Recent changes to global regulations on scrap plastic shipments have shaken up the export market for plastics recovered from electronics.

The Basel Convention this month began regulating the global trade of a handful of types of scrap plastic, including a great deal of e-plastics. During a Jan. 12 event hosted by the Basel Action Network (BAN), experts described market chaos as governments around the world implement the new Basel regulations into their national laws.

“It’s fair to say, 12 days in there’s a lot of confusion in the market,” said Craig Thompson of FPD Recycling, which supplies technology for processing e-scrap. Thompson has set up collection networks for electronics in the U.K. and has consulted with e-scrap firms on downstream processing of their e-plastics.

Formally titled the Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal, the global pact governs how shipments of certain types of hazardous waste are regulated between nations. It was amended in 2019 to include a variety of plastics under its purview. Its potential implications for the U.S. are particularly notable, because the U.S. is a major exporter of scrap plastic but has not ratified the Basel Convention.

The new restrictions officially took effect on Jan. 1, although some Basel-party countries began implementing them before that date and some are still finalizing their domestic lawmaking.

Shipped weights down substantially

As one example of the current tumult, Thompson noted that buyers in Malaysia are still requesting material from overseas scrap plastic suppliers. That’s despite the fact that shipments from the U.S. to Malaysia may be considered illegal under the new Basel rules, and the European Union has banned the export of plastic waste to countries that are generally considered to be developing nations, including Malaysia.

Adding to the confusion, the Malaysian government issued permits to recycling companies to import scrap plastic for 2021, despite the Basel changes, Thompson said.

Steve Wong, chairman of Hong Kong plastics recycling firm Fukutomi Recycling, recently described the Basel impacts in a plastics recycling market update.

“Plastic scrap supplies have been reduced by half due to the enforcement of Basel Convention amendments and the impacts of COVID-19,” he wrote.

Wong, who is also executive president of the China Scrap Plastics Association, added that scrap plastic traders are also facing challenges from increased freight rates and cancellations of bookings by shipping lines. Some of these impacts are lingering disruptions from the COVID-19 pandemic, which snarled the global shipping industry last year.

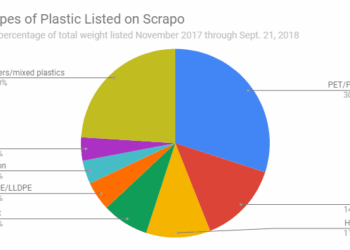

The regulations are impacting all types of e-plastics, as well as mixed plastics from the municipal recycling stream and contaminated plastics, Wong said. Shipments of these have slowed because of a new prior-notification requirement, he said.

As a result, there is a shortage of feedstock available for recycling firms in Southeast Asia, Wong noted. This has driven up prices for a variety of types of scrap plastic, including most engineering plastics, PE film, HDPE bottles and drums, and more.

“Factories have to fight for feedstocks to keep machines running,” Wong told E-Scrap News in a follow-up interview.

Some aspects are in flux

As countries work to adopt the Basel guidelines within their domestic laws, a key detail is how certain language is interpreted. For instance, to determine whether a load of plastic is subject to the Basel guidelines, regulators must consider whether it is “almost free from” contamination, but the official rules don’t identify a specific figure for what that means.

During the presentation this week, Jim Puckett of BAN, which advocates against waste exports, said countries are implementing different contamination limits to meet that criteria. Hong Kong, for example, has identified a 0.5% limit for a load to be considered “almost free from” contaminants. Indonesia will not allow any contamination in imported loads, whereas EU draft guidance is floating a limit of 2% for imports, Puckett said.

“For all intents and purposes, this is likely going to be decided by China, Hong Kong and the EU as the most important players,” Puckett said. BAN predicts the global standard for how this is interpreted will not be greater than 5% contamination.

Wong said it’s difficult to keep contamination to under 2% in a load without advanced sorting equipment that’s missing from most recycling facilities.

Technology solutions to struggles

Recycling firms are adapting to the changes, in some cases by installing new equipment. During the BAN presentation, Jeff Gloyd of URT described his company’s decision to install an e-plastics sorting system, opening the door to more domestic markets for the material.

“The more we can control the products that come out of our systems, the more we think we can decrease volatility in the market,” Gloyd said.

URT initiated the project three years ago, largely in response to China’s decision to restrict and ultimately end scrap plastic imports. Gloyd said the decision was not made lightly, and that it involved analyzing the market at the time, as well as a certain amount of guesswork about future market turbulence.

“I feel that we guessed right, and that the timing of the installation and operation of the unit coincides well with the new regulations started a couple weeks ago.”

Thompson of FPD Recycling said there are similar developments in Europe. He referenced companies in France, Latvia, Poland and Portugal that have recently installed equipment to process e-plastics.

Thompson’s company has begun installing X-ray separation technology for e-plastics, a method he described as one of the first to use a dry process rather than water, which sorts by density.

Potential for policy fixes

The market situation is also highlighting the potential of policy as a solution.

Wong, who also spoke on the BAN webinar, noted the current confluence of market struggles, pointing to the COVID-19 pandemic, unstable pricing, a geographical disconnect between supply and demand of e-plastics, and now the Basel Convention plastic amendments.

These forces, he said, highlight the value of policies such as extended producer responsibility (EPR), mandates use of recycled content and more. Such policies could create resilient markets that would be less susceptible to turmoil.

“For that, we need to have collaboration of government, lawmakers, brand owners, industry, recyclers and the general public,” Wong said.

These policies could also mitigate economic problems with e-plastics recycling, where the cost of recycling sometimes makes the end product not commercially viable.

Additionally, Wong said there needs to be a geographical shift in processing capacity. The U.S. is one of the largest e-plastics-generating countries, he noted, but the recycling sector is concentrated in Southeast Asia. He encouraged these recycling firms to adjust their operations to process material in the exporting countries, such as the U.S.

“I think our industry, in the end, will be very much focused on recycling locally, or recycling at the source of supply,” Wong said.

A version of this story appeared in Plastics Recycling Update on January 13.