March prices for HDPE natural bales rose by 10% on the month to a more than three-year high, further widening the price spread with color bales amid bearish end-use sectors and new waste import bans in Southeast Asia.

Natural bales were at a national average of 100.01 cents per pound for March, nearly 10 cents higher on the month and the highest level since October 2021, according to RecyclingMarkets.Net data. Color bales rose to 10.75 cents a pound, nearly double from February but still half their year-ago values.

This puts the price spread between natural and color at 89.26 cents per pound, wider by 4.19 cents than February’s record level.

Domestic demand for HDPE has risen with recycled content targets as well as the recent startup of the Republic Services plastics sorting center and Blue Polymers resin plant in Indianapolis. Republic began buying curbside HDPE bales last summer, according to Pete Keller, vice president of recycling and sustainability.

Global demand for PE remains soft in most markets and regions, Jeff Tate, CFO at major PE producer Dow, said at the JP Morgan 2025 Industrials Conference on March 13.

Looking forward, Dow is monitoring key macroeconomic indicators including ongoing geopolitical volatility including tariffs and the pace of interest rate cuts in the U.S. and Europe, Tate said, adding that the sluggish housing market has been driven by persistently high mortgage rates in the U.S.

On March 19, the U.S. Federal Reserve maintained interest rates from December levels, a continuing effort to slow the pace of inflation, but indicated it was likely to make two rate cuts later in the year.

So far in 2025 Dow has seen “no signs” of increasing economic activity, Tate added. Packaging accounts for 30% of Dow’s portfolio, with infrastructure at 40%, consumer at 20% and mobility at 10%. Color HDPE is particularly exposed to construction and infrastructure sectors, as its key end use is in drainage for agricultural and stormwater applications.

Adding to the bearish climate, March home builder confidence dropped by 3 points on the month, reaching 39, its lowest level in seven months, according to the National Association of Home Builders/Wells Fargo Housing Market Index. Levels above 50 indicate net optimism, and below 50, net pessimism.

“Economic uncertainty, the threat of tariffs and elevated construction costs pushed builder sentiment down in March even as builders express hope that a better regulatory environment will lead to an improving business climate,” the NAHB said in a press release.

Two key indicators for upcoming demand for construction materials fell year on year in February. New residential building permits issued in February were at 1.456 million, lower by 6.8% on the year, according to U.S. Census Bureau data, while single-family housing starts were at 1.501 million, lower by 2.9% on the year.

PE scrap exports plummet, virgin PE exports rise

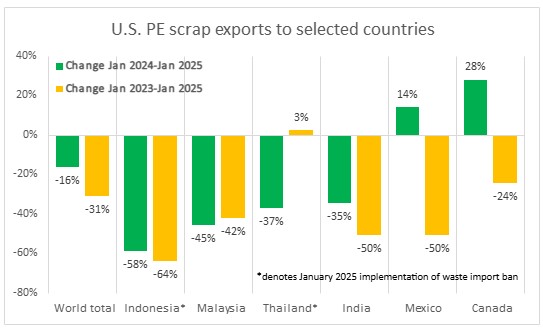

U.S. scrap PE exports in January fell by 16% on the year, to 10,000 metric tons, according to data from the U.S. International Trade Commission, amid waste import bans in Indonesia and Thailand that took effect at the beginning of the year.

In the absence of domestic demand, color HDPE bales may be sent from the U.S. to Southeast Asia, and if the January drop in exports represents a consistent trend, this could be contributing to bale pricing hitting multi-year lows to start the year. In full-year 2024, Indonesia and Thailand accounted for 15% of total PE scrap exports.

In the absence of domestic demand, color HDPE bales may be sent from the U.S. to Southeast Asia, and if the January drop in exports represents a consistent trend, this could be contributing to bale pricing hitting multi-year lows to start the year. In full-year 2024, Indonesia and Thailand accounted for 15% of total PE scrap exports.

In contrast, virgin PE exports for January rose by 9% on the year to 1.336 million metric tons. Among the top three destinations, Mexico received slightly lower volumes on the year while China and Brazil grew.

In November, Brazil launched an anti-dumping investigation against U.S. and Canadian PE exports. If the inquiry results in anti-dumping duties, this could dampen North American exports to Brazil and apply downward pressure to domestic virgin PE pricing.