From campus recycling crusader to Cascade president, Neil Peters-Michaud has shaped ITAD for 25 years, with Radiohead, Rivian road trips and axe throwing on the side. | Photo courtesy of Neil Peters-Michaud/Cascade Asset Management

Raised in Silicon Valley, Neil Peters-Michaud has built a career at the intersection of environmental advocacy, public policy and electronics reuse. He carried an early conservation ethic into his studies and campus projects at the University of Wisconsin-Madison, where he pushed practical waste-reduction efforts that paired savings with sustainability.

In its 2020 report, London-based Circular Energy Storage found that exports of used electric vehicles drove value for their batteries, rather than reuse and recycling. | Around the World Photos / Shutterstock

Reuse and recycling represent the smallest area of opportunity for used electric vehicle batteries, but remain important, according to a recent report from British consultancy Circular Energy Storage (CES) Research and Consulting. Continue Reading

American Battery Technology Company saw triple-digit revenue growth in Q4 as it scales to meet demand. | Quality Stock Arts / Shutterstock

American Battery Technology Company (ABTC) reported Q4 2025 revenue of $2.8 million, a 183% increase over the prior quarter, while full year revenue, ended June 30, 2025, surged 1,149% to $4.3 million compared with fiscal 2024. Continue Reading

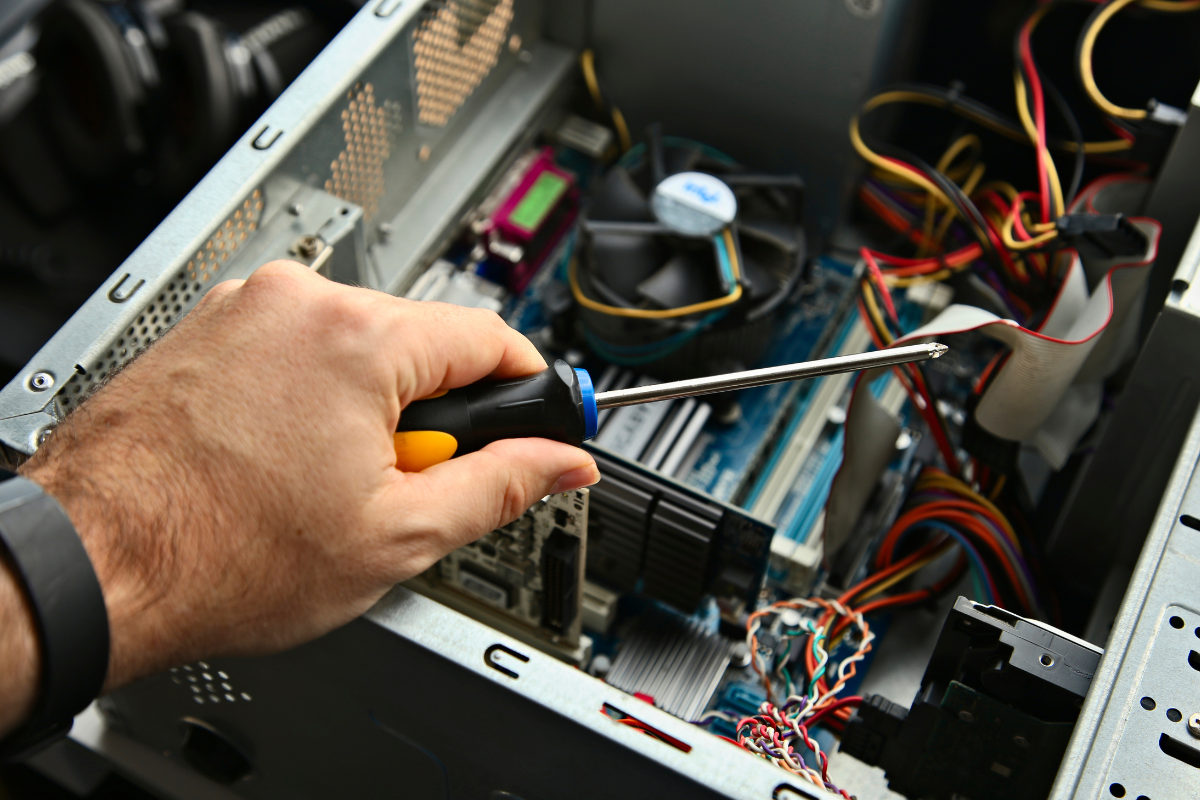

Tailwind’s move is among a series of private capital firms eyeing ITAD assets as hardware decommissioning volumes expands, regulation tightens and the stakes for data security and responsible recycling rise. | MD Photography / Shutterstock

Tailwind Capital is the latest private equity player to bet on the booming IT asset disposition industry, taking a majority stake in DMD Systems Recovery this month. The deal marks Tailwind’s first big move into the ITAD sector. Continue Reading

As California moves to implement SB 1215, the definition of battery-embedded device and the associated fees with the program are at the forefront of discussions. | Gorodenkoff / Shutterstock

Editor’s note: With 25 states and the District of Columbia covering 66% of the US population under e-scrap laws, jurisdictions continue to address collection and funding challenges as programs and technology evolve.

This EPR Update series in E-Scrap News examines the latest policy updates from four states navigating these regulatory shifts. Read part one here.

The West Coast has become a hub of activity in the producer responsibility legislative landscape, with all eyes on California as it prepares to launch an extended fee system covering battery-embedded devices.

With EPR spreading and shift to convenience-based collection, Hawaii’s SB 1298 adds devices, expands reporting and phases targets to 63% in 2025, 66% in 2026 and 70% in 2027. | Billions Photos / Shutterstock

Although battery recycling is still in its infancy, with many EV vehicles expected to remain on the road for years to come, the industry is collaborating and investing in its future. | Elnur / Shutterstock

Ever since I interviewed Lauren Roman of Transparent Planet about the electric vehicle (EV) battery sector and its recycling aspects, I started spending more time tracking what was happening there. Continue Reading