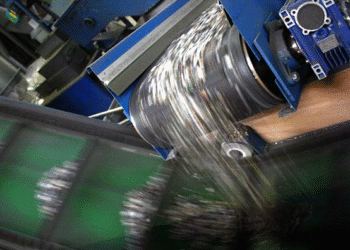

Despite recycling commodity prices tumbling nearly 20% in 2025, WM’s recycling segment saw operating EBITDA grow by more than 22%, the company announced during its fourth quarter/full-year 2025 earnings call.

CEO Jim Fish attributed the strong performance to the hauler’s investments in infrastructure upgrades and automation.

Houston-based WM completed automation upgrades at five recycling facilities in 2025 and opened facilities in four new markets, “which are enhancing the performance of our recycling network and creating new opportunities with customers,” Fish said.

Tech upgrades drive resiliency

COO John Morris told investors that WM’s technology investments have been key to boosting recycling portfolio performance despite commodity headwinds.

“A lot of that has driven sort of the middle of the P&L. And that’s where technology enablement and AI are paying off already, and we’ve made a lot of progress there,” he said, noting that the company has taken an “Internet of Things” (IoT) approach to certain transfer stations, recycling facilities and landfills. IoT refers to embedded sensors and connectivity to collect data to inform decision-making.

Morris added that building out technology enablement across WM’s fleet of 15,000 refuse vehicles and 4,500 healthcare vehicles as a logistics service is paying off too.

“And on the volume front, we’ve seen notable growth in 2025 in special waste, renewable energy and recycling,” he said.

Commodity outlook

Recycling commodity prices averaged $62 per ton as 2025 came to an end, according to Tara Hemmer, senior VP and chief sustainability officer. She expects the first half of 2026 to fall in the $60-$65 range “and then ramping in the back half of the year.”

“What we’re starting to see is a little bit of green shoots on the fiber side,” Hemmer told investors. “The headlines previously were that a lot of capacity had been taken out of the US market, which is true. That was more inefficient mill capacity. But the larger mills that remain are going to be looking for material, some of the cloud around tariffs has been lifted. So we’re anticipating that OCC prices should bounce back a bit in the back half of the year.”

She noted the company is “not expecting any material movement on plastic pricing moving forward.”

Despite the modest commodity price decline, CFO and Executive VP David Reed said WM expects minimal impact on margin, with four recycling facilities and six RNG projects scheduled to come online in 2026.

Looking further ahead, Reed said sustainability growth capital includes spending of about $85 million on two recently approved renewable natural gas facilities and one new recycling growth project, each expected to be completed and begin contributing operating EBITDA by 2028.

“As we carry our momentum into 2026, we expect to grow free cash flow by nearly 30% at the midpoint of our guidance,” Fish said. “This growth is underpinned by our unreplicable solid waste network as well as the intentional investments we have made in recycling and renewable energy projects, our fleet and a premier medical waste network.”

Earnings highlights

Q4 revenue: $6.3 billion, up from $5.89 billion, or 7.1% YOY

Q4 adjusted operating EBITDA: $1.97 billion, 31.3% margin

Q4 net income: $742 million, up from $598 million YOY

Q4 free cash flow: $823 million

Full-year revenue: $25.2 billion, up from $22.06 billion in 2024

Full-year adjusted operating EBITDA: $7.58 billion

Full-year net income: $2.7 billion

Full-year free cash flow: $2.93 billion, up 26.8% YOY

2026 projected revenue: $26.4 billion to $26.6 billion

2026 projected free cash flow: $3.75 billion to $3.85 billion

2026 projected adjusted operating EBITDA: $8.15 billion to $8.25 billion