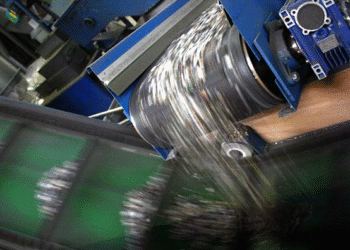

The White House this week issued an executive order directing the Department of Commerce to explore the effects of critical mineral imports on national security. Among other points, it calls for the agency to explore policies boosting recycling of minerals like cobalt, nickel, aluminum and palladium, as well as the 17 rare earth elements.

President Donald Trump on April 15 signed the executive order, titled “Ensuring National Security and Economic Resilience Through Section 232 Actions on Processed Critical Minerals and Derivative Products.”

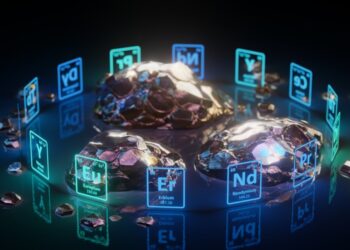

The order lays out how critical minerals, defined as those included on the U.S. Geological Survey’s 2022 list, are vital for U.S. manufacturing because they are used in electronics and have widespread applications across industries including defense. But in the U.S., these minerals “face significant global supply chain vulnerabilities and market distortions due to reliance on a small number of foreign suppliers.”

Likely taking aim at China, the order says foreign suppliers of critical minerals and rare earths “have engaged in widespread price manipulation, overcapacity, arbitrary export restrictions, and the exploitation of their supply chain dominance to distort world markets.”

Recently, China has expanded or issued new restrictions on exporting key minerals and rare earths used in manufacturing, as trade tensions with the U.S. have ratcheted up once again. Just last week, the country’s government announced a new licensing system that will restrict the export of seven rare earths to all countries.

It’s against that backdrop that the White House order sets the groundwork for U.S. policies that restrict or disincentivize importing critical minerals from overseas. It directs Commerce Secretary Howard Lutnick to explore tariffs or other restrictions on the minerals and also to look into “policies to incentivize domestic production, processing, and recycling” of the minerals.

The list of critical minerals covers numerous materials commonly recovered from end-of-life electronics, including: antimony (found in batteries and flame retardants), cobalt (rechargeable batteries), gallium (integrated circuits and LEDs), indium (LCD screens), lithium (batteries), palladium (circuit boards), rare earths (batteries and magnets), tantalum (capacitors), tin (circuit boards) and other metals.

Aside from the heightened focus on critical minerals, precious metals are seeing their own effects from the recent trade and economic developments: Gold, a key driver in circuit board value, reached another record high this week. Commodity analysis firm FXEmpire reported gold spot prices climbed over $3,300 per ounce on Wednesday.

“Investors seeking shelter from policy risks quickly rotated into gold, as broader financial markets absorbed the impact of the renewed trade war narrative,” the analysis firm wrote. It predicted further investor interest in gold as a safe-haven option, projecting prices could rise higher than $3,400 per ounce in the near-term.

According to the current Recycled Materials Association specifications for recycled commodity grades, low-grade circuit boards have less than 50 grams of gold per metric ton, medium-grade boards contain 50-200 grams per metric ton and high-grade boards have more than 200 grams per metric ton.