This article originally appeared in the September 2018 issue of Resource Recycling. Subscribe today for access to all print content.

Thus far in 2018, North American recycling companies have encountered plenty of headwinds when it comes to international trade, with processors, brokers and others trying to determine what to expect next on import policies in Asian markets.

But just as the industry was starting to adjust to the realities of National Sword, another globally oriented issue brought complications to recycling: the multi-billion dollar tariff battle being waged between the U.S. and longtime partners, most notably China.

The duties enacted by in the first quarter of 2018 directly impacted the steel and aluminum markets, leading to boosted prices garnered by metals processors.

But far more recycling stakeholders stand to be affected through higher costs for equipment, vehicles and other important day-to-day items made of metal. In addition, more recent tariff proposals from China target scrap paper and plastics directly.

And underlying the discussion is the potential impact on the health of the U.S. economy as a whole.

“Certainly, I think the potential implications of the trade war have reverberated around markets everywhere, whether it’s commodities markets, stock markets or currency markets,” said Joe Pickard, chief economist of the Institute of Scrap Recycling Industries (ISRI). “We’ve had an extended period of economic growth, and this is one of the things that could really derail that.”

Here, we’ll outline the ways this global economic issue is already shifting recycling realities, and we’ll analyze some of the longer-term impacts and unknowns a sustained international trade war could bring to materials recovery stakeholders.

Feeling shift in multiple ways

It’s true the tariff situation is multifaceted and evolving day by day (or tweet by tweet), making it a hard issue to succinctly characterize. But for Joe Jurden of Cook Paper Recycling Corporation in Kansas, one of the most pronounced impacts on his company is simple to describe.

“Something everyone in the recycling industry is feeling right now is the effect on baling wire,” Jurden said, noting that in the wake of steel tariffs rolled out in early spring, the cost of that materials-recovery staple has risen 10 to 12 percent. “Most budgets don’t have that kind of leeway. And it’s not over.”

The price of baling wire encapsulates what’s occurred in the steel market since President Donald Trump in March announced his administration would impose tariffs on steel and aluminum imported into the U.S. The tariffs, levied at 25 percent on steel and 10 percent on aluminum, took effect March 23. Soon after the U.S. duties were in place, China hit back with tariffs of its own, including a 25 percent tariff on scrap aluminum (see timeline below for a chronological look at the issue).

Since June 1, the U.S. steel tariffs have been extended to imports from all countries except Argentina, Australia, Brazil and South Korea, and the aluminum tariffs on all countries other than Argentina and Australia.

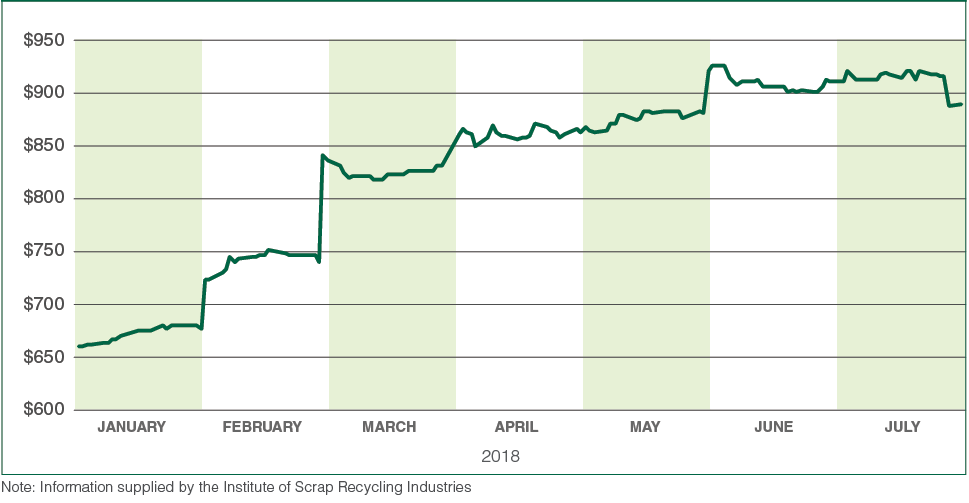

That activity has sent metals markets into a tizzy. The benchmark pricing for U.S. steel climbed roughly 40 percent over the first seven months of 2018, hitting a 10-year high in June (see chart below). Aluminum values, meanwhile, hit a seven-year high in April, but fell from there, in large part due to U.S. sanctions on a major Russian manufacturer.

Beyond the cost of baling wire, recycling companies are experiencing the early fallout from these market shifts in multiple ways, some good and some bad.

Take, for example, Chicago-area Lakeshore Recycling Systems. The company handles residential and commercial recyclables, including construction and demolition debris.

Alan Handley, Lakeshore’s CEO, said the price of scrap metal went through the roof when the steel and aluminum tariffs were announced. That has boosted revenues for Lakeshore’s sorting facilities that handle significant metal tonnages.

But tariffs have caused problems for Lakeshore in other ways.

Hardest hit have been the steel containers Lakeshore purchases to provide to commercial customers. Handley said the price of a 30-yard roll-off box has increased by about 20 percent since tariffs went into effect.

More problematic than price, however, is the lack of availability. “Wait times have dramatically increased, ” he said.

Handley noted that costs for packer trucks have also increased, and although the boost hasn’t been huge, if the market doesn’t equalize over time, the increase will have an impact.

“[The Chicago area is] a big market, and there’s a lot of people using steel for other stuff,” he said. “So the ability to get steel is just much more difficult than it used to be.”

Woes for equipment manufacturers

Recycling equipment makers say they have seen similar impacts in terms of costs and wait times for the metals that are essential to their offerings. That fact is almost certainly going to mean higher prices for those operators who make machinery purchases in the coming months and years.

Recycling equipment makers say they have seen similar impacts in terms of costs and wait times for the metals that are essential to their offerings. That fact is almost certainly going to mean higher prices for those operators who make machinery purchases in the coming months and years.

“In manufacturing, we’re in a high-overhead position,” said Ashley Davis, director of sales and marketing at CP Group. “Any direct cost we incur we have to pass on. Nobody likes it, but it is what it is.”

According to Davis and Mike Whitney, CP Group’s vice president of operations, the company started to see considerably higher steel prices at the end of last year – the economy was growing and so was demand for the metal. When tariffs were introduced in early 2018, the price jumped a little more, by roughly 20 percent, but the main factor continued to be market demand, according to the CP Group executives.

Whitney said the company in July of this year was paying significantly more for steel than it was last summer. He noted CP Group uses a few million pounds of steel annually – predominantly from steel mills in the U.S. and South Korea – and steel expenses account for 20 percent to half of the cost of a typical buildout of a new recycling facility or retrofit.

Similar to what Handley from Lakeshore has experienced, delivery times have also been an issue for CP Group.

Whitney gave the example of tube steel, which is used to make the walls of bunkers in recycling facilities. In June, CP Group’s warehouse got down to its minimum level of the material. “We placed an order with one of our steel suppliers,” Whitney said. “Generally, we’ll get it in a couple of days. This time it took us three weeks.”

Chris Hawn, CEO of Machinex Technologies, said input costs have gone up considerably for his company as well. Though Quebec-based Machinex does all its manufacturing in Canada and is therefore not directly affected by tariffs on steel imported to the U.S., the company still must deal with the boosted price of steel on the commodities market.

Hawn said no customer likes the idea of having to pay more for goods, but he added recycling companies have been understanding thus far, grasping the fact that higher equipment prices are due to larger forces.

“It’s not just equipment,” Hawn said. “There’s going to be increases in the price of automobiles and all other types of steel goods. We’re not the only industry being hit.”

But higher recycling equipment costs do have an extra sting right now, thanks to the other global phenomenon unfolding in the recycling world. The import reductions and new contamination specifications enacted by China and other Asian nations have forced domestic processors to scramble to produce cleaner bales. For many companies, part of the strategy has been integrating more equipment.

“Last year and this year were two of our busiest years in terms of sales,” said Davis of CP Group. “We have been really heavy on retrofits, cleaning up fibers and optical sorters.”

With Asian customs authorities indicating more import restrictions could be on the way and domestic buyers continuing to call for higher-quality bales, the push for more help on the sortation front seems set to continue. The fact that tariffs could make such efforts more expensive from an equipment perspective is not what stakeholders want to hear.

“Anything that could increase the costs for updating plants and the plastics recycling infrastructure would be of significant concern,” said Steve Alexander, executive director of the Association of Plastic Recyclers. “Anything that increases the price of equipment would be the wrong thing to do.”

Future unknowns around markets

While the tariffs that have been enacted thus far have produced recycling ripples mainly in terms of the steel market, the longer-term effect could spread wider.

One key question is whether more rounds of duties will be implemented by the Trump Administration. The U.S. in early July enacted 25 percent tariffs on $34 billion worth of Chinese imports after a U.S. investigation alleged unfair trade practices on China’s part. Those tariffs cover various machinery components and other products “containing industrially significant technologies,” according to the Office of the U.S. Trade Representative, which is part of part of the Trump cabinet.

China immediately responded by enacting tariffs of equal value on a variety of U.S. products. Since that tit-for-tat, tariffs affecting billions of dollars worth of additional trade have been discussed, and China and others have noted they are set to continue retaliating.

Beyond the tariffs that had been implemented by mid-July, the U.S. and China each proposed tariffs on an additional $16 billion in imports from the other country.

After the U.S. released a finalized list of $16 billion in products that would be hit with a 25 percent tariff beginning Aug. 23, China released its own finalized list in retaliation. China’s finalized document included recovered materials, including OCC and scrap plastics. Although very little scrap plastic has entered China from the U.S. this year, the Asian country has continued to be a major importer of OCC and other fiber that hits quality specifications (see story).

U.S. Midwest domestic hot-rolled coil steel (CRU) index futures quotes ($/Short Ton)

In addition, the $16 billion tariff list from China also named some virgin plastics categories, and that fact could have market reverberations that carry through to the recycling sector.

In addition, the $16 billion tariff list from China also named some virgin plastics categories, and that fact could have market reverberations that carry through to the recycling sector.

Among the virgin resins subject to duties is HDPE, which is the largest polyethylene market in terms of American exports to China, with the U.S. shipping 300,000 metric tons of HDPE to China last year. The Chinese list also names linear low density polyethylene (LLDPE), of which 130,000 metric tons were exported to China last year.

For virgin plastics producers, “this new list will hit where it hurts,” said Kailin Fu, associate director for polyolefins and engineering plastics at market analyst IHS Markit Chemical.

Smaller U.S. plastics producers will be most impacted by these changes because they will be less able to adapt. Global companies will be able to shift their strategy and supply China with material out of the Middle East and Southeast Asia, Fu noted. Then, those companies’ U.S. exports can be moved to markets in Latin America and Europe.

The tariffs could also shake the economics surrounding virgin PE production projects that are currently under construction.

The North American PE market has about 7 million metric tons of new capacity slated to come on-line by 2022, according to Fu, and those projects were initiated before the tariffs were in the picture.

“The U.S. market cannot absorb all this 7 million tons of new capacity; it has to be exported,” Fu said. “And China was supposed to be one of the biggest receivers.”

It remains to be seen what that flood of material will do to virgin PE plastic prices – and to the recycled prices that generally follow their virgin counterparts.

Further, the U.S has proposed yet another list covering $200 billion in imports, which includes numerous plastic materials, and that move elicited another round of retaliation from Beijing.

Together with the tariffs that were slated to take effect Aug. 23, the $200 billion list could greatly impact markets around finished goods made of plastic, a product category that is regularly exported from China to the U.S.

The U.S. $16 billion tariff list covers pipe, film and sheen, and the $200 billion list includes PE bags and sacks.

“That’s 90 percent of all the finished goods we track,” Fu said.

If huge quantities of these goods can no longer be economically moved into the U.S. market, the reverberations through global manufacturing chains, including material demand, could be significant.

Still, Fu said it’s too early to sound serious alarm bells on the issue. “Right now, we really don’t expect prices to go drastically high or low on either side,” she said. “The pricing factor for recycled really isn’t obvious yet.”

Another component of the plastics discussion that could prove relevant to the recycling industry is the impact tariffs will have on the growing number of operations looking to ship recycled resin to China.

Since China enacted major restrictions on scrap plastic imports, many Chinese plastics recycling companies have set up new facilities outside the country. They receive raw scrap plastics at those facilities and process them into flake or pellet grade, before shipping them into China. Because they are no longer classified as solid waste, the scrap restrictions don’t apply.

But the commodity codes that are used to identify products covered by the tariffs do not distinguish between resin made from recycled or virgin materials. Although an additional tariff on shipping certain pellets into China might not make or break a company’s decision to set up a new processing plant, it could dissuade companies from choosing to locate inside the U.S. while the tariffs are in effect.

“It depends on which grade they end up producing here in the U.S.,” Fu said. “If it happens to be the codes on the Chinese announcements, they will be subjected to the duty.”

Long-range concerns about materials and economy

Regardless of how recently announced duties affect recycled values, producers of recycled plastic and some other materials could be impacted by the tariffs on aluminum that are already in place and causing market shifts.

Rising steel markets are causing recycling equipment manufacturers to increase their prices. One vendor representative said steel typically accounts for 20 percent to half of the cost of a new facility or retrofit.

Pickard, the ISRI economist, noted that companies that consume aluminum are currently being forced to pay more for the material than in the past. At this point, he said, that cost increase is being seen as a short-term bump that many are willing to withstand.

But if aluminum prices stay high for an extended period of time, companies that have typically used aluminum in packaging and products could begin to look for other options. Think more craft beer in glass bottles. Or more plastic pouches replacing aluminum cans for food products.

“The aluminum price might be higher short term, but if that reality is making aluminum a less competitive material long term, that could be worrying,” Pickard said.

That kind of shifting landscape on product and packaging material economics comes as recycled paper and plastics are undergoing their own supply and demand uncertainties.

Jurden of Cook Paper noted that China’s scrap import restrictions have had a similar effect as tariffs – the policies have had a chilling effect on Chinese imports, they’ve disrupted the global flow of scrap commodities, and they’ve disrupted domestic and international prices.

“I think we’ve kind of endured the worst, but that’s a short-term perspective,” Jurden said. “Long term? That’s a great question.”

Ultimately, the unknowns surrounding the duration of tariff impacts are what seem to be spooking recycling executives the most.

“The question in my mind is what’s the definition of long term?” said Hawn of Machinex Technologies. “Right now you hear some people say we’ll be feeling the effects of this for 12 to 24 months. But then you hear other economists say it could be a lot worse.”

Many business organizations have come out hard against the tariffs, noting that historically, such measures lead to economic declines that can spread quickly across sectors.

“Tariffs imposed by the United States are nothing more than a tax increase on American consumers and businesses,” the U.S. Chamber of Commerce notes on its website, “including manufacturers, farmers, and technology companies, who will all pay more for commonly used products and materials.”

The Aluminum Association, meanwhile, has stated that aluminum import tariffs should be levied only on specific countries, rather than across the board. “The administration’s trade remedies should specifically target structural aluminum overcapacity in China, which is caused by rampant, illegal government subsidies in that country.”

Pickard said his group started having concerns as soon as tariffs were first mentioned at the highest levels of government, despite the fact the initial action has been a boost for many ISRI members.

His group has noted that taken holistically, the tariff action could “irreparably harm” the competitiveness of U.S. materials recovery stakeholders.

“In the short term, it has driven up prices along the ferrous supply chain, which is to the benefit of ferrous recyclers,” Pickard acknowledged. “But longer term, if that impacts pricing of materials that households have to pay, that’s going to put a break on personal consumption expenditures and economic growth. That’s bad for the economy, and what’s bad for the economy is going to be bad for the recycling industry too.”

Dan Leif is the managing editor of Resource Recycling and can be contacted at [email protected]. Colin Staub is the publication’s staff writer and can be contacted at [email protected]. Jared Paben, associate editor, also contributed reporting to this article.