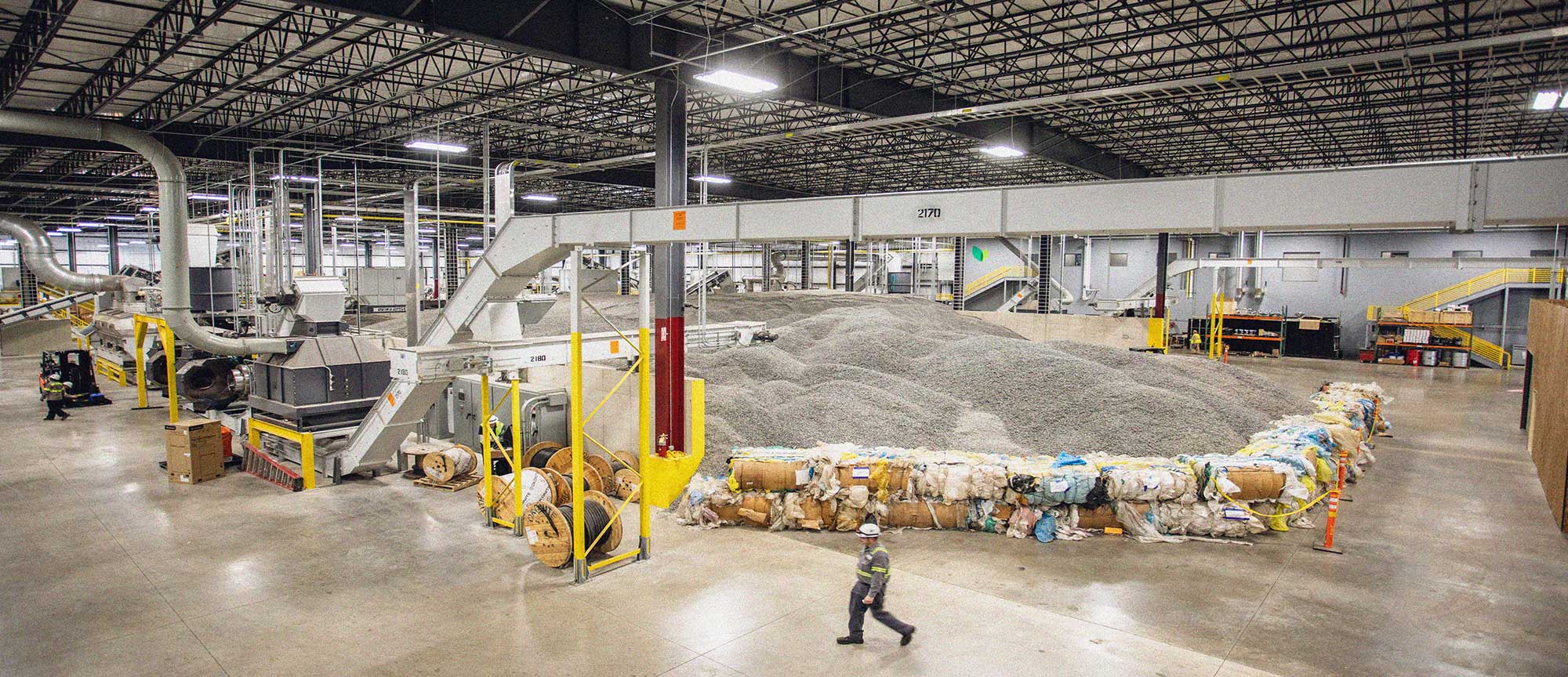

Brightmark’s bankrupt Indiana pyrolysis facility has been sold to parent company Brightmark for $14.3 million in a move that will keep the facility operating and retain most or all of its more than 100 employees, a judge ruled this month. The latest development came after a competitive auction process with plenty of twists and turns.

The Ashley, Indiana-based chemical recycling facility, which was owned by a separate subsidiary of Brightmark, filed for bankruptcy in March after defaulting on a loan to UMB Bank that stemmed from municipal bonds that were issued several years earlier.

The company declared $178 million in debt and an inability to continue making payments on it under the existing company structure. The company indicated a plan to reorganize and keep the facility operational under new ownership through a bankruptcy auction process.

The auction process was carried out with assistance from investment bank SSG Capital Advisers, which reported in court documents that it reached out to 335 potential interested parties, of which 35 signed non-disclosure agreements to further explore a sale and four conducted site visits.

By the May 5 bid deadline, the court received four qualified bids: one each from primary creditor UMB Bank, parent company Brightmark, Freepoint Eco-Systems and Braven Environmental, according to court documents. During the May 7 auction, Brightmark submitted the initial bid of $7.5 million. There were 25 competitive rounds of bidding, and in the 26th round, UMB Bank was selected as the highest bidder, according to the auction transcript.

UMB’s offer was a $17.3 million credit bid, which was ultimately valued at $14.5 million when considering administrative costs not accounted for in the bid. Brightmark’s $14.3 million cash bid, the next closest, was selected as the backup.

During a May 9 hearing on the sale, testimony from those involved with the sale process, along with the differences between how the two buyers would handle the facility, convinced Delaware Bankruptcy Court Judge Laurie Silverstein that, in fact, the Brightmark parent company bid was the higher and better choice.

“I do think that I am to consider what is best overall, for all the constituents of the estate, I think that goes into what is ‘best,'” Silverstein said. “And valuing these two offers, there is no question what is best.”

Plan to keep facility going is key

During the May 9 hearing, Neil Gupta, managing director of SSG and moderator of the auction, testified that UMB’s bid was premised around liquidating the facility completely. It would result in all of the employees at the Indiana facility being laid off. Brightmark CEO Bob Powell testified during the hearing that there are currently 107 employees onsite at the plant.

Similarly, UMB’s bid would involve canceling all of the Brightmark facility’s contracts, Gupta said, including “a lot of feedstock agreements.” He estimated around 50 contracts would be canceled.

Additionally, he testified the UMB bid did not consider any environmental cleanup costs that could occur during the shutdown of the facility. While he didn’t have an exact number, Gupta estimated there are more than 30,000 gallons of pyrolysis oil on the premises.

On the other hand, Brightmark’s bid, while $250,000 lower, was structured around keeping the facility operational. It would retain the majority of, if not all, of the Indiana facility employees, would assume all contracts and all administrative cost liabilities, Gupta said.

Still, he testified that, in consultation with the debtors, he continued to believe the UMB bid was the highest and best offer.

Silverstein, the judge, took a different view. At the end of the five-hour hearing that also featured lengthy testimony from Powell, she commented on the stark difference in where each bid leaves the facility. In one case, the facility is shut down, there are layoffs and canceled contracts, as well as the potential environmental issues in the case of a botched shutdown. She anticipated substantial costs involved with safely and properly shutting the facility down.

On the other hand, Brightmark’s parent company bid “leaves the company ongoing,” Silverstein said. “They are assuming literally all of the contracts, they are assuming and taking on any environmental liabilities, they are preserving jobs and contributing to the community.”

The “only value that the UMB bid brings is to UMB,” she added.

She assessed the auction process as being fair, as there was ample notice and there were a number of third-party participants early in the process who helped to establish the real market value of the facility. Early in the process, UMB alleged that the sale process was biased in favor of Brightmark selling to itself.

Legal counsel for UMB asked how much higher a liquidating bid would need to be for it to be selected over a bid that keeps the facility operational. Silverstein declined to name a figure, saying that it was a tough question, but “this bid is not enough.”

Silverstein on May 13 signed an order approving the facility sale to Brightmark, and it closed the same day. A further hearing on various matters in the case is set for June 24.

In a statement, Powell, Brightmark’s CEO, said the “retention of the Ashley facility is an important step in accomplishing our mission.”

A version of this story appeared in Plastics Recycling Update on May 29.