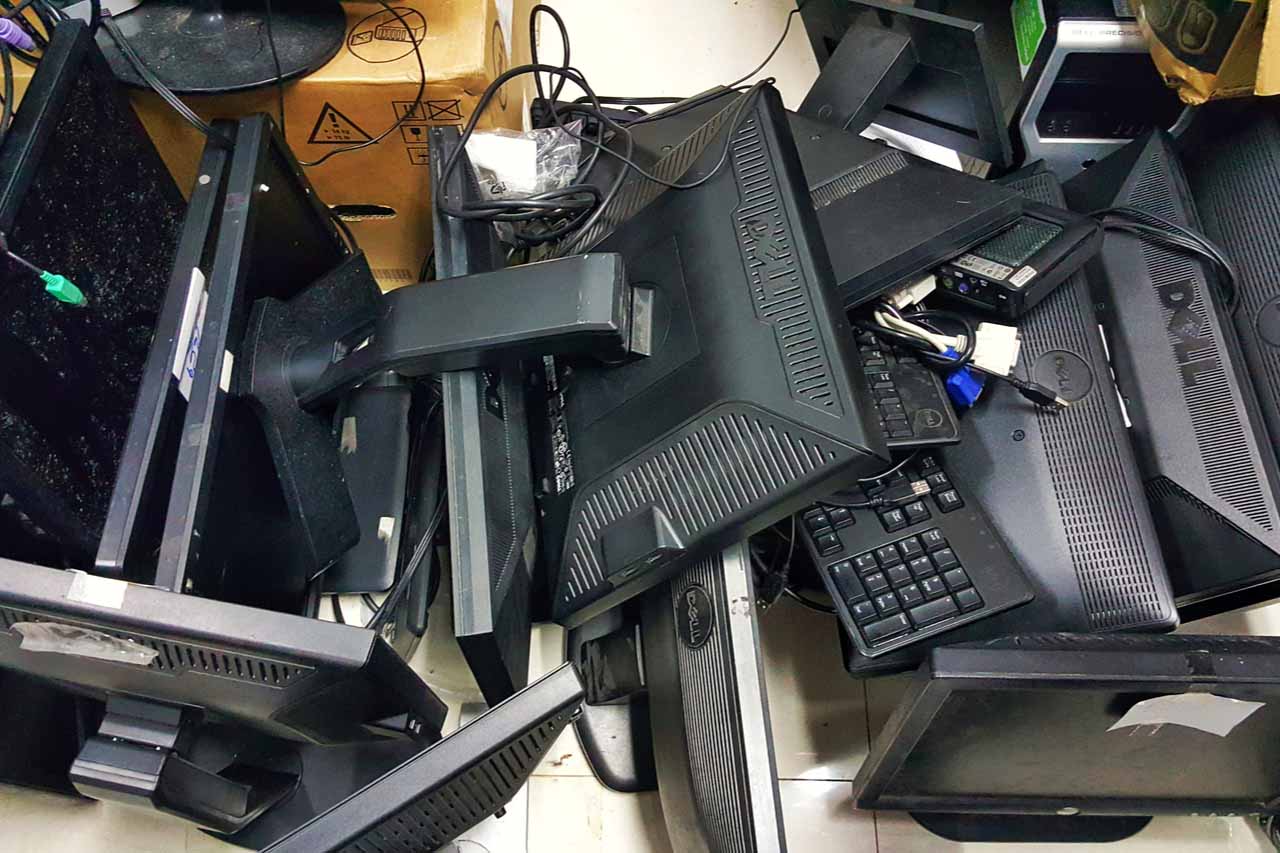

Over the past two years, the face of sustainability and IT asset disposition finance has evolved dramatically. | Koy Hipster / Shutterstock

On Tuesday, October 28, the Plenary Session of E-Scrap Conference will address “How Mergers and Acquisitions are Reshaping the ITAD Sector.” The discussion will be timely and important because the ITAD and electronics recycling sectors are being propelled by a fast-expanding universe of active capital.

In an upcoming report by Compliance Standards titled “Active Capital in Sustainability and ITAD: From Passive Finance to Operational Ownership,” we draw a vivid map of how private equity, infrastructure giants and mission-driven impact funds are transforming what was once a niche, fragmented set of services into institutional-grade infrastructure, governed by compliance, technology enablement, and measurable environmental outcomes.

From financial engineers to platform builders

Over the past two years, the face of sustainability and IT asset disposition finance has evolved dramatically. Private equity in the sector was once dominated by financial engineering, with value extracted primarily through leverage and quick turnarounds. But rising interest rates and shrinking exit markets have pushed investors to pivot. Today’s leading funds are staffed with operational partners, former executives and compliance specialists, individuals who are re-engineering their business rather than simply restructure a balance sheet.

The new strategy for investors is hands-on growth, coupled with compliance maturity, and long-term value. Active ownership now means that financial backers and sponsors take the driver’s seat in scaling the business, strengthening data security, standardizing operations, adopting best-in-class automation and integrating new compliance frameworks.

The broader capital landscape

Active capital in ITAD in 2025 is far from monolithic. On one end are “Circularity Impact Specialists” like Closed Loop Partners and Generate Capital, purpose-built to create infrastructure for recycling and ITAD, coupling capital with operational involvement. These firms now command influence well beyond their fund sizes due to their frontline role in partnerships with OEMs and major enterprises.

At the other pole are global infrastructure asset managers, such as EQT, Brookfield and others, who treat ITAD and recycling as essential extensions of their renewable-energy and utility portfolios. Their entry into the sector signals the maturation of recycling and electronics end-of-life as investable asset classes, with long-term, utility-style governance as the new standard.

Between these poles are a rising crop of mid-market private equity funds, such as Tailwind, Ancor Capital and Ara Partners, that specialize in buy-and-build strategies. Their approach: professionalize operations, consolidate fragmented regional providers, and inject the managerial discipline required for enterprise-scale compliance and reporting.

Compliance and circularity redefine value

The backdrop to this capital influx is a rapidly shifting regulatory environment. Europe’s Right-to-Repair Directive and a patchwork of US state-level laws require OEMs and enterprises to embed circular principles deep into product and supply chain design. Meanwhile, updated federal regulations, like stricter data destruction rules, make compliance both a value-add and a competitive necessity.

Simultaneously, the expiration of Windows 10 support this month (October 2025) has triggered one of the largest IT refresh cycles ever, pushing enormous volumes of equipment to responsible end-of-life processes. For ITAD providers, this flood of assets comes with new demands, device-level traceability, complete erasure telemetry and auditable downstream outcomes, requiring ITAD companies to seek new capital to keep pace with client expectations

Integration and outlook

What distinguishes today’s market is the convergence of resource recovery and ITAD. Investors increasingly treat recycling streams as sources of strategic materials, copper, gold, aluminum, and more, blurring the old boundary between electronics resale and raw material feedstock. The investment thesis goes beyond compliance or resale margins, to extend to national industrial policy and supply-chain resilience.

Looking ahead, we project that 2026 will start a true consolidation cycle, with the most sought after ITAD companies being the ones that embrace AI for compliance, forge cross-sector partnerships with critical-minerals processors, and can measure circular outcomes on behalf of their investors and clients.

As consolidation ramps up and the bar for participation rises, ITAD and recycling company leaders must prepare now. Investor-ready means operational excellence, transparent circular reporting, and a vision aligned with the global race to secure critical materials and achieve carbon accountability.

More stories about ITAD