The U.S. continued to export less scrap fiber and plastic during the first nine months of this year, with notable drops in paper shipped to India and plastic shipped to Mexico.

U.S. companies exported 10.7 million short tons of recovered fiber during the first three quarters of 2023, down 13% from the same period in 2022. For scrap plastics, the U.S. exported 699 million pounds during that period, down 5% from the year before.

The U.S. Census Bureau recently published trade data for September, allowing Resource Recycling to compare data from the first three quarters of 2023 with the data from the first three quarters of 2022.

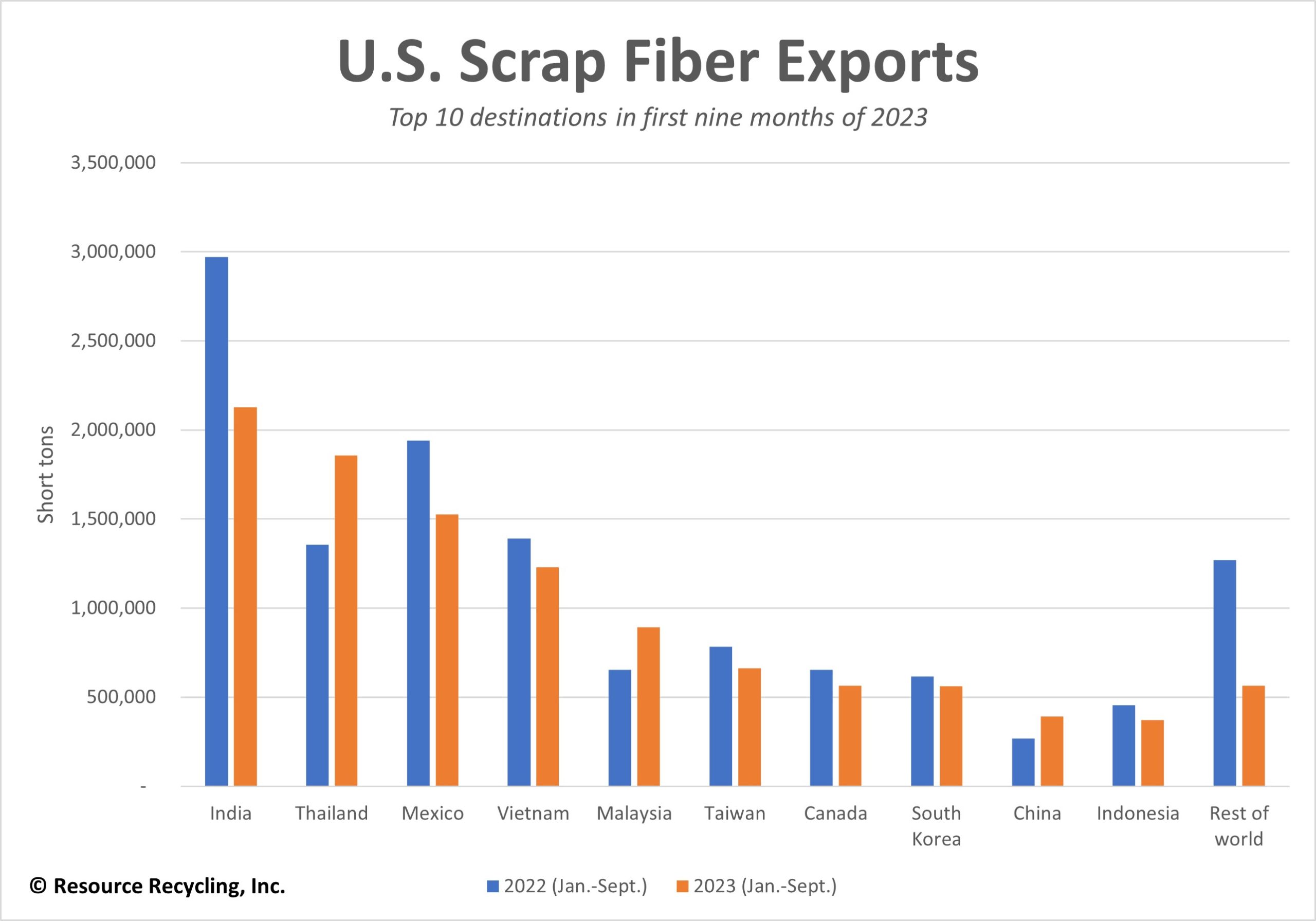

Fiber exports continue their decline

U.S. fiber exports have been trending downward since 2018, when China’s National Sword campaign started coming into effect, slashing the country’s scrap imports. In 2018, fiber exports totaled 21 million short tons. They fell to 18 million short tons in 2019 and 16 million short tons in 2020. In 2021, however, the number ticked upward to 18 million again. Following that blip, the total began falling again, dropping under 17 million pounds in 2022.

At the same time, domestic mill capacity has increased, although economic conditions over the past year or so have dented demand for corrugated packaging, leading some companies to idle production capacity and slow their bale buying.

Mill projects – some converting machines from producing writing and printing papers to corrugated packaging – have slowly increased U.S. demand for post-consumer fiber. As examples, this year Pratt Industries brought on-line a 100% recycled fiber mill in Kentucky, Cascades completed a mill conversion project in Virginia, and Domtar opened a recycled containerboard mill in Tennessee. Additionally, a recycled pulp mill near Norfolk, Va. has begun buying bales in anticipation of a January opening.

In terms of where U.S. companies have exported fiber this year, a lot less has been shipped to India, but quite a bit more has made its way to Thai ports.

The following are the top 10 destinations for scrap fiber during the first three quarters of 2023, compared with the prior-year period (these numbers exclude recycled pulp):

India received 2.1 million short tons (down 28%), Thailand received 1.9 million tons tons (up 37%), Mexico received 1.5 million short tons (down 21%), Vietnam received 1.2 million pounds (down 12%), Malaysia received 893,000 short tons (up 37%), Taiwan received 662,000 short tons (down 15%), Canada received 565,000 short tons (down 14%), South Korea received 560,000 short tons (down 9%), China received 391,000 short tons (up 47%) and Indonesia received 372,000 short tons (down 18%). The rest of the world combined took 564,000 short tons, down 56%.

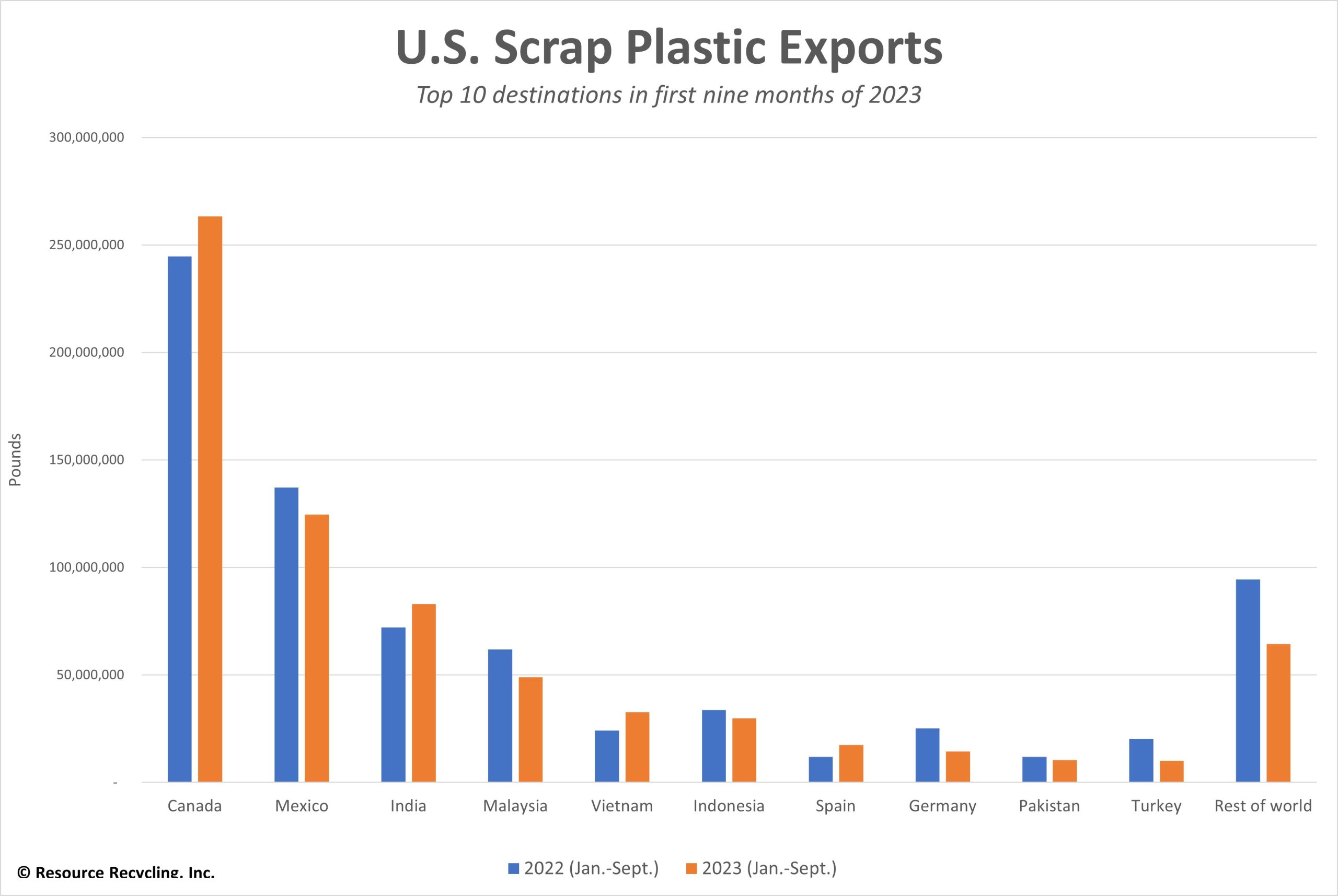

Plastic exports drop slightly

The 2023 drop in plastic exports is also a continuation of a yearslong trend.

Both trade policy and market shifts are likely responsible. In addition to the National Sword campaign, effects have been felt by an amendment to the Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal. That amendment added restrictions on the international trade in scrap plastics starting in 2021.

In response, major shipping lines announced they would no longer accept bookings for the materials.

Meanwhile, domestic investments have increased the capacity to recycle plastic in the U.S., including those tackling PET, rigid polyethylene, PE film and PP. Plastic recycling research firm Stina Inc. has documented a years-long trend away from exports.

In terms of where exported material has gone this year, there have also been notable changes. The U.S. sent substantially more plastic north to Canada but quite a bit less south to Mexico.

The following are the top 10 destinations for scrap plastic during the first three quarters of 2023, compared with the prior-year period:

Canada received 263 million pounds (up 8%), Mexico received 125 million pounds (down 9%), India received 83 million pounds (up 15%), Malaysia received 49 million pounds (down 21%), Vietnam received 33 million pounds (up 36%), Indonesia received 30 million pounds (down 11%), Spain received 17 million pounds (up 47%), Germany received 14 million pounds (down 42%) and Turkey received 10 million pounds (down 51%). The rest of the world combined took 64 million pounds, down 32%.