This article appeared in the November 2023 issue of Resource Recycling. Subscribe today for access to all print content.

This article appeared in the November 2023 issue of Resource Recycling. Subscribe today for access to all print content.

The recycling sector experienced plenty of change during the COVID-19 pandemic.

MRFs instituted systems for social distancing. Container deposit systems were put on hold. And material generation from offices and other commercial centers dropped as residential tonnages soared.

As we move toward 2024, some of those shifts are starting to feel like the distant past. But another major pandemic trend is continuing to reverberate: volatility in markets for various recyclables.

In the first 18 months of the pandemic, prices for many recyclable commodities rose steadily as buying patterns and supply chain complications spiked demand for manufacturing inputs across the board. That upward trend, however, was followed by a significant fall and move into a recent period of mixed signals.

What are the key factors behind all the recent price fluctuations and what does the pandemic pricing experience tell us about the realm of recycling markets as a whole? Let’s dig in and explore.

MRF value bell curve

We can look at several different data points to help us visualize the scope of commodities market volatility going back to early 2020, when COVID-19 first upended daily life across the globe.

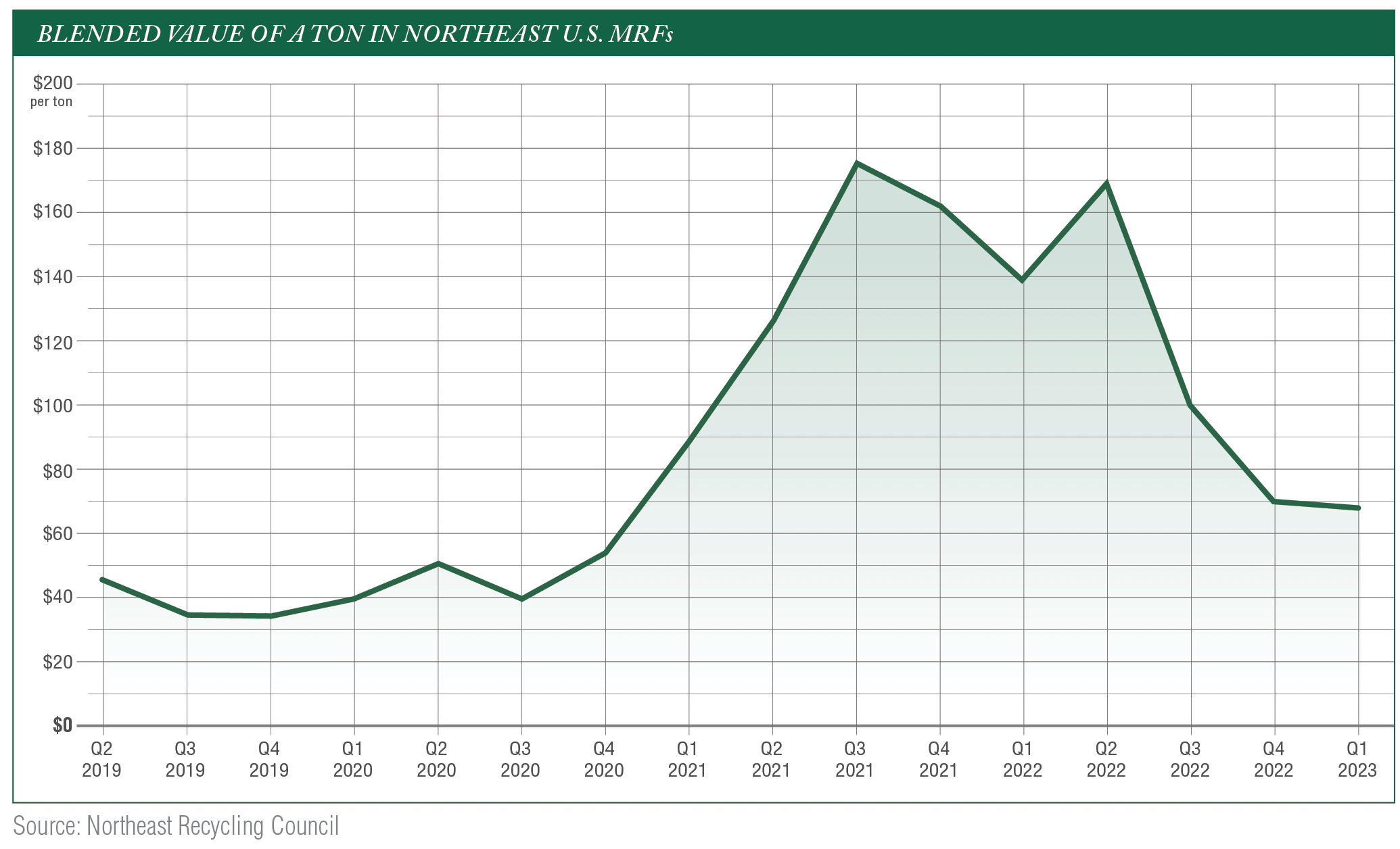

The chart on the opposite page shows the blended value of an average ton of material processed and marketed by MRFs in the Northeast U.S. This information is tabulated on a quarterly basis by the Northeast Recycling Council. It is based on surveys of facility operators in the Northeast region, who report the average value received (or paid) for key commodities during the quarterly reporting period.

Those values are then combined into a weighted ton that accounts for the typical material mix, reflecting the average blended value per ton for materials marketed in the region. The cost of disposing residuals is factored in.

This NERC-calculated MRF blended value was just under $46 per ton in the second quarter of 2019 and moved up slowly through 2020. In 2021, the blended ton average skyrocketed, hitting a peak of $176 in the third quarter, and it remained over $160 through the first half of 2022 before beginning a steep descent.

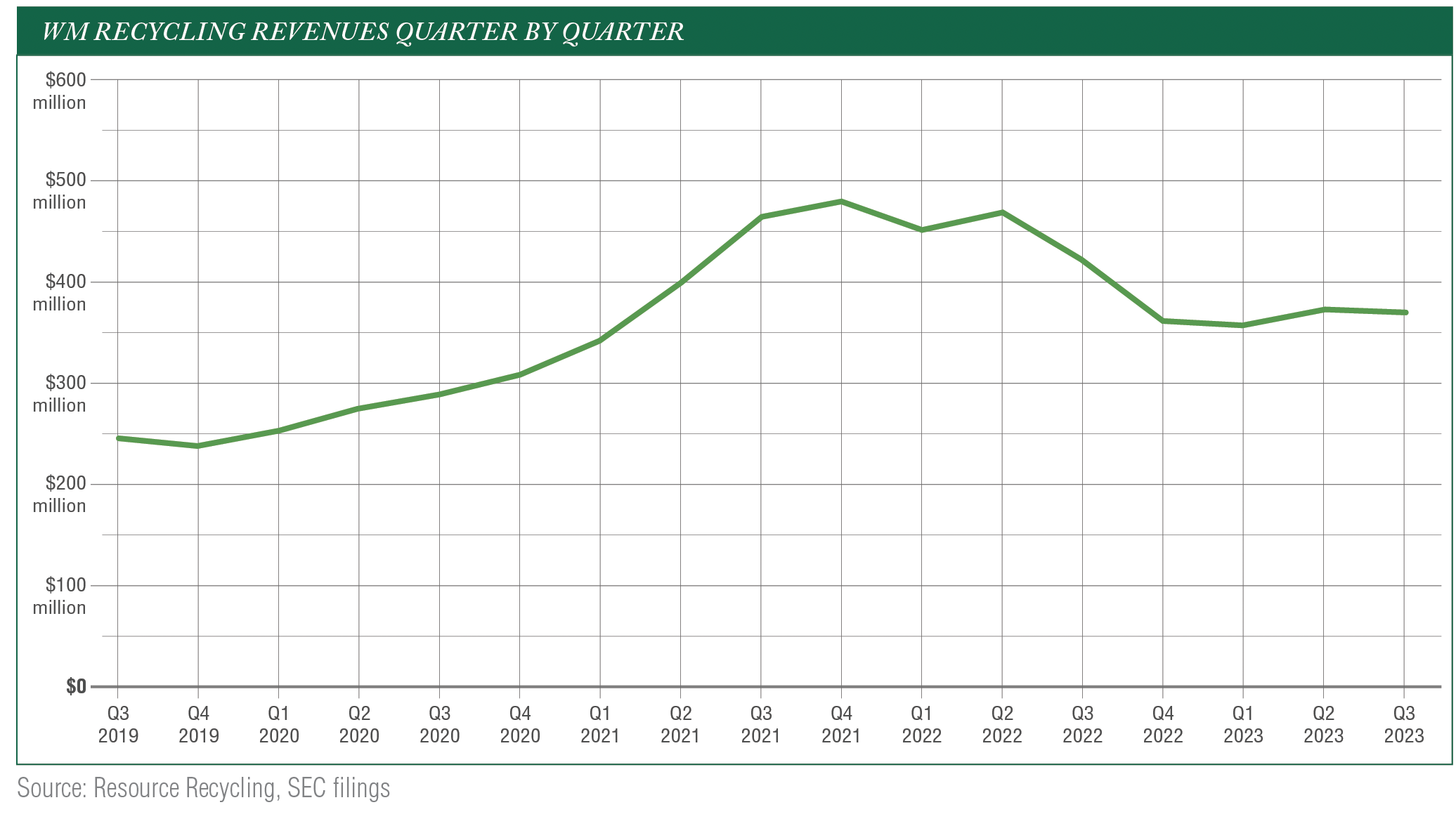

Another illustration of the extreme price fluctuation for recyclables over the past three years can be seen by looking at the quarterly recycling revenue numbers for WM, the largest processor and marketer of recyclables in the U.S.

The chart on page 30 shows the firm’s recycling revenue quarter-by-quarter going back to late 2019 (as a publicly traded company, WM’s financials are publicly available). The revenue total takes into account a number of inputs, including processing fees and brokerage revenues, but the most influential factor is the value of the material that moves through the company’s 100-plus MRFs and goes to market.

In the third quarter of 2019, WM reported a recycling revenue total of $245 million. That number nearly doubled over the following two years, topping out at $478 million in the fourth quarter of 2021. It then fell steadily to a low of $358 million in the first quarter of this year. It has increased slightly in the two quarters since.

The charts for the Northeast MRF blended ton values and the WM recycling revenues illustrate the industry’s commodity story clearly. Prices rose significantly through 2021, hitting record values for some material types. And then values fell back to pre-pandemic territory during the second half of 2022 and early 2023.

At one industry conference this fall, I heard a market observer call late 2021 the pandemic pricing “sugar high.” It’s an apt metaphor. Like the kid who eats the whole bowl of Halloween candy, markets went into hyper mode, but only temporarily. The crash came quick and material processors – and, by extension, the community recycling programs they serve – were hit hard.

The paper tale

What were the specific market phenomena of the pandemic years that caused so much volatility in recycling pricing?

Paper is where the conversation needs to start.

Though the full recycling material stream continues to evolve, commingled processing facilities still typically see OCC, mixed paper and other paper grades account for 60% to 70% of the overall weight coming in.

If we look at national price reporting supplied by

RecyclingMarkets.net (we print these figures each month on the back page of Resource Recycling), we see that the overall pricing curve seen for the blended ton at MRFs over the past several years has closely followed the dynamics of recycled paper markets. This is hardly surprising – again, most material at the MRF is fiber.

Let’s go back to where paper markets sat before COVID-19 shook everything up. The national average OCC price in January 2020 was $25 per ton, and mixed paper was just below zero. At that point, the industry was still feeling the impacts on China’s National Sword policy, which had upended the established flow of recovered fiber.

But the pandemic quickly shifted demand realities.

Supply chain chaos and manufacturing stoppages in Asia and elsewhere occurred at the same time consumers started stocking up on goods and turning to e-commerce like never before. Suddenly, recovered fiber (and many other materials) were desperately needed, and prices illustrated how demand began to outpace supply.

By the start of 2021, OCC from MRFs was selling at a national average of $75 per ton, and mixed paper had climbed above $33 per ton. In September 2021, OCC was over $170 and mixed paper was just below $100 – less than two years before, a mixed paper price that high seemed almost unfathomable.

The fall in paper pricing happened nearly as dramatically as the uptick, however. And by the end of 2022, OCC sat below $30 per ton and mixed paper was back in negative territory.

What happened? In short, supply chains caught up with themselves.

As COVID-19 policies loosened and shipping routes stabilized, manufacturers found they had the product they needed. MRFs, in fact, began hearing from paper mills that inventories were actually higher than they needed to be, and some paper mills took market-related downtime, leaving MRF suppliers with dwindling options in terms of downstream customers.

In recent months, paper pricing has seen a bit of a rebound (OCC in October had climbed back to $73 per ton and mixed paper had reached $28). Factors in this market stabilization have included the regular early-autumn uptick in manufacturing ahead of the holidays and a generally stable economy, which has gven manufacturers confidence.

In addition, a handful of new mills in North America have opened (even as older ones have closed), which has likely spurred demand.

Big swing in plastic values

A number of the market factors that have influenced swings in paper pricing over the past three years have also had a large impact on recovered plastics, though the polymers market has certainly had its own unique set of influences at play.

In January 2020, before the pandemic hit, scrap plastics markets were generally stable, though certainly not setting the recycling world on fire. At that date, the national average for PET bales being sold by MRFs was just under 11 cents per pound, natural HDPE was averaging 59 cents per pound, and scrap polypropylene was being sold for a little under 6 cents per pound.

Like paper, plastics markets were continuing to recalibrate in the wake of China’s major clampdown on imports in 2018. Also like paper, plastic pricing started climbing as the pandemic took hold.

By the summer of 2021, PET had eclipsed 25 cents per pound, natural HDPE hit a record of $1.08 per pound and PP was nearly 40 cents per pound.

Again, COVID-19 complications in manufacturing and surging product demand from cooped-up consumers accounted for much of the resin value spike. Another factor some market observers pointed to was newly penned commitments from brand owners to use more recycled plastic in packaging.

In the early months of 2022, PET pricing continued to rise, hitting a peak of 40 cents per pound in April 2022, and PP prices remained above 20 cents per pound into the summer of 2022. But from there, plastics dropped across the board, with markets starting to go particularly low since June of this year.

In October, PET was selling at below 9 cents per pound, natural HDPE was at 25 cents per pound and PP was selling for 5 cents per pound. Not surprisingly, that type of market reality has created challenges.

“The demand is just not there and the supply is high,” Andrea Bassetti, senior analyst for plastics recycling at market research firm ICIS, said during the Resource Recycling Conference in August. “We have a lot of recyclers calling us, telling us, “You know what, we have bales in our warehouses. It’s cheaper for us to send it to the landfill with a one-time fee rather than selling it at these prices at which they are now.’”

The plastics price fall has been generally driven by extremely low virgin plastics pricing, which has occurred as more virgin production has come on-line and overall consumer product demand has remained relatively muted.

It’s also worth noting that recycled plastics tend to be used in high volumes in carpet and other building improvement applications. With homeowners having completed many projects during the heart of the pandemic and wider building efforts slowing down as interest rates remain high, it’s not shocking that recycled resin markets would feel a demand drop.

Various influences on UBCs

Aluminum is the final key material category in the curbside mix that is greatly affected by wider market forces. And it too has seen significant pricing swings over the past three years, though the metal’s price volatility has been somewhat less pronounced than that for paper and plastic.

According to RecyclingMarkets.net, used beverage cans (UBCs) were selling for a national average of 51 cents per pound in January 2020. That price stayed relatively level until the second half of 2021, when a sharp rise started. In April and May of 2022, UBCs hit their pandemic peak, selling at $1.14 per pound each month.

Similar to the other commodities, UBCs have experienced a price decrease over the past year, and in October the grade was selling at a national average of 62 cents per pound, the lowest price it has seen since March of 2021.

Aside from the material demand dynamics from the first 18 months of the pandemic described above for other materials, UBC markets have been impacted by a few other factors of note.

First, the wider anti-plastics sentiment that continues to play out in society has spurred instances of material substitution and aluminum products have started showing up in more packaging segments. Aluminum demand has also increased in the automotive sector – electric vehicles rely on aluminum for a number of components, and the growth of EVs is expected to be a significant demand pull for the material.

When it comes to the recent fall in the price of recycled aluminum, the Ukraine war is a factor.

Russia is a major global manufacturer of the metal through state-owned enterprises, and the country has ramped up production as one avenue to fund military efforts. Analysts say this behavior has led to greater global supply and put downward pressure on pricing throughout the aluminum spectrum, including recycled.

Volatility: a fact of recycling life

It’s clear that pricing trends for recycled commodities are tied to global factors that are almost always beyond the control of any one stakeholder or industry segment. The COVID pandemic showed in no uncertain terms that unexpected events can lead to extreme price fluctuation.

And the pandemic of course was not the only global phenomenon to affect the economics of recycling in recent years.

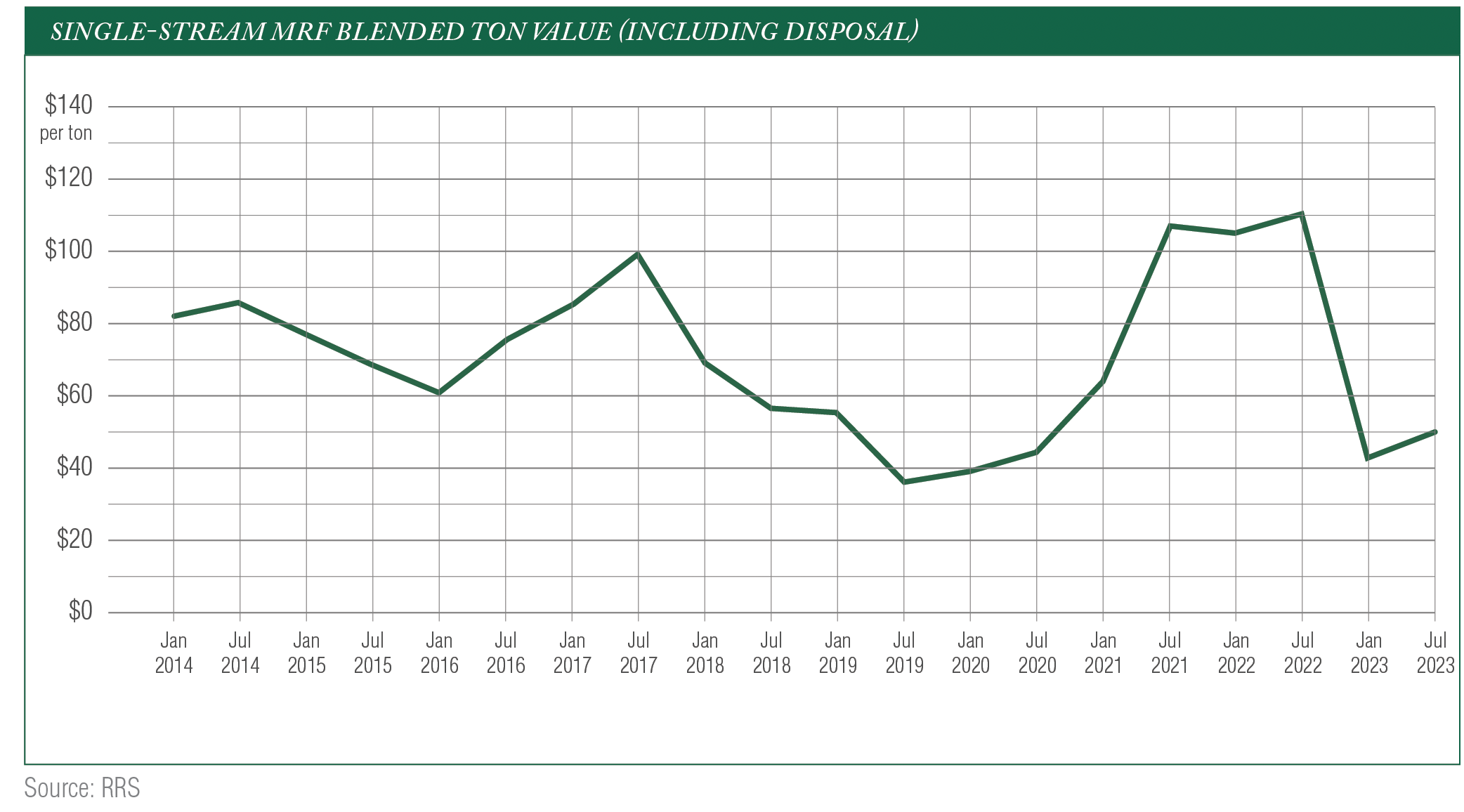

The chart above shows the average U.S. MRF blended ton, as calculated by the industry consultancy RRS. That RRS graphic details general pricing levels going back the start of 2014, and makes clear that over the past 10 years, the value of material being marketed by facilities has gone through two significant waves – the first in the wake of China’s National Sword announcement and the second amid the pandemic.

For professionals who have been in the business for decades, such volatility likely has not been surprising, even if the factors leading to pricing shifts have been completely unpredictable.

The reality of this business is that pricing fluctuations are inevitable. When you are dealing with global commodities, you are going to be influenced by global phenomena. And in an increasingly connected world, major global developments are likely to be even more impactful on various stakeholders.

Ultimately, the key for economic stability for communities, processors, material buyers and others is this: Develop systems that intelligently account for volatility, and do not presume that pricing (or anything else) will remain unchanged for any significant amount of time.

Dan Leif was editorial director of Resource Recycling until November 2023. He started with the company in 2013.