The U.S. exported 7.35 million short tons of recovered fiber during the first half of 2020, down 25% year over year. | Halawi/Shutterstock

New trade figures show lower U.S. exports of both recovered paper and plastic from January to June, compared with the same period last year. The decline was largely driven by less material going to China and India.

The U.S. Census Bureau, which is part of the Department of Commerce, last week released export figures for June 2020, providing a look at recycled material export trends for the first half of the year.

The numbers illustrate the substantial impacts of overseas import restrictions enacted in Southeast Asian countries over the past year as well as some COVID-19 ramifications.

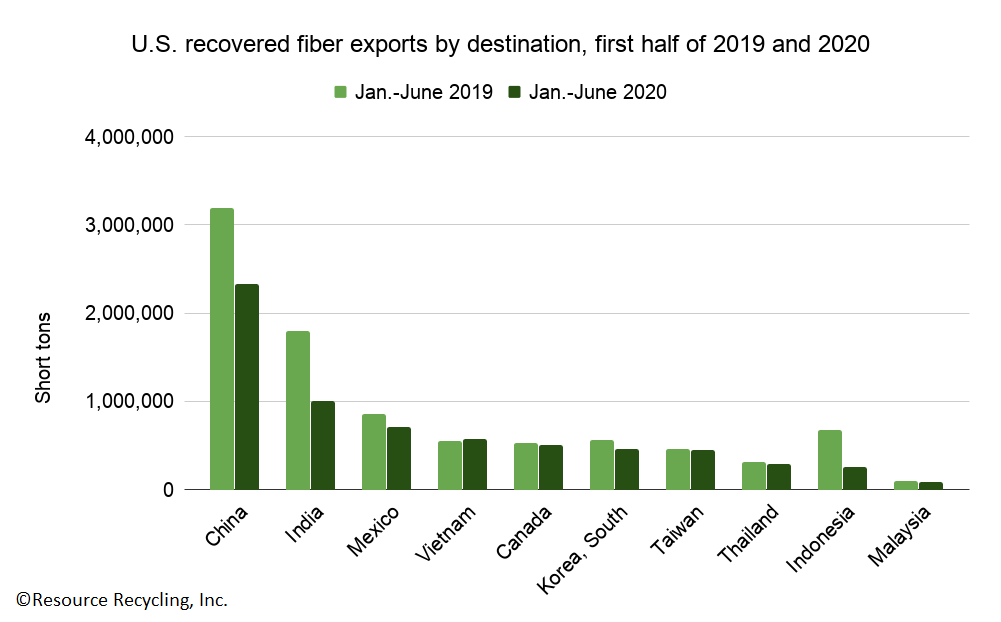

They also show that China remains the key export market for recovered fiber, with the nation bringing in well over twice the volume compared with the next closest player in the market. That fact is critical because China is widely expected to shut off all recovered fiber imports in the coming months, meaning major tonnages will need a new place to go.

The export decreases for U.S. recycled paper and plastic come on the heels of 2019, which saw a large-scale decline in shipments of both commodities.

Paper exports down by a quarter

The U.S. exported 7.35 million short tons of recovered fiber during the first half of 2020, down 25% from the 9.76 million short tons exported during that time in 2019.

The decrease was led by a substantial drop in exports to China, which brought in 2.33 million short tons of recovered fiber through June of 2020. That’s down by more than 850,000 short tons, or 27%, compared with the first half of last year.

India, the second biggest export market for U.S. recovered fiber during the first six months of this year, also slashed imports significantly. The country imported 800,000 fewer short tons during the first half of 2020 compared with 2019, a decrease of 44%. Indian government officials enacted stricter quality rules for mixed paper imports around the start of 2020.

Overall, India imported 1 million short tons of recovered fiber in the first half of 2020.

In another significant change, Indonesia cut U.S. recycled paper imports from 676,000 short tons during the first half of 2019 to 260,000 short tons during that period this year. The decline came during a period of change for Indonesia’s paper import rules. Those regulations were finalized in June.

(Story continues below chart.)

Plastic exports see modest decline

Plastic exports see modest decline

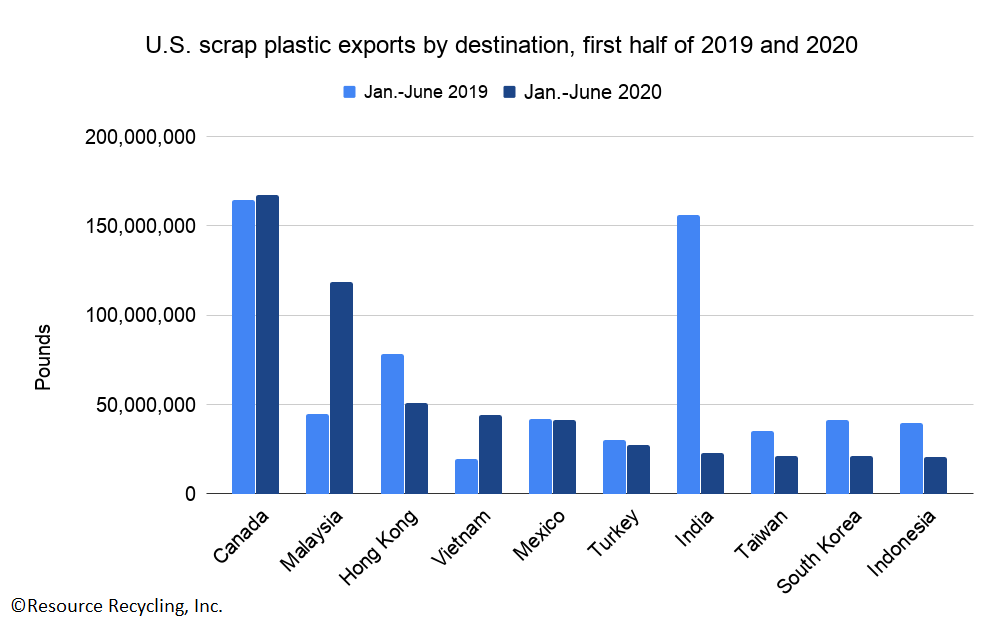

Meanwhile, U.S. exporters sent 635 million pounds of scrap plastic out of the country during the first half of the year, down 18% compared with the same period in 2019.

Most of the major export markets for scrap plastic saw moderate to significant declines, with a couple notable exceptions. Malaysia, which has enacted stringent scrap plastic import rules in recent years, nearly tripled its imports of the material this year compared with the first half of 2019. And Vietnam more than doubled its imports.

But those increases weren’t enough to offset the major decline in shipments to India, which reduced imports from 156 million pounds in the first half of 2019 to 23 million pounds during that period this year. The drop comes as India is increasing scrutiny on scrap plastic imports. The country has faced lockdowns and significant strife at the ports due to the COVID-19 pandemic.

More stories about markets

- ‘Operational readiness is high’ as Oregon rolls out EPR

- Pizza box demand declining, report says

- Paper operations close in Georgia, Texas

Plastic exports see modest decline

Plastic exports see modest decline