Norway-based Agilyx will transfer its Houston plastics sorting center to joint-venture partners LyondellBasell and ExxonMobil, and will unwind its final investment decision for the second such facility, planned for the Dallas-Fort Worth area.

Agilyx also will become full owner of the Cyclyx International consortium by March 25, and will keep the 50,000 metric tons/year offtake agreement with ExxonMobil, with potential for additional volumes in the future, the company said Feb. 4. Cyclyx will continue to carry a long-term lease for the Dallas-Fort Worth facility, and may explore subleasing the location.

In 2022, LyondellBasell and ExxonMobil invested in Cyclyx to develop sorting facilities to feed the growing needs of their respective recycling capacities. Cyclyx itself is a consortium of companies throughout the plastics supply chain, including Advanced Drainage Systems, Ineos, Freepoint Eco-Systems, Iron Mountain, Kimberley-Clark, PepsiCo, Nova Chemicals and others.

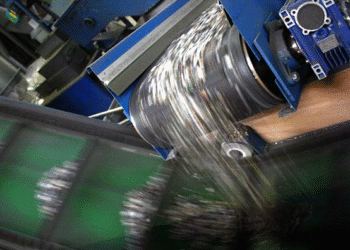

On Feb. 2, ExxonMobil announced its third chemical recycling plant in Baytown, Texas, was operational, bringing its processing capacity to about 250 million pounds/year (113,400 metric tons/year) of plastic waste. The global energy giant sources its feedstock from the Cyclyx joint venture, which supplies plastic scrap feedstock to both chemical and mechanical recyclers.

In November 2024, ExxonMobil announced capacity expansions for its chemical recycling facilities in Texas, and around the same time, Cyclyx announced FID on the second pre-processing plant, which it expected to start up in second-half 2026. Each of the two planned centers were expected to process about 300 million pounds/year of scrap plastic feedstock.

“Full control of Cyclyx and ongoing offtake opportunities will allow for greater synergies between EU and US operations,” the company said in a statement.

Alongside these changes, Agilyx will place greater emphasis on expanding GreenDot, the EU plastics recycling platform it acquired last October. Through GreenDot, Agilyx aims to supply high-quality feedstock to European recyclers, and is “actively discussing with a select group of top-tier financial partners the funding of future European expansion.”

In early December 2025, GreenDot acquired Italian HDPE and PP compounder Forplast, and has “current exclusivity on an additional M&A transaction, and a high-quality pipeline of further assets under active evaluation and discussion.” Until February 2024, GreenDot was also a producer responsibility organization in the US.

Agilyx expects GreenDot to generate more than €20 million ($23.6 million) in EBITDA this year, and aims for more than €100 million ($118 million) by 2030 via M&A activity and organic growth.

“This reorganization represents a decisive step in simplifying Agilyx’s business and reducing risk,” said Ranjeet Bhatia, CEO of Agilyx. “By transferring Cyclyx Houston Circularity Center to our partners, acquiring 100% ownership of Cyclyx International, and retaining long-term offtake contract with ExxonMobil, we are substantially reducing our capex and opex exposures while significantly increasing strategic and financial flexibility. These actions preserve the strategic value of Cyclyx while increasing alignment with our expanding European platform.”