This article originally appeared in the November 2019 issue of Resource Recycling. Subscribe today for access to all print content.

By now, virtually every American is well aware of the massive growth of e-commerce.

Amazon and other online sellers are regularly used by individuals across the demographic spectrum, and many traditional retail businesses are closing or trying to reinvent themselves.

But what may not be so obvious is how much room for growth still exists for the online shopping segment. According to numbers from the U.S. Department of Commerce, e-commerce currently represents just 10.7% of retail sales in the United States. In many ways, e-commerce is only just emerging.

Like other recycling stakeholders, AMERIPEN, a group that represents the North American packaging value chain, believes the continued expansion of e-commerce will have significant implications for the U.S. materials recovery system.

Now is the time to be planning and implementing the policies, programs and practices needed to ensure our domestic recovery system is ready for greater numbers of boxes, mailers and other items – and also for changes within those material categories themselves.

Discussions on advancing our domestic recovery system must examine our needs not just against what we are challenged with today, but also with an understanding of what we’ll be facing in the future.

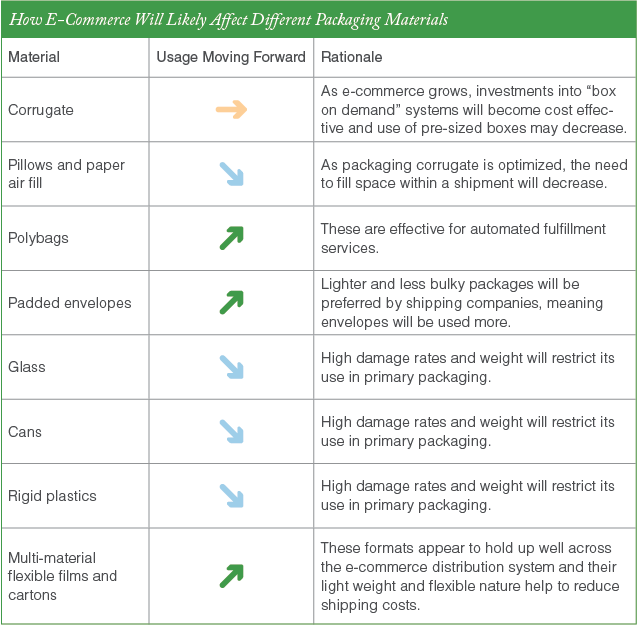

To move such planning forward, AMERIPEN has analyzed how the materials stream will evolve as e-commerce trends continue to unfold. The goal is to help spur engagement and action from all parties working to handle the municipal waste stream.

Added complexity in logistics

The traditional retail logistics system is relatively linear. Suppliers ship products, often bundled in large quantities for safe shipping and efficient storage, to a warehouse or back-of-store where they are inventoried until individual units are needed on the retail shelf.

The consumer then purchases products on-site and is generally responsible for taking their purchases with them. In this model, transportation and logistics are primarily focused between the supplier, warehouse and retailer. Movement of the product predominately comes in the form of freight, forklift and pallets.

E-commerce upsets this traditional paradigm. The consumer now replaces the retailer as the focal point of the supply chain and a far more complex logistical process must be followed to deliver product to the end user.

Bulk products are now sent to a fulfillment center where they are broken down and shelved. When an order comes in, products must be picked and re-packaged for shipment directly to the consumer. Transport providers, such as FedEx, UPS and the U.S. Postal Service, then use sortation centers to aggregate delivery to regional locations and use parcel carriers to get goods to the homes of consumers.

This new distribution system engages more service providers and processes, resulting in significantly more touchpoints than the traditional retail environment. According to research outlined in the 2017 AMERIPEN paper “Optimizing Packaging for an E-Commerce World,” products are handled an average of five times in a traditional retail supply chain. In the e-commerce network, on the other hand, products tend to be handled manually and touched a minimum of 20 times.

In this new environment, rules are changing for packaging design. But packaging does not exist in isolation. Members of the packaging value chain know they need to look across the full spectrum and ensure what is being designed today is ready for recovery tomorrow.

So let’s take a look at the ways the e-commerce distribution system is demanding new packaging design. And we’ll explore what that means on the recovery front.

Reliance on film bags and corrugated containers

As e-commerce grows its relative share to retail sales, an increasing number of companies are beginning to invest in technologies unique to the specific needs of e-commerce.

Online shopping and subsequent distribution warrants its own unique set of packaging SKUs. Investments into shippers and other distribution packaging are becoming cost effective as demand grows. This means what we are seeing today in terms of ecommerce trends is likely to shift again tomorrow.

For example, our data indicates the use of polybags is significantly increasing. Polybags, made of plastic film and often used to contain products inside a larger package, are required by most online retailers as an additional wrap around any packaging of liquids – this is to ensure any leakage due to damage during transport is contained.

Additionally, polybags are required for items such as jewelry and small electronics to ensure capture of all parts should the product break during transport. Clothing is also typically shipped in a polybag, primarily to help fulfillment center workers grab and go as they package products.

Currently, these bags are not accepted in most curbside programs, although they may be eligible for store drop-off programs. This is clearly an area ripe for work to ensure material is sent to proper channels at end of use.

Another important material in this discussion is OCC, or old corrugated containers.

In a recent survey by AMERIPEN of municipal recycling facilities, operators estimated they’ve seen a 30% to 40% increase in corrugate from curbside systems over the past few years. At the same time, according to numbers from the American Forest & Paper Association, the national recovery rate of OCC declined between 2016 and 2017 before increasing in 2018.

As we introduce more corrugate into the curbside system, the risk of contamination by other materials increases. Additionally, elements like consumer behavior and curbside collection practices may influence the volumes and quality of the corrugate collected.

The push to right-size packaging

Polybags and corrugate are two material types that have been staples of the e-commerce paradigm ever since its inception. But as online shopping continues its development, economic forces are bringing new packaging types into the mix.

Transport providers are understanding that reducing the weight and bulk of packages opens the door to price and cost efficiencies. Add in consumer frustration over over-packaged products in e-commerce delivery and we get a new trend: a significant rise in the use of padded mailing envelopes.

Mailing envelopes may be multi-material and therefore unrecyclable, or they may be mono-material but only recyclable via store-drop off programs. Either way, municipal recycling facilities are noting a rise of padded envelopes in their systems as consumers place them into curbside collection.

Along with weight and bulk, another important cost consideration for companies involved in the e-commerce system is the risk of breakage or damage. As a result, we’re seeing increased movement toward flexible and multi-material formats.

Traditional rigid packaging formats, such as cans, hard plastics and glass, are increasingly at risk of breakage or creating inadvertent damage to other products in the e-commerce environment. The risk of heavier materials rolling over a bag of chips or breaking and spilling products across a shipment are significantly reduced when replaced with lighter-weight and more flexible packaging formats. Some online retailers have started to restrict the use of certain packaging materials for delivery to reduce this risk and encourage e-commerce innovation.

Of course, while flexible and multi-material packaging formats are proving effective for e-commerce distribution, they are difficult for our current recovery system to process. In many cases, we lack sufficient end markets for reprocessing, and our ability to collect and sort these materials is limited by existing technologies.

As use of flexible and multi-material packaging grows in e-commerce, we absolutely must be discussing how to advance their collection, sortation and re-processing to ensure we capture their value.

More disruptive trends to track

As companies learn more about what works for e-commerce distribution channels and try to sell products in new and more innovative ways, expect more substantial shifts in packaging design that will subsequently impact materials recovery.

The first thing to keep in mind is that convenience is king in this realm. Today’s consumer is on-the-go and looking for ways to simplify their lifestyles. Takeout or pre-made foods and meals kits are continuing to grow in popularity.

Online food delivery – a category encompassing meal kits, online grocery services and restaurant delivery includes – relies on a wide array of products and packaging. From a recovery standpoint, AMERIPEN believes we need to pay more attention to the collection of foodservice packaging both via curbside systems and away-from-home channels. We also need to start considering how we best address the small sachets and packaging formats frequently found in meals kits.

Further, online retailers know their greatest costs occur during fulfillment and delivery. Pressure to reduce expenses in these two phases is resulting in significant innovation.

For example, automation is frequently being used in fulfillment centers with robotic arms or drones. The use of robotics in fulfillment can significantly reduce the time spent in identifying and packaging products for shipment. In some cases, a set of tasks that would take a human 60 to 75 minutes to accomplish can be achieved in just 15 minutes through automation.

Creating packaging that’s easy to scan and grab will be essential to the success of automation. From a packaging standpoint, this means light-weight materials and large labels with potentially embedded tech.

Meanwhile, with rising delivery costs and labor shortages within the shipping sector, we should anticipate even more innovation in the delivery phase. As applications for alternative transport (think drone delivery) and other technologies emerge, packaging will need to respond to new requirements around weight, space and more. That could result in completely new package designs.

Finally, much attention in the e-commerce sphere has been given to the process of “unboxing,” the goal of which is to create an emotional appeal with the consumer as the package is being opened. Popular unboxing strategies include using recognizable packages, wrapping products up like a gift and including personalized thank you notes.

As more attention is given to the unboxing experience, there will likely be increased use of additional tissues, labels, inks and other embellishments that may render perfectly good material unrecyclable. The inclusion of small sachets for free sampling and “gifting” is also anticipated to rise.

Critical questions

E-commerce is shifting how companies design packaging, and those shifts will have a significant impact on the U.S. recovery system. While more work needs to be done to explore the best policies and programs to respond to these shifts, the time is right to start asking some critical questions.

First, how do we best invest in R&D to advance sorting technologies and end market development for the flexible and multi-materials formats that are anticipated to grow?

Additionally, how can we streamline curbside practices to simplify the process of recycling existing materials like OCC while at the same time better communicate alternative collection points like store-drop off?

Another important question: Should we encourage the adoption of bridging technologies to help increase the value and advancement of end markets for hard-to-handle materials?

And, finally, what is needed to increase access to recovery for away-from-home and multi-family housing to ensure we adequately capture the significant increases in material we can expect to see from shifts in lifestyle?

We are currently at an inflection point with our domestic recycling system and stakeholders across the value chain are calling for change. The realities of e-commerce need to factor large in today’s industry-wide discussion.

It’s clear that with e-commerce set to continue to grow and go through its own evolution, materials recovery stakeholders will have to keep an eye toward the future so we can invest in the needs for tomorrow as well as today.

Kyla Fisher is program manager at AMERIPEN and can be contacted at [email protected].

AMERIPEN represents the North American packaging value chain by providing public policymakers with fact-based, material-neutral, scientific information. It is the only organization exclusively focused on U.S. public policy for the entire packaging industry.