The U.S. exported 1.3 billion fewer pounds of scrap plastic in 2018 than the year before, new figures show, representing a 35 percent decrease.

The U.S. exported 1.3 billion fewer pounds of scrap plastic in 2018 than the year before, new figures show, representing a 35 percent decrease.

Full-year export figures were released by the U.S. Census Bureau last week. The numbers show which countries increased imports in 2018 and underscore how little volume was shipped to China.

But perhaps most striking is the overall drop in material leaving the U.S. compared to previous years. Exporters shipped 2.4 billion pounds of scrap plastic last year, down from 3.7 billion pounds in 2017 and 4.3 billion pounds in 2016.

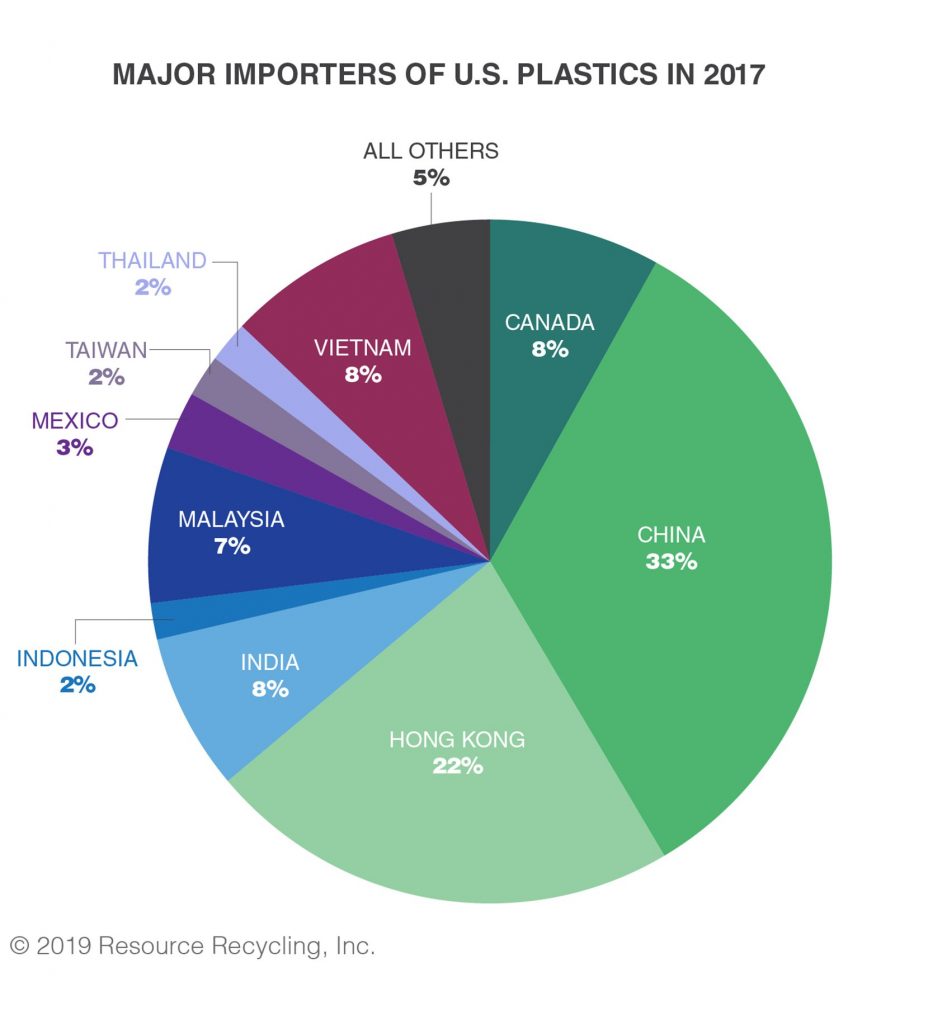

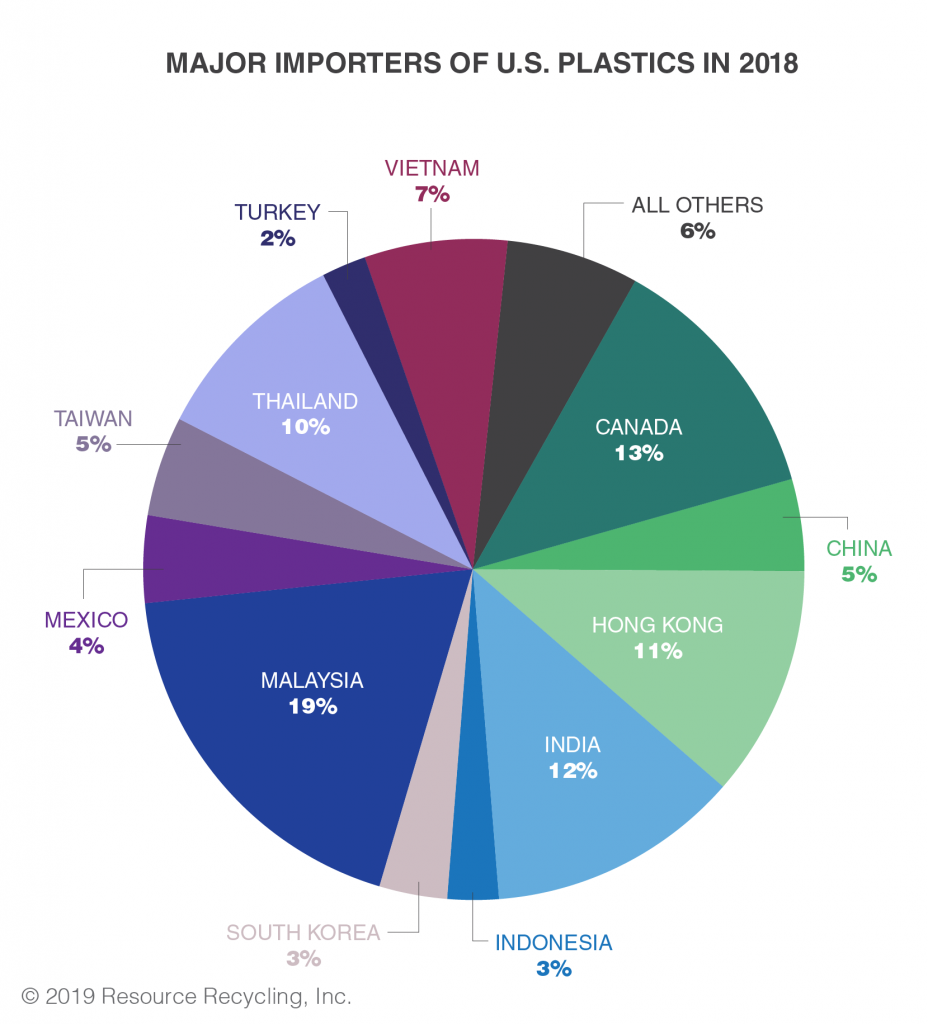

The shift in export destinations has also become even clearer. China went from receiving 33.4 percent of recovered plastic exported from the U.S. in 2017 to just 4.5 percent in 2018. Hong Kong also became a less significant buyer, importing 11.3 percent of exported U.S. plastic, down from 22.4 percent in 2017 (much of what is shipped to Hong Kong is re-exported to Mainland China).

As the biggest players decreased purchases of U.S. plastic, many other countries brought in a larger share. Some were particularly dramatic – Malaysia’s share of U.S. plastic jumped from 7.3 percent to 18.8 percent.

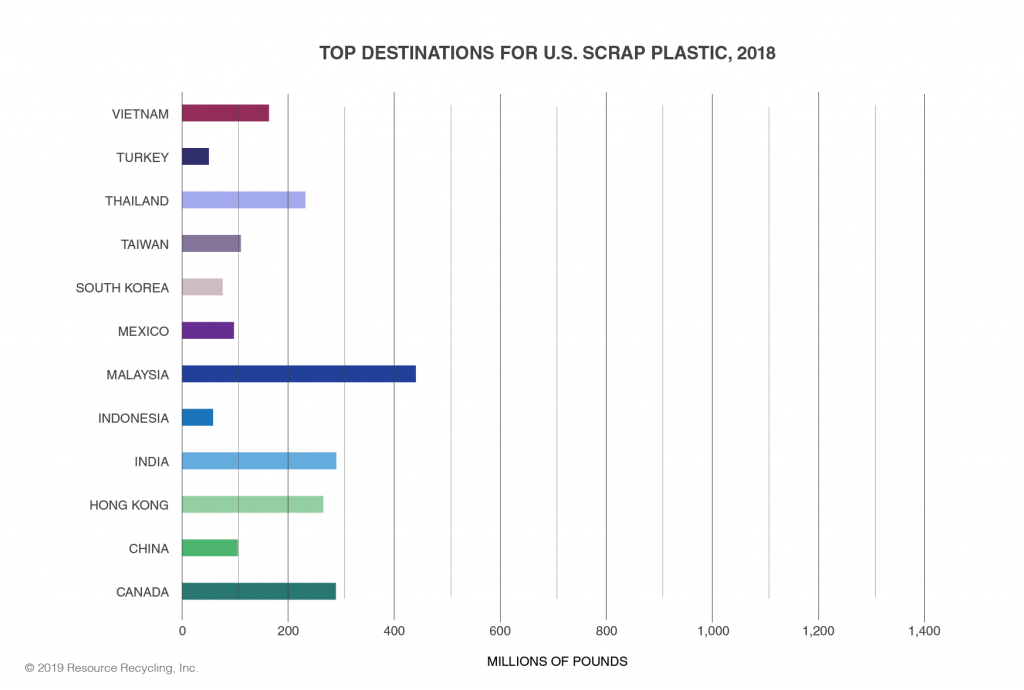

By weight, the largest importers of U.S. scrap plastic were Malaysia (443 million pounds), Canada (294 million), India (294 million), Hong Kong (267 million), Thailand (235 million), Vietnam (165 million), Taiwan (114 million), China (106 million), Mexico (101 million), South Korea (78 million), Indonesia (60 million) and Turkey (52 million).

Although the Census Bureau numbers paint a picture of export trends, they don’t capture the entire scope of scrap plastic movement. Experts recently described a growing practice of exporters incorrectly labeling plastic shipments with other tariff codes to avoid import restrictions.

(Story continues below charts. Click a chart to view it larger in a new browser window.)

Export shifts cause fluctuations by month

Last year was a turbulent one for global plastic shipments. Exports to Malaysia, Thailand and Vietnam, for example, grew substantially in early 2018 compared with previous years, in some cases doubling and tripling year-over-year. But midway through 2018, each country separately began taking action to counter the trend. The result was a year of fluctuation in exports to Southeast Asia.

Malaysia averaged imports of about 56 million pounds of U.S. scrap plastic per month from January through July. But in August that figure plummeted to 10 million pounds, following policy changes to stem the increase. The monthly volume remained relatively low for the remainder of the year.

Thailand charted a similar course, clamping down in July to reduce imports after what had been higher-than-normal volumes the first half of the year. However, shipments to Thailand began to inch back up by the end of the year, rising from a low of 1 million pounds in August to 17 million pounds in December.

Vietnam also slashed imports beginning in June, but unlike Thailand the country saw no major increase as the year drew to a close. Vietnam brought in a high of 39 million pounds in May but closed the year out with 2 million pounds in December.

Photo credit: MAGNIFIER/Shutterstock

More stories about exports

- Dow execs talk PE production during bleak earnings call

- Malaysia’s import ban ‘very much up in the air’

- Some tariffs suspended, metal duties spur backlash