Seeing increased market demand for RPET and the introduction of federal legislation mandating recycled content in products, S&P Global Platts decided to launch daily spot price assessments for PET bales starting April 1, according to a press release. S&P Global Platts is a provider of information and benchmark prices for commodities and energy markets.

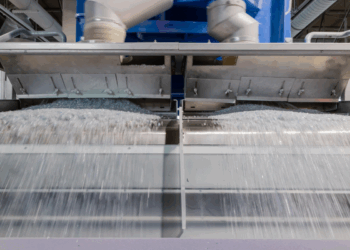

According to the release, the LA-area pricing will reflect premium-grade bales, primarily from redemption centers and with a minimum of 70% PET, and curbside material with a minimum of 60% PET. Bales from the area should be at least 80% clear PET bottles.

In Chicago, the assessment will reflect curbside, mixed-color bales (include clear, transparent green and transparent blue but excluding black and other solid colors), with a minimum of 60% PET.

“In a market where demand will continue to outweigh supply, securing a reliable source of recycled plastics at a fair price will be challenging and S&P Global Platts Analytics forecasts that competition for quality, recycled plastics will be fierce over the next decade,” Rob Stier, petrochemical analyst at S&P Global Platts, stated in the release. “The trend seen in Europe with recycled PET flakes pricing higher than virgin PET may become the new normal, with buyers having to pay a premium for food-grade recycled PET. Therefore, having confidence in the recycled plastics prices will be increasingly important to help market participants meet the recycled content demanded by the marketplace.”

The company’s price-tracking service joins competitors already in the marketplace, including RecyclingMarkets.net and OPIS PetroChemWire, which is owned by IHS Markit. RecyclingMarkets.net provides Plastics Recycling Update and sister publication Resource Recycling with a monthly report of prices for bales of post-consumer PET, HDPE, PP, film, cardboard, paper, aluminum and steel.

Recycled plastics outlook in light of coronavirus

S&P Global Platts on April 1 published a blog post examining the impact of reduced recyclables collection on the plastics recycling industry. The analysis notes that the virus has disrupted container redemption programs in several states, as well as curbside and drop-off services in a number of communities.

The company also predicts brand owners may switch from RPET to virgin PET in the face of the crisis. “Companies are in survival mode so they probably are not going to worry about paying more for recycled content when their business and the entire energy value chain is at risk,” Stier stated in the post.

Meanwhile, virgin plastic prices have plummeted because of lower oil prices, a product of the price war between Russia and OPEC. On March 25, for example, imported and domestic prime PET was 43 cents per pound and 50 cents per pound, respectively, their lowest prices since S&P Global Platts started tracking them in 2006. The low prices will provide an incentive for manufacturers to use virgin plastic instead of recycled flakes and pellets.