are available.

Third quarter exports were also lower than the first two quarters of the year.

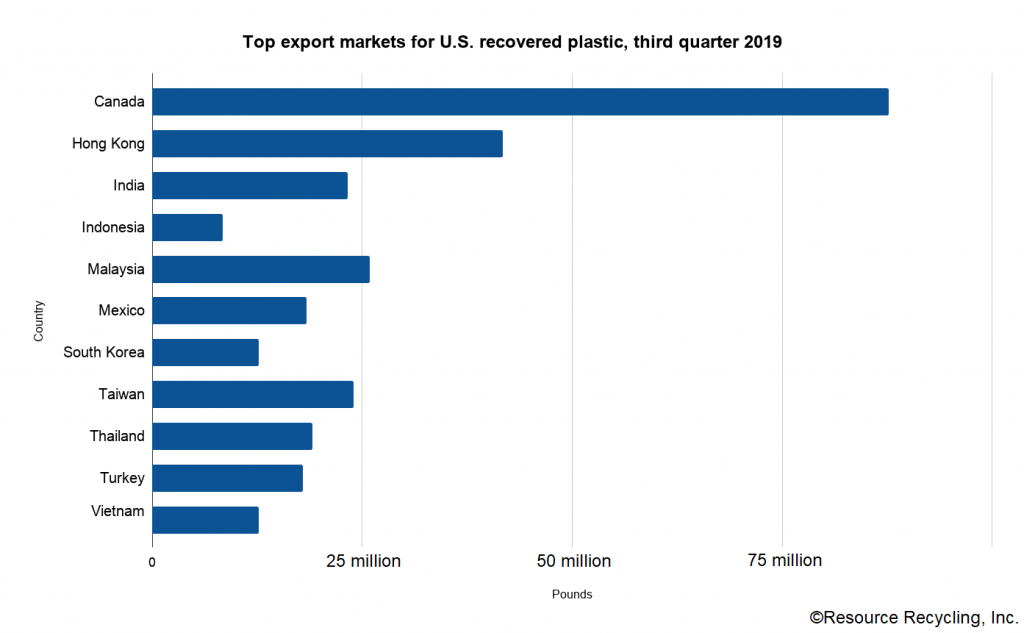

By volume, the largest importers of U.S. scrap plastics in the third quarter were Canada (88 million pounds), Hong Kong (42 million pounds), Malaysia (26 million pounds), Taiwan (24 million pounds), India (23 million pounds), China (5 million pounds), Thailand (19 million pounds), Mexico (18 million pounds), Turkey (18 million pounds), South Korea (13 million pounds), Vietnam (13 million pounds) and Indonesia (8 million pounds).

Compared with the third quarter in 2018, major decreases were seen in plastic shipped to India (down 68%), Malaysia (down 63%) and Hong Kong (down 37%).

The third quarter was particularly notable for exports to India, because that country implemented stringent scrap plastic import restrictions at the end of August. The monthly shipment figures reflect this policy: The country imported 15 million pounds in July, 5 million pounds in August and 4 million pounds in September.

Domestic markets favor natural HDPE, PET stable

As export volumes continue a slog downward, domestic markets for common curbside plastics remain relatively stable. And for one grade, the market is rising rapidly.

Natural HDPE has skyrocketed in recent weeks. It climbed in price from 21.94 cents per pound in August to 25.88 cents per pound in September, before nearly doubling to 46.38 cents per pound in October. (Those numbers represent pricing on RecyclingMarkets.net’s Secondary Material Pricing Index, and they indicate national averages being paid for post-consumer recyclable materials in a sorted, baled format, picked up at most major recycling centers.)

Mick Barry, president of Des Moines, Iowa-based Mid America Recycling, said he’s seeing natural HDPE at as high as 55 cents per pound.

“I have not seen, in my 30 years of dealing with secondary materials, the price move this much on natural,” he said. The price increased five times in October, he added. “It’s extremely unusual.”

In conversations with PE processors, Barry learned that sector is seeing “ungodly demand” and processors have few reserves of the material. Natural HDPE is a particularly desirable recovered resin because, unlike colored HDPE, it can be used in end products of any pigment.

The price increase has financial and operational implications for recyclers.

“When it’s 17 cents for [colored HDPE] and 20 cents for natural, there’s no incentive to pull them apart,” Barry said. But with natural HDPE roughly 40 cents per pound higher in price, MRFs can raise the value significantly by separating the HDPE types.

Although it’s not seeing the exponential price increase of natural HDPE, recycled PET demand remains strong in certain domestic markets, resulting in relative price stability recently.

“We haven’t had any free fall,” said Sally Houghton, deputy executive director of Plastic Recycling Corporation of California (PRCC), which brokers bales of recycled PET bottles for suppliers across California. “We have it gradually decline, and then sort of hit bottom, and gradually bump along the bottom.”

Prices have seen only modest changes in recent months, sticking in the range of 10 to 15 cents per pound, according to RecyclingMarkets.net.

Now, Houghton added, prices are seeing a slight uptick, which is normal for autumn. Consumers generally go through fewer PET bottle beverages in the cooler months, constricting supply while demand remains relatively constant.

Push to stay domestic

Mid America makes bales of natural HDPE, color HDPE, PET and mixed plastics Nos. 3-7. Virtually all the company’s plastics remain in North America – the company has used international markets in the past, but it has moved off exporting in recent years.

Mid America moved away from export markets based on the interest of its commercial suppliers. The company handles material both from residential curbside programs and from large retailers. After sorting their back-of-house recyclables, these companies don’t want to see that material end up being poorly processed in a country without the proper infrastructure, Barry explained.

“They do not want their material going to a marginally acceptable market,” he said.

But the cost effectiveness of exporting is also tenuous for Mid America.

“Out of Des Moines, Iowa, it doesn’t make a whole lot of sense financially,” Barry said. When plastic prices are higher, the freight to get the material to a port can pencil out and the MRF can still generate a profit from the transaction. But when prices drop below about 20 cents per pound, Barry noted, export becomes unrealistic.

“In the dimes, the freight doesn’t work out,” he said.

National pricing for PET and color HDPE is trending in this range: RecyclingMarkets.net last month reported PET beverage bottles and jars were at 9.80 cents per pound, and color HDPE was sitting at 13.06 cents per pound.

Global complications

Some suppliers simply want to avoid the new headaches associated with international sales.

Exporting, Houghton of PRCC explained, has become much more involved than it was in the time before China’s import restrictions. Many overseas buyers want to have live inspections of bales before shipping, and there is a good deal more paperwork required.

“Most of our suppliers would prefer to ship domestically, to stay on shore,” she said.

PRCC does work in export markets occasionally – for instance, the brokerage recently increased its export volume of MRF-grade PET bottles – but in general, domestic demand is strong enough to support moving material to U.S. buyers.

“The demand is there and we think it will continue,” Houghton said.

Most of PRCC’s domestic material is spoken for in California. Among other reclaimers, PRCC supplies a substantial amount of recovered PET bales to rPlanet Earth, a major reclaimer in Los Angeles.

For Mid America, even low-grade plastics are remaining in the U.S. The MRF operator is in the enviable position of having a nearby domestic processor in Illinois for these bales.

“They re-sort it and try to upgrade the No. 5s,” Barry said, referring to the resin identification code for polypropylene. “We just don’t have enough optical scanning or manpower to grab 5s out.” (Pulling out PP can raise the value of mixed plastic bales and make it financially feasible to spend additional resources to process them.)

Barry’s downstream plastics processor purchases mixed bales from Mid America for 1 or 2 cents per pound, and the company then sells recovered resin to large plastic manufacturers.