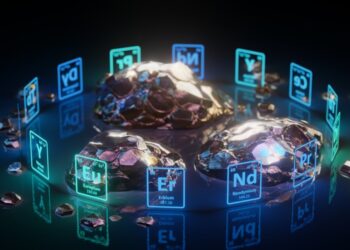

As technology trade tensions between China and the U.S. escalate, bans on trading minerals used in producing LED screens, semiconductors, chips and batteries are again putting the recycling sector in the spotlight.

On Dec. 2, the U.S. expanded export restrictions to China of chip-making equipment and sanctioned 140 Chinese companies, aiming to slow China’s development of advanced AI and its semiconductor production, Al Jazeera reported.

In response, China on Dec. 3 banned exports to the U.S. of the minerals gallium, germanium and antimony, which are used to manufacture semiconductors and military equipment, among other products. China is the leading producer of gallium, germanium and antimony worldwide, while the U.S. produces no gallium or antimony and very small amounts of germanium.

The retaliatory bans are the latest moves in a back-and-forth series of export restrictions that have been ramping up since at least 2022, according to Al Jazeera and other outlets. In July 2023, China started requiring special licences to export gallium and germanium to the U.S., and in October 2023, it tightened up sales of graphite products, which are used in batteries.

President-elect Donald Trump has said he plans to impose even heavier sanctions on China, including a 60% tariff on all Chinese goods.

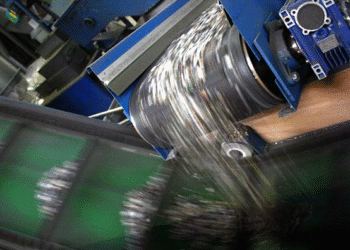

A recent report from the International Energy Agency found that recycling could lower the need for new mining activity by 25-40% by 2050 if scaled properly.

It also found that the use of recycled materials has failed to keep pace with material consumption. For example, the share of secondary supply of copper in total demand fell from 37% in 2015 to 33% in 2023. The share for recycled nickel decreased from 35% to 31% over the same period. Only aluminum saw an increase in recycled share, from 24% to 26%.

Battery recycling is one area poised for huge growth, the report added, and China has been leading in that area: In 2023, global capacity for material recovery grew by 50% year over year, and China accounted for 80% of that growth. The report projected that China will retain 70% of material recovery capacity in 2030, with the formation of China Resources Recycling Group, a state-owned enterprise for recycling and reusing end-of-life batteries, scrap steel and e-scrap.