March has brought surges in prices for several curbside recyclables, with PET containers up 24%, aluminum cans up 25%, color HDPE up 32% and polypropylene up 30%.

March has brought surges in prices for several curbside recyclables, with PET containers up 24%, aluminum cans up 25%, color HDPE up 32% and polypropylene up 30%.

March has brought surges in prices for several curbside recyclables, with PET containers up 24%, aluminum cans up 25%, color HDPE up 32% and polypropylene up 30%.

March has brought surges in prices for several curbside recyclables, with PET containers up 24%, aluminum cans up 25%, color HDPE up 32% and polypropylene up 30%.

The largest waste and recycling haulers in North America reported rising revenues for 2021. | Photick/Shutterstock

Surging commodity prices drove markedly higher recycling revenues for the largest haulers in North America last year. Those companies say they’ll put a lot of money into upgrading their MRFs in 2022.

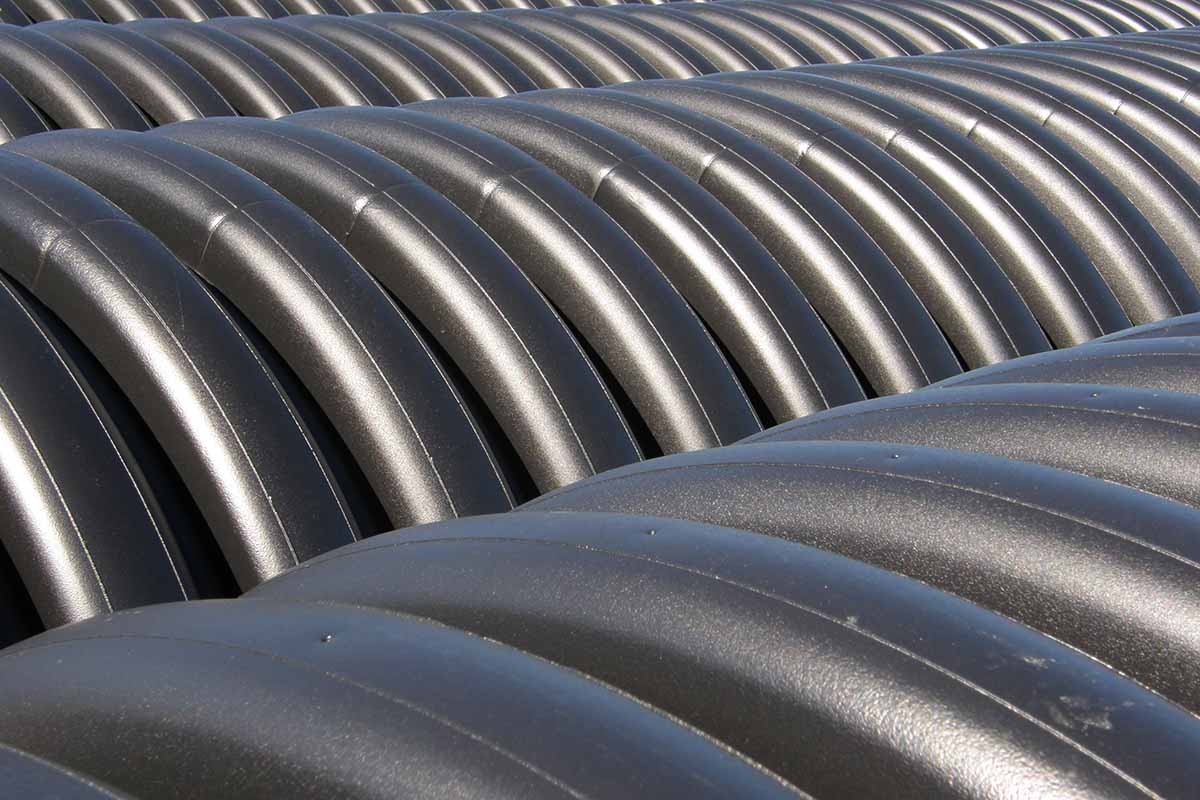

Volatile pricing in resin markets has presented challenges for Advanced Drainage Systems over the past year. | Chris Tennant/Shutterstock

Using recycled plastic is good business for Advanced Drainage Systems, but recent reports and interviews make clear that it’s not always painless.

February has brought substantial price increases for three curbside commodities: PET containers, aluminum cans and polypropylene.

February has brought substantial price increases for three curbside commodities: PET containers, aluminum cans and polypropylene.

Every 1,000 square feet of Everboard prevents about 1 ton of mixed paper-plastic from going to landfill. | Courtesy of Continuus

Within three years, Waste Management could be sending 150,000 tons of mixed paper and plastic each year to a factory that will recycle the otherwise-landfill-bound material into a high-quality roofing board.

According to AF&PA, in 2021, U.S. mills took in a total of nearly 33 million tons of recovered fiber, the largest amount in over a decade. | noomcpk/Shutterstock

About 94% of U.S. residents had either curbside or drop-off recycling service for at least one type of paper last year, indicating recycling programs largely retained the material despite pandemic pressures.

MRFs are enjoying notably higher prices for used beverage cans and PET containers this month, with bale values rising by 14% and 10%, respectively.

MRFs are enjoying notably higher prices for used beverage cans and PET containers this month, with bale values rising by 14% and 10%, respectively.

U.S. MRFs are bearing lower prices for curbside fiber and plastic loads this month, with particularly painful declines reported for HDPE and PP.

U.S. MRFs are bearing lower prices for curbside fiber and plastic loads this month, with particularly painful declines reported for HDPE and PP.

A survey of 16 MRFs in 10 northeastern states found the average blended value of a ton of curbside recyclables rose substantially in the third quarter. | Natallia Boroda/Shutterstock

Materials recovery facilities in the northeastern U.S. enjoyed a sharp increase in recyclables prices during the third quarter, according to a survey from the Northeast Recycling Council.