Konektus Photo/Shutterstock

PET bottles are often identified as the most commonly recycled plastic in North America. However, some technical and economic barriers can limit the recycling of other PET packaging formats, such as thermoformed trays and clamshells, from being effectively recycled. This represents a significant undertaking for the industry, knowing that the use of PET thermoforms for all types of packaging (such as food, electronics, and cosmetics) has increased significantly over the past few years.

In Canada, PET thermoforms are accepted in curbside collection systems, with a successful collection rate of over 50%. Currently, the most common practice consists of mixing PET thermoforms into PET bottle bales, which are then sorted and washed to be used into different applications. However, due to their greater brittleness, processing PET thermoforms with bottles can lower the overall recycling yield and affect the quality of the recycled output, which limits its use in some end-markets.

These challenges are only going to be exacerbated in upcoming years in Canada, as the volume of thermoforms is expected to rise, both for regulatory and voluntary reasons. On the regulatory side, the expansion of deposit programs across the country will increase PET thermoform concentrations in MRFs by diverting PET bottles away from the curbside stream. In Quebec, for instance, the newly expanded program will include all beverage containers over 100 ml by March 2025. On the voluntary side, many brands and retailers are turning to PET thermoforms as alternatives to harder-to-recycle materials, such as polystyrene (PS) trays. In Canada, thermoforms are identified as a preferable alternative to PS in different eco-design resources, including in the Golden Design Rules for Plastic Packaging adapted to the Canadian market by the Canada Plastics Pact.

A challenge designed for the Circular Plastics Taskforce

Founded in January 2020, the Circular Plastics Taskforce (CPT) is a non-for-profit organization that was born out of the unprecedented collaboration between leading Canadian beverage and food companies, packaging manufacturers and industry associations. Since its inception, the group’s unique federating approach has attracted the support of government and industry partners, positioning it as a leading circularity organization in Canada and North America. The CPT’s mission is simple but ambitious: to support the building of a circular economy for all post-consumer plastics put on the market in Canada.

The work of the CPT focuses on what it calls the “orphans of the bin.” By that, the CPT means resin types or packaging formats that are usually accepted in Canadian curbside collection systems, but don’t currently have a solid path towards circularity, whether it is due to sorting issues, inadequate recycling infrastructure or lack of end markets. In this respect, PET thermoforms fit the bill perfectly.

After deciding that they wanted to work on thermoforms, the first step taken by the CPT was to discuss with PET recycling stakeholders to get an overview on the current state of affairs. The group soon realized that there appeared to be many conflicting viewpoints amongst the industry on how to handle thermoforms. While everyone seemed to agree there was a limit to the amount that could be processed through existing PET recycling lines, the percentage mentioned was not consistent and many challenged both the feasibility and viability of increasing their concentration. However, there seemed to be a lack of supporting evidence to corroborate those assumptions as no robust data or research finding could be provided.

To fill that gap, the CPT designed a research project that would test the ability of a PET reclaimer to process different thresholds of PET thermoforms and document the impact on both process efficiency and output quality. The project management was handed to Michel Gosselin, a PET recycling expert, to kick-start this research with the support of multiple Canadian PET reclaimers.

A practical approach

The study tested three different bales with varying concentrations of PET thermoforms. The control sample (approx. 41% thermoforms on total clear PET) consisted of commercially available bales that are considered representative of standard residential curbside bales commonly processed in Canada. The second sample (64%) was acquired through EFS-plastics and contains a higher level of PET thermoforms. This material came from a secondary sorting line which recovers PET from non-PET bales. The third sample (90%) was acquired from a MRF in California, where PET thermoforms are positively sorted out to produce thermoform-only bales.

One truckload of each of the three samples was then sent to a Canadian PET reclaimer with extensive experience in sorting and washing PET bales. The trial was done on a washing line that was modified over the years to improve efficiency and specifically reduce the generation of fines, here defined as flakes under 1.7mm (or 0.07 inches), specifically to produce sheet. The material was processed through the sorting line, including NIR and color automatic sorters, then through the wash line and the flake sorting equipment. Similar parameters were used for all three types of bales, with only minor adjustments done to optimize the process for each sample. While the initial target was to run the material at the line-rated capacity, the line speed when running the 90% material was lowered to 60% of normal throughput, due to contamination in the sink/float bath and clogging in the extraction screw coming out of the prewash. The reclaimer commented that this problem could be solved if there was a need to process material with very high levels of thermoformed PET on a regular basis.

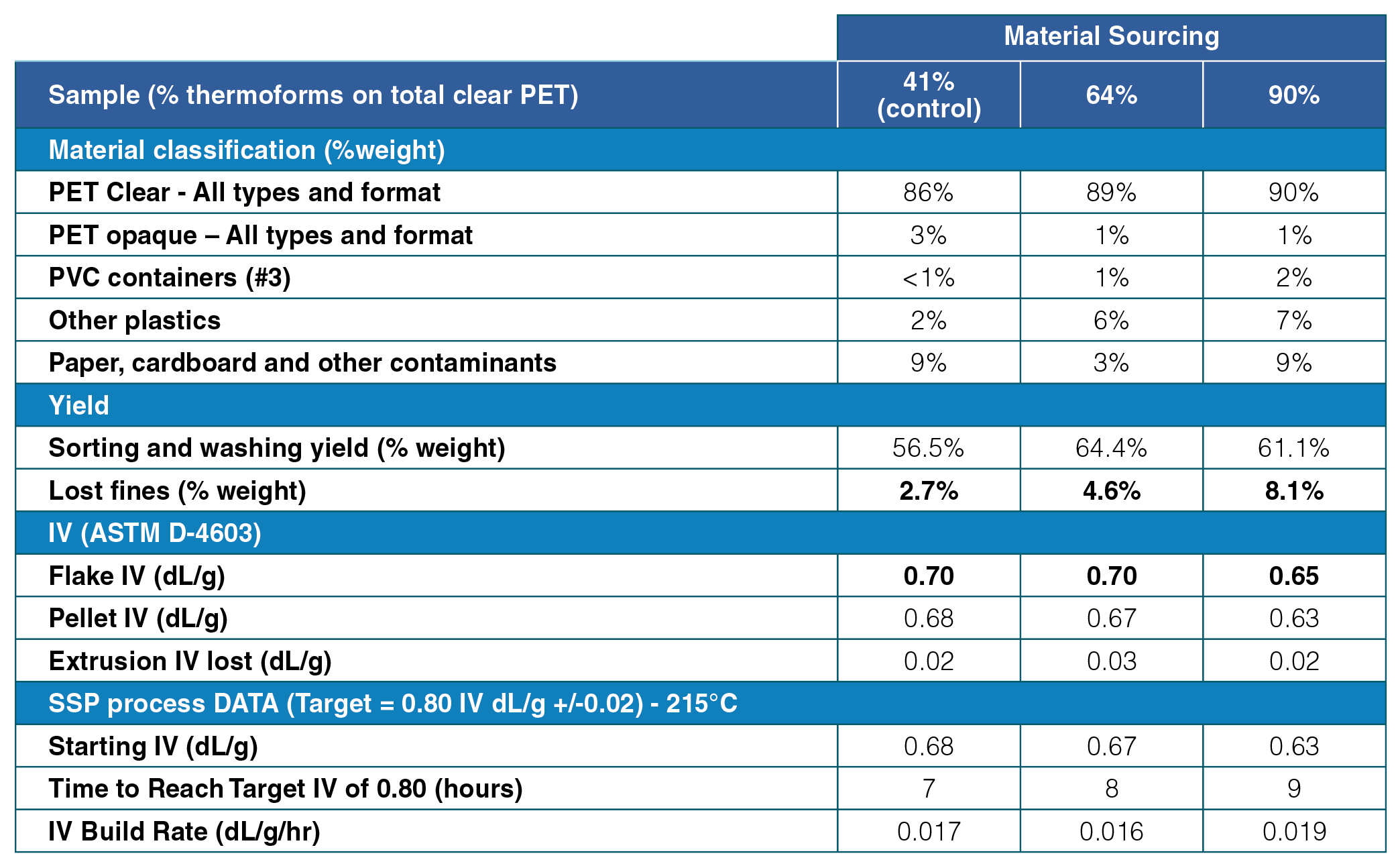

Flake outputs from these trials were then sent to an independent lab to analyze, among others, their color, haze, and intrinsic viscosity (IV). As it is a main concern with thermoform recycling, the sorting and washing yields were also measured, notably the percentage of lost fines. The table below shows the main results from this analysis.

The study shows that the overall clear washed flake yield can be considered similar for the three types of sourced material. The 56.5% yield for the control material is considered to represent a low-quality bale for the reclaimer, as a high-quality bale provides a yield of around 70%. Furthermore, as expected, the lost fines content is increasing as the percentage of thermoforms increases. However, for most reclaimers supplying to the sheet industry, the lost fines fraction of 8.1% obtained for the 90% sample could probably be considered as acceptable. For those supplying exclusively the bottle industry, the control sample using 41% PET thermoform may be a more acceptable result.

“Considering what we often hear about the very high level of lost fines when converting PET thermoforms, it was surprising to find the relatively low level of lost fines, even for a modified process,” confirmed Michel Gosselin, the project manager. “While increasing, the fact that the numbers remained relatively reasonable even for a bale that is made almost entirely of thermoforms is promising.”

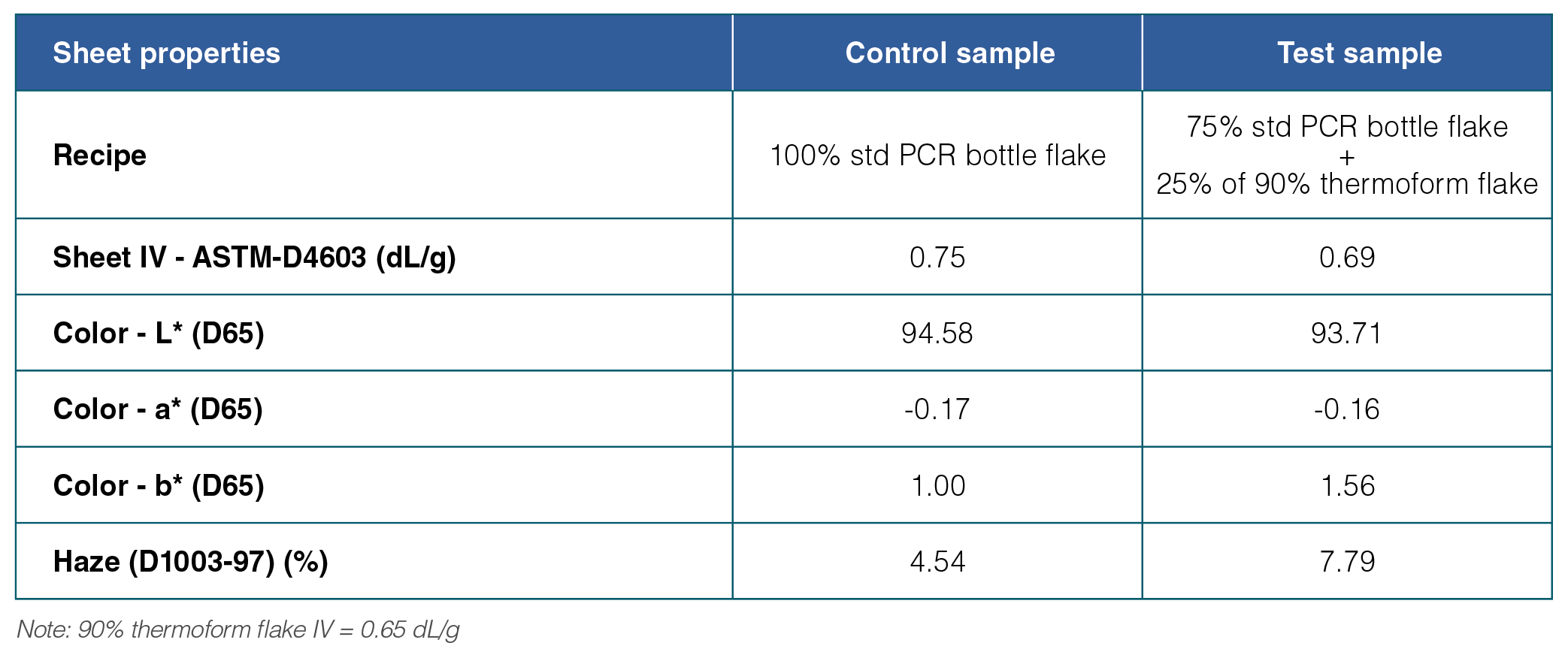

Finally, to move one step further up the recycling chain, 5,000 pounds of clean flakes from the 90% sample were sent to a Canadian manufacturer of PET sheets and thermoform containers. Sheets containing a mix of 25% of the sample and 75% of post-consumer recycled (PCR) bottle flakes were processed using extruders commonly used in the industry. Once produced, the sheets were evaluated for color, haze and IV, as seen in the table below. As a control sample, a sheet made of 100% post-consumer recycled (PCR) bottle flakes was also processed and analyzed.

This test showed that the IV for the sheet extruded using the 90% material was lower than the control sample, which was to be expected. The color values were similar for both samples, except for the b* values (i.e. color tend to be more yellow). However, a difference lower than 1.0 is usually invisible to the human eye. Finally, the main difference was seen in the haze values. While this difference is visible to the human eye, the reclaimer reported that the sheet containing thermoforms could be sold in some markets, with approval from the end customers.

Guiding the development of new infrastructure

To summarize, three main conclusions emerge from this study:

- Equipment is available to sort and process high concentrations of thermoforms when present in the PET stream.

- Modifications can be made to a wash line to better process thermoforms.

- PCR sheet can be made and formed into thermoforms of acceptable quality for specific markets using thermoform-only bales.

The CPT is aware that those conclusions have their limitations, notably due to the small sample size. Hence, in the coming month, the organization will study other components such as the cost of installing or operating the additional machinery or the effects on certain bottle grades or fiber end markets or processes designed to produce material for them.

However, the results show that there is room to grow with respect to the mechanical recycling of thermoforms, from packaging design all the way through end markets.

Through its work, the CPT’s goal is to spark some new conversations and a cross-border dialogue on the future of PET recycling, notably through an upcoming webinar in Spring 2024. In the coming year, the CPT will also continue to explore ways to deepen the knowledge on thermoform recycling by building partnerships with established industry players, such as The Recycling Partnership and the Association of Plastics Recyclers, and by leading research projects and pilots across North America. Among others, the organization plans to look into how increasing thermoforms concentrations can affect bottle and fiber production, as well as to assess the cost implications.

Charles David Mathieu-Poulin is a strategic advisor for the Circular Plastics Taskforce. For more information on the CPT and to access the full technical reports, visit gapc.ca. To contact the CPT, please send an email to [email protected].

This article appeared in the Spring 2024 issue of Plastics Recycling Update. Subscribe today for access to all print content.