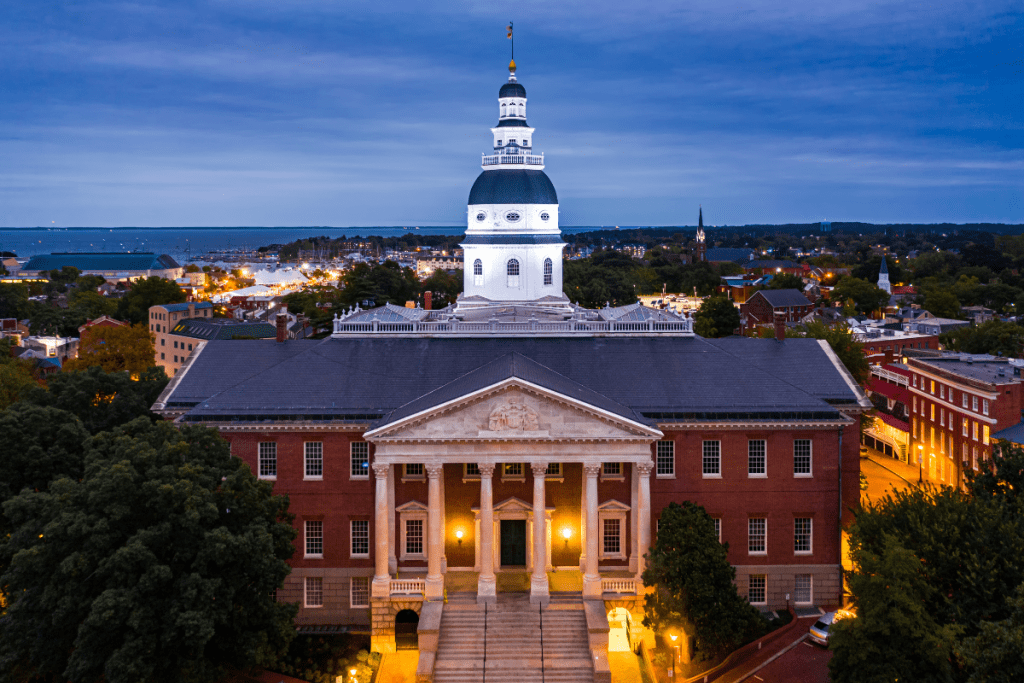

A needs assessment found that a well-designed EPR program could increase Maryland’s recycling rate for paper and packaging products from 34% to 50%. | Mihai Andritoiu/Shutterstock

Advisory groups in Maryland have shared a needs assessment and a packaging extended producer responsibility recommendation with the state legislature, finding that EPR for paper and plastic packaging could increase collection from 984,400 tons to 1.5 million tons.

The reports, which were due to the legislature at the end of 2024, come as more states look to EPR to handle packaging materials. Maryland has one packaging EPR bill introduced so far this session, SB 901.

SB 901 would direct a producer responsibility organization to set goals for post-consumer recycled content levels, recyclability rates, recycling rates, reuse rates, source reduction levels, composting rates and contamination reduction.

The PRO would also set fees that would allow for improvements to the system and reimbursements to local governments for up to half the cost of collection, along with the full cost of transportation and processing.

Fees would have to include eco-modulation factors, the bill notes, and reimbursement rates would have to account for population size, distance to MRFs and other socioeconomic or geographic factors the state chooses.

Advisory committee recommendations

As part of the legislation, Circular Action Alliance was selected as the PRO for the needs assessment, and an advisory committee was convened to make recommendations.

The committee recommended looking to Minnesota’s recently passed packaging EPR law for a framework, including its definition of “producer.” It also noted that Colorado’s advisory council “has been very consistent with its meeting cadence.”

The document laid out what roles the PRO, state and advisory councils should fulfill, as well as what data would need to be collected.

Fees could be adjusted based on eco-modulation, the report added, and should “leave room for innovation, creativity, and improvements.” The collected fees should be enough to cover PRO costs, state administration costs and reimbursements for collection, sorting, processing

and education to both local governments and the private sector.

As for timeline, the group recommended having producers register within a year of the passage of a law, the PRO submitting a plan two years after that, then full rollout of the EPR program within five years of law passage.

“For the purposes of Packaging Extended Producer Responsibility, ‘recycle’ or ‘recycling’ means the process of collecting, sorting, cleansing, treating, and reconstituting materials that would otherwise ultimately be disposed of, and returning them to, or maintaining them with, the economic mainstream in the form of recovered material for new, reused, or reconstituted products, that meet the quality standards necessary to be used in the marketplace,” the committee wrote.

Recycling should not include landfilling, combustion, incineration, energy generation, fuel production or alternative daily cover, the committee added.

Finally, if a deposit return system for used beverage containers or any other kind of EPR program is enacted, it should be harmonized with the potential packaging EPR program in a manner that ensures that there is no overlap of fees, the report noted.

Assessment highlights path to 50% diversion

The 150-page needs assessment looked at waste characterization studies, demographics, worker conditions, environmental justice, system cost and baseline data. It found that “a well-designed program” could increase the state’s recycling rate for paper and packaging products from 34% to 50%.

In addition, it could capture an additional $53 million of material value for about 20% higher costs than the current baseline. The estimated cost of the modeled EPR program is $550 million, an increase of $144 million from the cost of the baseline system. On a per-ton-recycled basis, the baseline cost is $412, and EPR could lower that cost to $378 per ton.

Among those costs is updating MRF equipment for between $9.2 million and $10.3 million, which would add 190,150 tons of annual capacity. Maryland has 42 transfer stations – 38 in-state and four in neighboring jurisdictions – and of those, 22 facilities accept recyclables. The state also has nearly 300 reuse organizations, 19% of which accept packaging materials.

A November 2024 waste characterization study found that compared to the last study done in 2016, the current disposed waste stream has a higher percent of plastics, organics, paper, glass and household hazardous waste. Construction and demolition materials, meanwhile, saw a significant decrease. In both commercial and residential streams, organics were the most prevalent material.

Looking at recycling rates, the assessment found the commercial sector has the highest recycling rate of paper and plastic packaging at 39%, followed by single-family households at an average of 30% and multifamily households at 16%.

The materials with the highest recycling rates across all sectors are glass and OCC. Looking specifically at covered paper and plastic packaging materials, the ones with the the highest recycling rates are OCC (52%) and paper (37%), followed by metal (30%), rigid plastics (27%), glass (24%), cartons (8%) and flexible plastics, “which is essentially 0%.”

Overall, Maryland generated about 2.9 million tons of covered materials in 2022 and about 34%, or 984,400 tons, was recycled at a cost of roughly $406 million. Approximately 65% of the cost came from residential curbside collection, while 32% was from commercial curbside collection and the remaining 3% from drop-off collection.

“EPR legislation could help stabilize pricing, increase demand for post-consumer feedstocks, and strengthen the remanufacturing sector,” the assessment noted. “By fostering efficient and accessible end markets, Maryland could improve the economic sustainability of its recycling system and incentivize higher material recovery rates.”

The assessment estimated that under EPR, improvements to recycling rates could be as follows:

- Rigid plastic would increase from 27% to 33%.

- Flexible plastic would increase from 0% to 9%.

- Glass would increase from 24% to 43%.

- Mixed paper would increase from 37% to 59%.

- OCC would increase from 52% to 69%.

- Cartons would increase from 8% to 17%.

- Metal would increase from 30% to 44%.

The needs assessment also surveyed municipalities, haulers and MRFs. Municipalities indicated general support for EPR but expressed concerns about “mandates that may disrupt existing operations, program implementation requirements, or additional costs to counties and municipalities that are not covered by the program.”

Haulers, MRFs and composting facility owners and operators “appreciate the opportunity to increase recycling in the State but are concerned about reporting requirements and operational impacts,” the authors wrote. The assessment also highlighted the importance of “balancing policy mechanisms with administrative feasibility.”