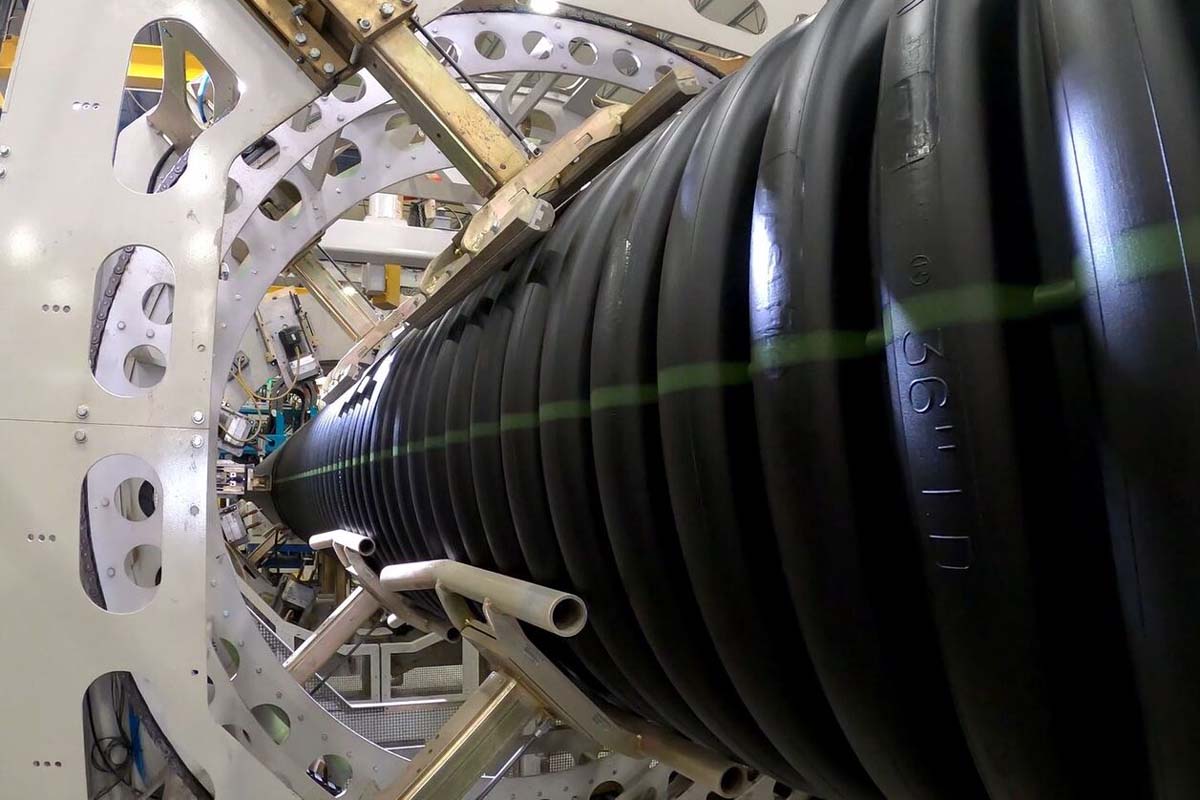

Baled clamshells in Ridwell’s Portland facility on Aug. 15, 2024, awaiting shipment to a downstream processor. | Marissa Heffernan/Resource Recycling.

As more consumers turn a skeptical eye to traditional recycling programs, Ridwell, a company that provides curbside collection of hard-to-recycle materials, is growing into numerous markets across the country. And the company is doing it with transparency in mind. Continue Reading