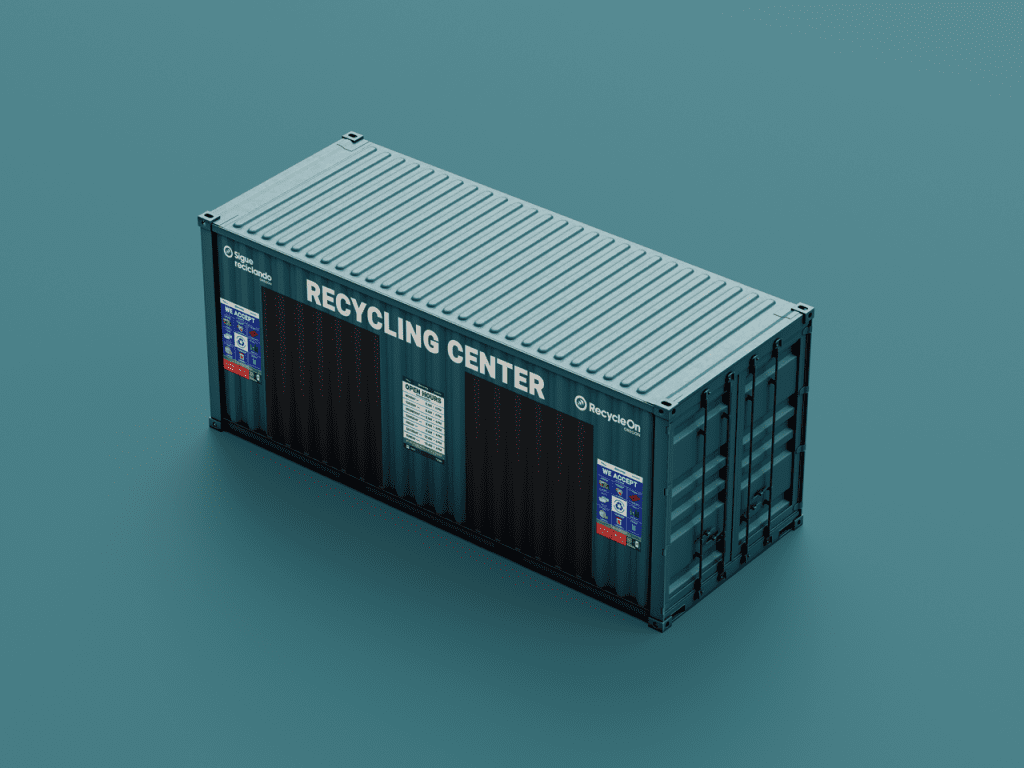

Producer responsibility organization Circular Action Alliance plans to build a network of 144 PRO Recycling Centers, pictured, for hard-to-recycle items. | Photo Courtesy of Circular Action Alliance

Extended producer responsibility for packaging in Oregon is officially implemented, with the first dollars from producer fees flowing out to the communities most in need as of July 1.

Veja/Shutterstock

Changes to Oregon’s container deposit program drew reader attention last month, as did coverage of end market demand concerns, a legislative effort to support a mixed-waste MRF, and extended producer responsibility analysis in the U.S. and Canada.

Marissa Heffernan moderates a panel at the 2024 Plastics Recycling Conference. | Big Wave Photography / Resource Recycling.

When I started working for Resource Recycling, I thought I knew quite a bit about recycling. After all, I grew up in a bottle bill state, turning in cans for candy money, and was the child checking neighbors’ recycling bins to make sure they were using it right. Continue Reading

During an investor presentation, WM leaders outlined investments in recycling and automation. | 2p2play/Shutterstock

Leaders at hauling giant WM discussed expansions in the company’s recycling infrastructure and automation at a recent investor day, expressing optimism for WM’s future as landfill closures increase demand for collection and recycling. Continue Reading

The group will promote MRF upgrades and product design changes to facilitate higher capture of small packaging items, like metal bottle caps. | xpixel/Shutterstock

Led by the Glass Packaging Institute, a new initiative seeks to improve MRF sortation of smaller packaging materials that often get missorted and end up in the glass stream. Continue Reading

Glass sourced from Seattle and the surrounding areas saw temporary disruptions due to the loss of a major end user. | Photo courtesy Seattle Public Utilities

Several months after the primary end user for Seattle-area curbside glass pulled out of the area and disrupted regional glass collection, logistics upgrades have enabled programs to resume moving material as usual. Continue Reading

The Basel Convention regulated plastic scrap in 2021, but each party country must adopt domestic laws to enforce those rules. | hanohiki/Shutterstock

The Malaysian government recently published regulations indicating the country will stop all U.S.-sourced imports of scrap plastic on July 1, and reports from traders indicate the flow already has slowed. Continue Reading

Coloradans are working to implement a series of recycling-related policies, which sometimes support and sometimes oppose each other. | Gargonia/Shutterstock

When it comes to recycling, most policy is set at the state level — but not all of it. When city ordinances, state law and a governor’s priorities all interact, it can be a recipe for both significant change and serious complexity.

A warm welcome back to “Women in Circularity,” where we shine a light on women moving us toward a circular economy. This month, I was pleased to connect with a leader in community-based circular solutions: Teresa Bradley. Teresa is the CEO of Race to Zero Waste. Race to Zero Waste is a nonprofit dedicated to advancing zero waste principles and an equitable circular economy through education, action and advocacy to reduce single-use plastics and address the urgent challenges of our changing climate. Teresa has over 20 years of experience in zero waste operations and advocacy. Continue Reading

A warm welcome back to “Women in Circularity,” where we shine a light on women moving us toward a circular economy. This month, I was pleased to connect with a leader in community-based circular solutions: Teresa Bradley. Teresa is the CEO of Race to Zero Waste. Race to Zero Waste is a nonprofit dedicated to advancing zero waste principles and an equitable circular economy through education, action and advocacy to reduce single-use plastics and address the urgent challenges of our changing climate. Teresa has over 20 years of experience in zero waste operations and advocacy. Continue Reading